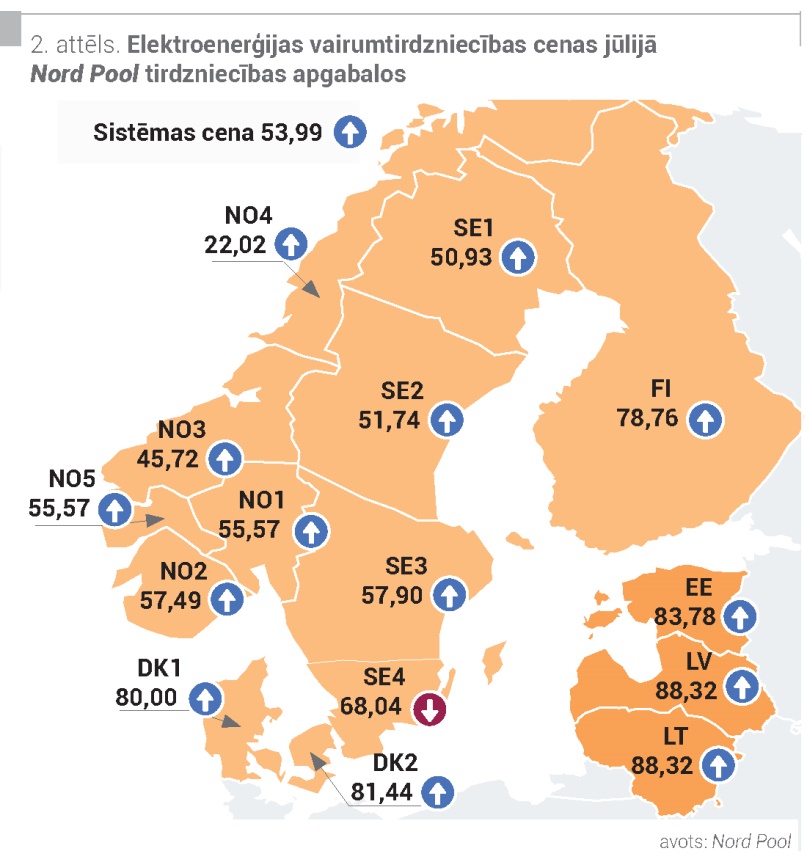

In July, the price of the Nord Pool system increased by 24% to 53.99 EUR / MWh. The last similar system price level was observed in July 2018 – 51.70 EUR / MWh. In all the Baltic trading areas at that time, the highest electricity prices were reached since each country started operating on the Nord Pool exchange. The average monthly electricity price in Latvia increased by 16%, while in Lithuania – by 14% and was unified at 88.32 EUR / MWh.

–

–

Content will continue after the ad

Advertising

–

In Estonia, the price of electricity increased by 17% to 83.78 EUR / MWh compared to June. In the Baltics, the hourly price range ranged from 2.90 EUR / MWh to 137.03 EUR / MW. In July, fluctuations in electricity prices were determined by climatic and hydrological conditions, as well as energy market trends. Although drier weather conditions were observed in the Nordic and Baltic countries in July, they were more moderate in terms of air temperature, which contributed to a 4% increase in electricity demand in the Nord Pool region compared to July last year. Total electricity generation in the region remained at the level of the previous month. Although the development of wind farms increased by 15% in July compared to June, it was still 8% lower than in July 2020. At the same time, the filling level of the Nordic water reservoirs fell below the normal range last month. In July, the annual maintenance of nuclear power plants in the Nordic countries continues, as a result of which the volume of development of nuclear power plants was reduced to 76% of the total installed capacity. Energy flows from neighboring countries also had an impact on Baltic electricity prices. In July, energy flows from Sweden’s SE4 area were twice as high as a month earlier, while flows from Finland fell by 8% and from Russia by 43% compared to June.

Electricity futures prices are rising

In July, a volatile but generally rising trend in futures prices was observed, mainly due to rising energy prices and low Nordic hydro balance sheets. At the beginning of July, the hydro balance decreased to -5.4 TWh below the norm and at the end of the month dropped to -10.1 TWh below the norm. As in June, last month the Nordic snow stocks were below normal and decreased by another 69% compared to the previous month, as well as by 61% less than in July 2020. Precipitation in July this year is 18% lower than in the previous year, but it remains slightly above normal. Last month, the average price of the August futures contract for electricity (“Nordic Futures”) was 50.55 EUR / MWh, which is an increase of 28% compared to the previous month. In July, the average price of the system contract in the 4th quarter of 2021 increased by 15% to 47.66 EUR / MWh, with the contract closing price increasing to 51.60 EUR / MWh at the end of the month. There was also a growing trend for the average price of the system “futures” in 2022, which increased by 4% and was 32.47 EUR / MWh, ending the month with 34.15 EUR / MWh. In July, the average price of Latvia’s electricity futures for the August futures contract jumped by 26% to 83.52 EUR / MWh, with the contract closing at 84.60 EUR / MWh at the end of the month. The price of Latvia’s “futures” in 2022 increased by 9% and was 60.22 EUR / MWh, at the end of the month the contract ended with a price of 62.15 EUR / MWh.

Demand has increased in the Baltics

Compared to July 2020, electricity consumption in the Baltics increased by 6% last month, and a total of 2,151 GWh of electricity was consumed. Data from the Latvian Environment, Geology and Meteorology Center show that the average air temperature in Latvia in July was +21.5 ° C, which is 4.1 ° C above the monthly norm, thus last month together with July 2010 was the warmest in the history of observations. (since 1924). This undeniably had an impact on Latvia’s electricity consumption, which increased by 8% to 587 GWh compared to July last year. In Lithuania, electricity consumption increased to 992 GWh and exceeded the data of July of the previous year by 7%. The amount of electricity consumed in Estonia increased by 4%, 571 GWh was consumed last month.

In July, electricity production in the Baltics remained at the previous month’s level, and a total of 1,073 GWh of electricity was generated. Last month, production volumes in Latvia decreased by 14% to 299 GWh compared to June. Lithuania produced 317 GWh of electricity in July, a decrease of 8% compared to June. In Estonia, on the other hand, electricity generation increased by 19% and 456 GWh was generated. The ratio of production to total electricity consumption in the Baltics in July was 3% lower than in the previous month – 50%. In Latvia, the ratio of generation to monthly consumption decreased to 51%. In Lithuania, this figure fell to 32% last month, while in Estonia it rose to 80%.

Tributary of the Daugava below the normal level

In July, the inflow into the Daugava continued the downward trend of the previous month and was 31% lower than the inflow in 2020 and the multi-annual average. According to the Latvian Center for Environment, Geology and Meteorology, last month the total precipitation was 24% below the monthly norm, which contributed to the deterioration of the hydrological situation. Accordingly “Latvenergo“Hydropower plants in July decreased by 60% compared to June and produced 73 GWh. Looking back at the data of July last year, it can be seen that this year Latvenergo’s hydropower plants produced 35% less electricity. Meanwhile, Latvenergo’s thermal power plants1 GWh of electricity, which is 68% more than in June and almost three times more than in July a year earlier. TEC The increase in development was stimulated by both market demand and the decrease in HPP development.

Natural gas and coal futures prices have a marked upward trend

In July, the price of Brent Crude Futures crude oil futures contract increased by 2% on average on a monthly basis to USD 74.29 / bbl and ended at USD 76.33 / bbl at the end of the month. In the first half of the month, oil prices were affected by uncertainty over the failure of OPEC + member states to agree on an increase in oil production in August. In the middle of the month, however, OPEC + member states managed to come to a common denominator and decide to increase oil production by 0.4 m bbl / day in August, which reduced the increase in the oil market price. In July, oil futures price volatility was fueled by reports of fluctuating levels of US crude oil stocks. Last month, oil demand also showed a growing trend, which continues to be maintained by the global economy. However, the faster price increase was dampened by concerns about declining demand with the spread of the Covid-19 Delta variant. The average price of the coal futures contract (API2 Coal Futures Front month) increased by 25% in July to USD 129.43 / t, and the contract closed at USD 138.40 / t. Demand in Asia, especially China and India, continues to rise last month. The July floods affected not only Germany, making it difficult to transport coal, but also mines and railways in central China, which led to increased interest in coal imports. The supply of coal from South Africa was lower in the first half of the month due to civil unrest, while the supply from Russia decreased in the second half of July. Rising natural gas prices also had an impact on coal prices in July. At the end of the month, the price of a coal futures contract had reached its highest level in the last 13 years – USD 139.10 / t.

–

:quality(80)/cdn-kiosk-api.telegraaf.nl/b98aa506-00ea-11ec-8adf-02d1dbdc35d1.jpg)