Wealth tax.

Maybe it’s the name of this treasure that makes the debate so heated?

For there is no doubt that the word “wealth” gives associations to rich people. And rich people have to pay taxes – right?

Then it is no wonder it gets drunk when a so-called “rich man” goes out and complains about his plight. The tax is not even that high, it is 0.85 percent.

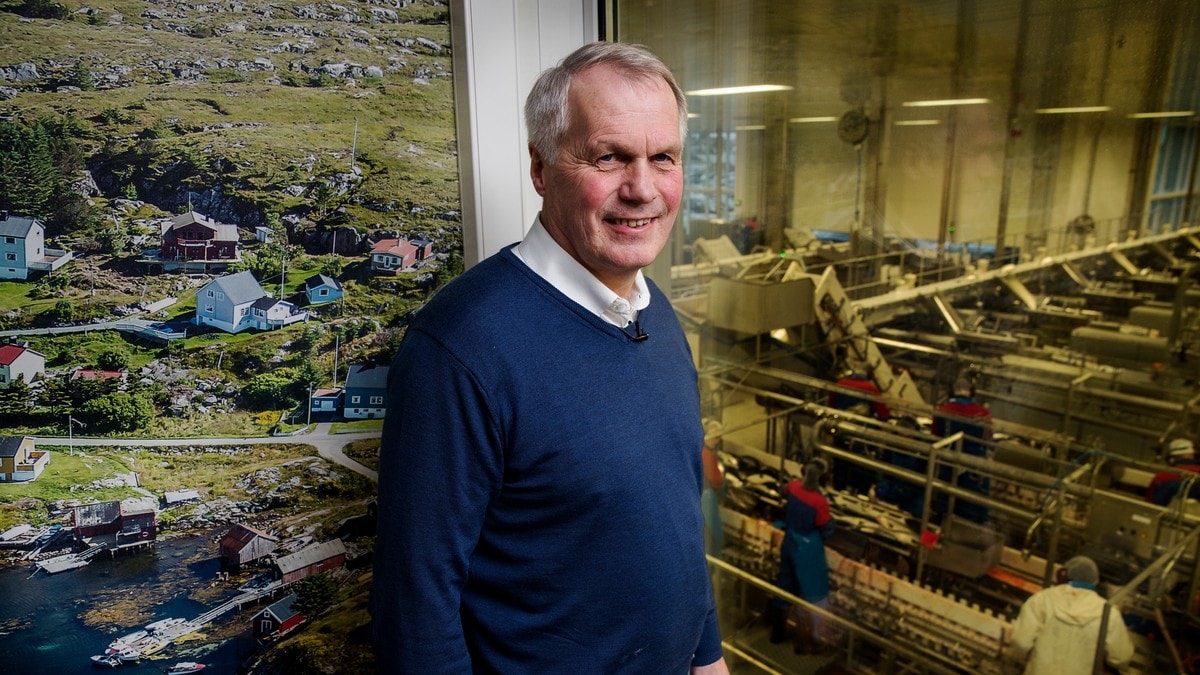

As when the owner of the salmon giant Salmar, Gustav Witzøe, said to VG earlier this summer that he could save a lot of money by moving from Norway or selling the company abroad – to avoid the wealth tax.

Everything in place for a hot debate

The backdrop is the parliamentary elections this autumn, and the Labor Party’s promise to raise the wealth tax. If that happens, then Witzøe says that he will consider flagging out.

Here are all the ingredients in place for a hot debate; a “rich man” who complains, is questioned in the election campaign and a controversial tax.

Witzøe has received both very harsh criticism for the scheme, but also support from shop stewards in his own company, and investor Øystein Stray Spetalen – while Minister of Fisheries Odd Emil Ingebrigtsen (H) believes the supporters of increased wealth tax (Labor and Social Democrats) play on envy and stigma of “the rich”, according to DN.

Prime Minister Erna Solberg (H) believes that the wealth tax of 0.85 percent is a competitive advantage for foreign investors and leads to more Norwegian companies being sold abroad.

This is now rejected by Professor Jarle Møen at NHH, who believes that research shows that differences in wealth tax between countries will not affect the purchase and sale of companies.

– No, it’s a big misunderstanding. It is neither theoretical nor empirical research that supports these claims, he says to NRK.

Other claims that are frequently discussed are:

1) Wealth tax on «working capital» taps Norwegian companies

Simply explained; a business owner pays wealth tax on the value of, for example, the machines that pack the goods or the hotel building the company owns – regardless of whether the company makes a profit or not.

The argument against wealth tax here is that the owners then in some cases have to take dividends from the company to pay wealth tax – and then you also have to pay dividend tax on it.

The term “working capital” is politically debated, used by the Conservatives, among others. In addition, it was in one report written by the Frisch Center, it is also admittedly somewhat controversial, concluding that the business owner’s wealth tax does not have a negative effect on jobs and investments.

On the contrary.

2) It is not only the “rich” who pay wealth tax

In 2019, Statistics Norway researchers Elin Halvorsen and Thor Olav Thoresen pointed out in a post in DN that those with the ten per cent lowest annual incomes pay on average almost as much of their income in wealth tax as the ten per cent richest.

In other words, many people with low incomes pay wealth tax. For example, many retirees will fall into this category.

Interestingly, they also found that People with low incomes who pay wealth tax should have a relatively good tax ability, when looking at the income of that person over the entire life cycle.

Funny when you look at the numbers

The challenge with the wealth tax debate is that it mostly takes place at the headline level. Tax is politics, and there is perhaps no part of tax policy that creates as much commitment as wealth tax.

It’s actually quite funny, if you look at the numbers. In 2019, the state collected NOK 1,276 billion in taxes and fees.

In total, the state collects around NOK 16 billion a year in wealth tax. The roughly 500,000 who pay wealth tax pay around 30,000 kroner each.

Not huge amounts that the welfare state stands on, in other words. Most of us pay a lot more in income tax.

Nevertheless, the debate will probably not subside in the first place.

–