According to the development expert, “Surcharges disproportionately affect lower-quota middle-income countries, which need both extensive IMF financing to pay as well as longer repayment periods to recover from shocks“.

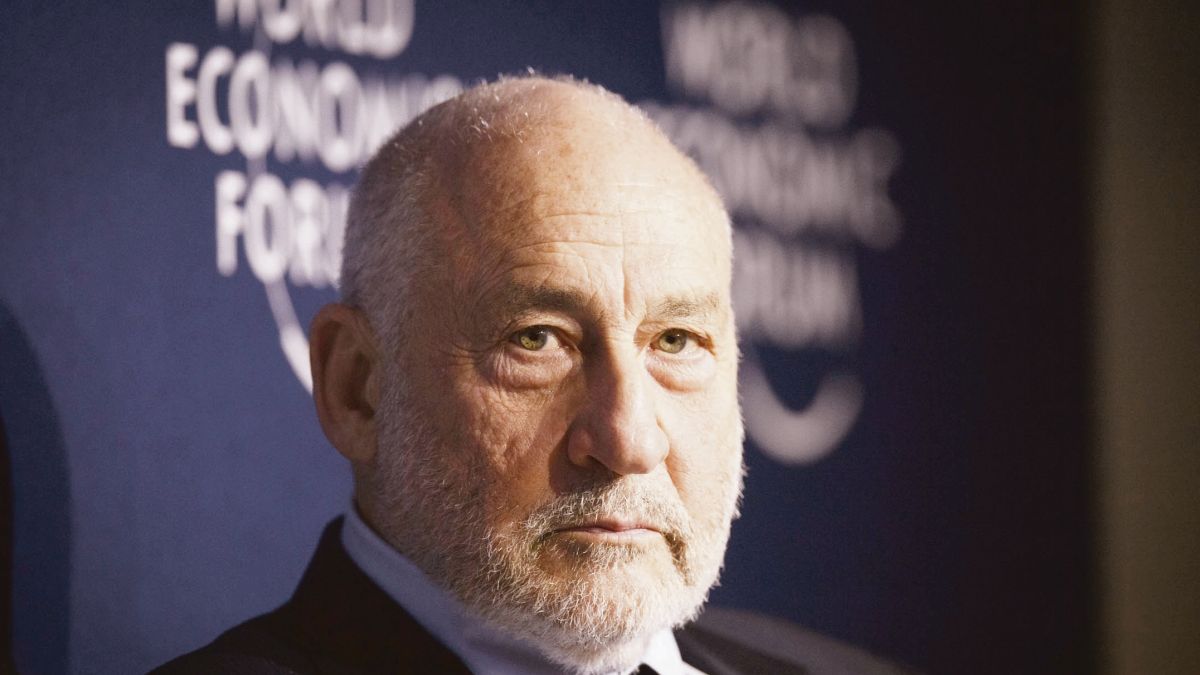

Stiglitz expressed his views in a column entitled “Understanding the consequences of IMF surcharges: the need to implement reforms,” co-authored with the economist Kevin Gallagher, published in the Global Development Policy Center at Boston University.

The authors considered that the Fund “should not get involved in the business of profiting from those in dire straits. It should eliminate surcharges immediately amid the Covid-19 crisis and work to reform its own accounts.”

“Charging countries in the most dire straits in exchange for basic support from the world’s financial institution of last resort may seem strange.: It is a regressive hand-over, and it is likely that this will intensify in the world after the pandemic, since an increasing number of poor countries will have to assume surcharges. moment on the agreement of the International Monetary Fund with Argentina.

Alberto Fernández himself made a statement on the subject in El Uncover recently: “The agreement is closed, the rate drop needs to be made official. But if it does not come out soon, it can be handled with a pari passu clause, such as the issue of the term. “, he anticipated.

According to economists, “It is important that member countries do not rely too heavily on the IMF for liquidity, but regressive and pro-cyclical surcharges are not the way to create incentives to do so in the midst of a global economic crisis“.

In this regard, they indicated that at least two objections can be raised to the argument of imposing surcharges to avoid failure to pay: the first, due to the IMF’s preferred creditor status and the central role it plays in the international financial system, the lack of payments directly does not represent a problem, or at least not until now.

The second argument, they continued, is that high interest rates (surcharges) are alleged to be necessary to prevent moral hazard, to deter countries from borrowing excessively from the IMF, and to encourage them to pay more quickly. .

The economists were of the opinion, however, that “countries often do everything possible to avoid going to the Monetary Fund, even borrowing from others at much higher rates“.

Also, “since there is no automatic right to borrow, the IMF will always be in a position to curb excessive borrowing,” concluded Stiglitz and Gallagher.

–