–

–

Content will continue after the ad

Advertising

–

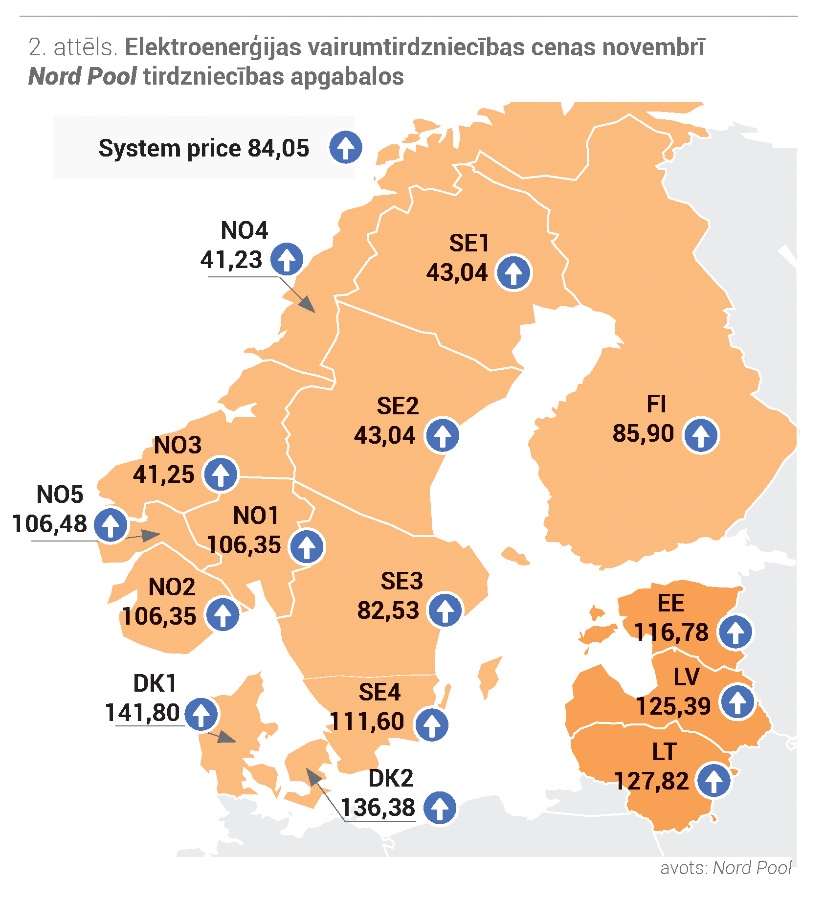

In November, the monthly price of the Nord Pool system was 84.05 EUR / MWh, which increased by 47% compared to October and reached a new all-time high. Electricity prices in the Baltic region also set new records. The highest price in the Baltic region was in Lithuania – 127.82 EUR / MWh, which is an increase of 17% compared to the previous month. In Latvia, the price of electricity increased by 18% to 125.39 EUR / MWh. Meanwhile, the average monthly price in Estonia was 116.78 EUR / MWh, which is 11% more than in October. In the Baltics, the hourly price range ranged from 1.47 EUR / MWh to 421.87 EUR / MW.

Colder weather last month boosted electricity demand in the Nord Pool region by 5% compared to November last year. At the same time, electricity generation also increased by 9% compared to November 2020, as well as by 11% compared to October this year. Last month, the increase in electricity prices was facilitated by a decrease of about 12% in the development of wind farms compared to the previous month. Normalized rainfall in Scandinavia no longer contributed to the increase in reservoir filling, which remained at the October level, or 7% below the November norm. The rise in prices in November was also due to a 14% drop in energy flows from Finland, a 16% drop in flows from Sweden’s SE4 sales area and a 42% drop from Russia a month earlier.

The Nordic hydro balance is deteriorating

Last month, the prices of futures contracts in the system as a whole showed an upward trend, while Latvia’s futures contracts showed a decline. One of the factors determining the prices was the level of the Nordic hydro balance, which was -3.7 TWh at the beginning of the month, falling to -9.5 TWh below the norm at the end of November. Fluctuations in the market for energy products also had an impact on the volatility of future electricity contract prices.

Last month, the system’s December futures contract (Nordic Futures) the average price was 75.28 EUR / MWh, which increased by 9%, closing the month with a significantly higher price – 121.50 EUR / MWh. A similar trend was observed for the system contract in the 1st quarter of 2022, which increased by 9% to 70.57 EUR / MWh. The average price of a system contract in 2022 was 41.62 EUR / MWh, which increased by 5% compared to the previous month.

In November, the trends of future electricity contracts between Latvia and the system differed. The price of Latvia’s futures contract in November decreased by 6% to 124.04 EUR / MWh, however, at the end of the month the price rose sharply to 197.63 EUR / MWh. Of Latvia in 2022 futures the contract decreased by 10% to 97.64 EUR / MWh during the month, closing the month at the highest price – 109.00 EUR / MWh.

Generation in the Baltics has covered 57% of total electricity consumption

Last month, consumption in the Baltics increased by 3% compared to November 2020, consuming a total of 2,441 GWh of electricity. In November, electricity consumption in Latvia increased by 3%, and 621 GWh was consumed compared to the same period last year. The amount of electricity consumed in Estonia in October was 745 GWh, an increase of 4%. Last month, Lithuania consumed 3% more electricity – 1,075 GWh than in November of the previous year.

In November, the Baltics generated a total of 1,394 GWh of electricity, an increase of 7% year-on-year and a 16% increase over the October results. Last month, electricity production in Latvia was 422 GWh, which increased by 56% compared to October, but was 7% lower than in November 2020. In Estonia, electricity generation was 619 GWh, an increase of 15% compared to October and 48% higher than in November of the previous year. At the same time, electricity production in Lithuania last month fell by 17% compared to November 2020 and was 11% lower than in October, for a total of 353 GWh.

Last month, the ratio of production to electricity consumption in the Baltics increased compared to October and amounted to 57%. In Latvia, the ratio of generation to monthly consumption rose to 68% in November, in Estonia it rose to 83%, while in Lithuania it fell to 33%.

The inflow of the Daugava is 13% below the multi-year average

According to the data of the LEGMC, the total amount of precipitation in Latvia in November was 33% above the norm of the month of 1991-2020 and 28% above the norm of 1981-2010. monthly norms. The inflow of the Daugava in November almost doubled compared to October, to an average of 364 m3 / s, but it was not enough to exceed the multi-year average level, from which the inflow was 13% lower last month.

AS “Latvenergo“Hydroelectric power plants generated 163 GWh of electricity in November, where production volumes increased by 79% compared to October and were 15% higher than in November of the previous year. Electricity generation at Latvenergo AS thermal power plants increased by 72% compared to October. by 13% less than in November 2020, and 160 GWh of electricity was generated last month. TEC The increase in the volume of development was mainly determined by the market demand, as well as the availability of the TEC 2-2 power unit after the completion of maintenance works at the end of October.

New records for the price of European emission allowances in November

Brent Crude Futures crude oil futures prices were volatile last month at $ 80.85 / bbl. At the end of November, the contract dropped to a lower level and closed at USD 70.57 / bbl.

In early November, China released gasoline and diesel reserves to increase supply, leading to a reduction in oil prices. At the same time, Opec + did not live up to the expectations of market participants and, despite several calls to increase supply, remained on track. To curb energy inflation, the United States considered releasing oil reserves in the second half of November, which helped push down oil prices. At the end of November, crude oil prices fell as Europe was hit by the restrictive measures surrounding the fourth wave of Covid-19, as well as the rapid global spread of a new form of Covid-19.

Coal futures contract (API2 Coal Futures Front month) In November, it decreased by 31% to 136.33 USD / t, ending the month with 111.10 USD / t.

Last month, coal prices were affected by a number of events in China. The highest domestic coal production has been observed since 2015, the second factor being the announcement of a planned price cap for domestic coal prices. In addition, China eased informal bans on coal imports from Australia to secure winter coal reserves. Although prices have stabilized in the short term, there are still concerns in the global coal market about supply disruptions, rising natural gas prices and the expected increase in consumption during the winter season.

November natural gas futures contract (Dutch TTF) prices were volatile, with the average monthly price being 81.31 EUR / MWh, which is almost 6 times higher than the previous year’s price in November, when it was 13.89 EUR / MWh.

Natural gas prices were highly volatile last month, driven mainly by fluctuating gas flows from Russia and Norway. The price of natural gas was also affected by concerns about the impact of the new Covid-19 variant on the global economy. In addition, imports of liquefied natural gas into Europe increased by 2% compared to October, as demand increased, with natural gas storage filling at the end of the month falling to 68% of total capacity and 20% lower than a year earlier. In addition, the removal of natural gas from storage increased as temperatures fell across Europe, signaling a rise in prices in December. Together with variable deliveries, the price of natural gas reached a new record in December, approaching the level of 130 EUR / MWh and continuing to rise sharply.

European emissions quota (USA Futures) On December 21, the contract price increased by 11% on average per month to 66.12 EUR / t.

In November, the price of European emission allowances reached a new all-time high of EUR 75.37 / t, rising sharply by more than 32% since the beginning of November. Such an increase occurred after YEAR The Climate Change Conference (COP26) as well as the initiatives of the new German government to set the floor of allowance prices at least 60 EUR / t. The rise in emission allowance prices continued in December, according to forecasts for colder weather conditions, and the production of electricity at natural gas and coal-fired power stations also increased, thus forecasting the price level at around 80 EUR / t.

–