JAKARTA – Composite Stock Price Index (IHSG) is forecast to strengthen on trading today. The movement of the JCI will be in the range of 5.885-5.991.

Reliance Sekuritas analyst, Lanjar Nafi said, the JCI movement technically moved in a short-term bearish trend after failing to break out the long-term bearish trend and failing to hold on to the psychological level of 6000.

Also Read: JCI Closes Stronger to 5,949 Amid Emergency PPKM News

“Momentum movement of the Stochastic and RSI indicators is pointing to the oversold area with bearish momentum. The MACD indicator is moving under pressure between the MACD line and the Histogram which goes hand in hand with weakening towards undervalued conditions. So we expect the JCI movement to be very heavy with the potential to try to strengthen at the support resistance at 5.885-5.991 ,” said Lanjar in his research, Wednesday (30/6/2021).

Technically observable stocks include; AKRA, BBRI, TLKM, WIKA, AALI, ACST, ASII, HMSP, ICBP, IMAS, INCO, INTP, JPFA, JSMR, PTPP.

Also Read: Revenue Increases, IDX Earns IDR 487 Billion Net Profit in 2020

Previously, the JCI had strengthened close to a percent at the beginning of the trading session and closed up 9.58 points or 0.16% to a level of 5,949.05 with shares in the Primary Consumer Goods sector (+1.48%) jumping more than a percent, driving the JCI strengthening to at the end of the session, while the Technology (-1.13%) and Transportation (-1.83%) sectors weakened to put pressure on the JCI.

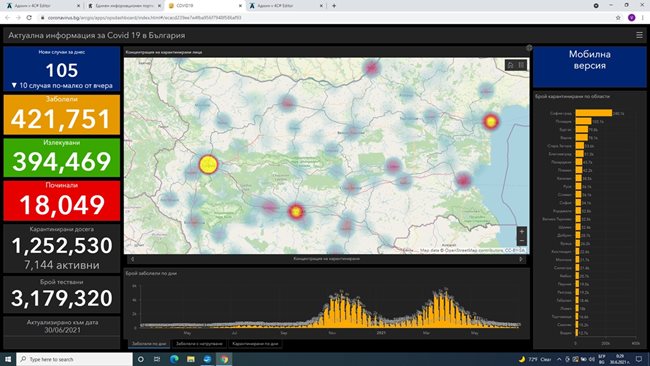

Shares of SSMA (+7.5%), GGRM (+6.7%) and ASII (+2.8%) became the leaders for strengthening in yesterday’s trading. Investors are still haunted by the impact of the Emergency PPKM due to the spread and the number of Covid-19 cases has increased again.