While media coverage – and critics – of public pensions often draw attention to important unfunded liabilities, a new study by a professional group of public pensions offers a new way of looking at these liabilities – one way, according to them, more relevant to the way the economy and the SPX markets,

job.

The group, the National Conference on Public Employees’ Retirement Systems (NCPERS), is advocating for a new approach to viewing liabilities in the context of economic growth, known as “sustainability assessment.” .

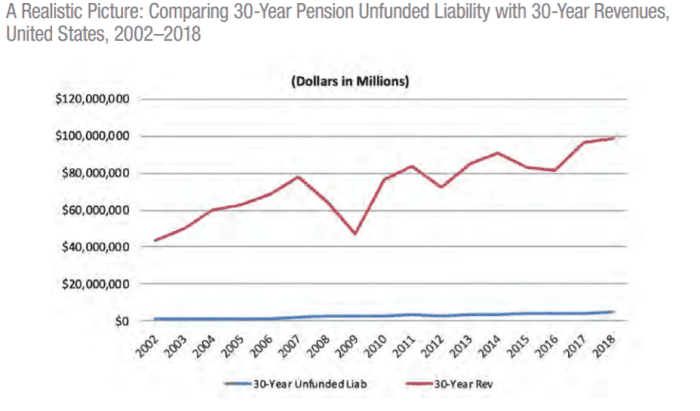

Critics of public pensions “compare pension commitments over 30 years, that is to say commitments amortized over 30 years, with state and local revenues over one year. They then argue that public pensions are not sustainable, ”writes NCPERS report author Michael Kahn.

“Comparing 30-year pension liabilities to state and local income over one year is like a bank telling the borrower their 30-year mortgage is due at the end of this year,” he said. he declared.

NCPERS argues that traditional methods of presenting pension liabilities are often misleading. Source: NCPERS

–

Instead, Kahn writes, outstanding public pension liabilities should be placed in the context of the 30-year period over which they are amortized, rather than being seen as something that must be paid off immediately.

–

NCPERS maintains that its approach to analyzing income and liabilities is more accurate. Source: NCPERS

–

Kahn argues that such an approach should be an additional tool for monitoring how well funded and sustainable a pension plan is, in addition to existing familiar approaches like actuarial analysis and stress testing.

He urges “continuous monitoring of sustainability and making budgetary adjustments to keep the ratio of unfunded liabilities to economic capacity stable at, say, the average of the past two decades.”

As an example, he cites a 2020 Chicago Tribune opinion piece, which claims pension liabilities in Illinois total 10 times state and local income. “It sure sounds terrifying,” Kahn writes, “but it’s not the right comparison. When we compare pension liabilities amortized over 30 years with income over 30 years (an apple-to-apple comparison), they only represent about 8% of income.

While it may be interesting to find a new, more compelling way to define commitments, the NCPERS report adds to a recent wave of public pension research that argues that there are good reasons to provide context. broader issue of the financing of pensions.

A 2021 Brookings Institution discussion paper challenged the idea that state and local governments should fully fund pensions – that is, for the entire 30-year period Kahn mentioned above.

Governments “don’t have to pay off their debt like a household does,” said Louise Sheiner, one of the co-authors of the Brookings article, in an interview with Oxtero. “They can just keep rolling it. They will never go bankrupt and will have to pay all at once.

See: Public pensions don’t need to be fully funded to be sustainable, article says

Certainly there are some public pension plans with unsustainable funding levels that need to be addressed urgently. Kentucky’s employee retirement system, one of the least funded systems in the country according to data from Boston College’s Center on Retirement Research, was only 16.5% funded in 2019.

See: He runs the least well-funded public pension in the country. Here is his “good news” story

Moreover, any analysis of sustainability relies on governments making the contributions they are asked to make in good times and bad, which has not always happened.

But there are also good reasons to criticize descriptions that characterize retirement situations as dire in the midst of a fully funded surge. Among them: Spending an inordinate share of an operating budget on future spending can crowd out actual current needs, such as schools or capital projects.

In addition, the perceived need to fully fund 30 years of liabilities may lead municipalities to engage in financial practices that are arguably riskier or harmful, such as taking on debt to fill pension gaps.

Read more : State and local governments issued more pension bonds this year than ever

–