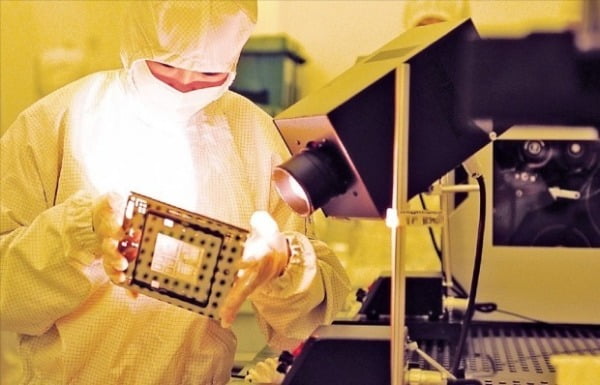

Photo = Hankyung DB

–

On April 16, 2019, a single photo titled “Anyoung Haseyo” hit the global semiconductor industry. The main character in the picture is Raja Koduri, senior vice president of Intel’s’semiconductor empire’. Wearing a jumper and sneakers, he posted a picture taken in front of the sculpture at Giheung, Yongin, Gyeonggi, the birthplace of Samsung Electronics Semiconductor on his Twitter account.

–

–

Raja Koduri, senior vice president of Intel at Samsung Electronics’ Giheung plant in April 2019. Raja Koduri Twitter capture

–

Vice President Ko Doo-ri has the experience of overseeing the GPU business at AMD, a fabless (semiconductor design company) specializing in CPU (central processing unit) and GPU (graphic processing unit) in the United States. Moved to Intel in November 2017, he is in charge of Intel’s external graphics card Xe.

In one photo he posted, various observations were poured in the semiconductor industry. The visit of Vice President Ko Douri is the day when Samsung Electronics announced that it has successfully developed a 5nm (nanometer) foundry process. Foundry is a business that produces semiconductors from outside companies. In connection with this, it was said that Intel will entrust the production of GPUs, which are less important than CPUs, to Samsung Electronics’ Foundry Division.

Some analyzes say that it was not for a foundry, but for’memory semiconductor cooperation’. It was said that Ko Douri visited Samsung Electronics to procure GDDR5 DRAM for Intel’s graphics card under development.

About 1 year and 9 months have passed since then, but news of new cooperation between Samsung Electronics and Intel has not been heard. The relationship between Senior Vice President Ko Douri and Samsung Electronics continues. Vice President Ko Douri spoke as a speaker at the’Samsung SAFE 2020′ online forum held by the Samsung Electronics Foundry Division in October last year.

However, there was another article recently mentioning the possibility of cooperation between Samsung Electronics and Intel. Bloomberg, a global economic news agency, reported an article on the 8th (East US Time) titled “Intel is in talks with TSMC and Samsung regarding outsourcing of some chip production.” It is said that Intel will entrust the production of some products to TSMC or Samsung Electronics’ foundry division. Bloomberg wrote that TSMC is preparing 4nm and 5nm lines to win orders for Intel. It was evaluated as Talks with Samsung, whose foundry capabilities trail TSMC’s, are at a more preliminary stage. It is an atmosphere that puts more weight on the contract with TSMC than on Samsung Electronics.

Will Intel break the stubbornness of ’50 years of self-production’?

Intel is a’general semiconductor company’ that designs, manufactures and sells its own chips. There is no need to give orders to foundries (semiconductor consignment production, or OEM) companies such as TSMC and Samsung Electronics’ foundry division that produce semiconductors by receiving orders from fabless (semiconductor design companies). This is because there are enough own production facilities. It is known that Intel has rarely used outsourcing production in its 50-year history.

Nevertheless, the reason why Intel’s’outsourcing production’ story is constantly coming out is because of the criticism that “the technology to produce semiconductors is inferior to TSMC or Samsung Electronics.”

Intel is currently mass-producing products in the 10nm process of circuit line width (the width of the transition gate through which electrons flow). It is said that the narrower the line width, the smaller and more efficient high-performance semiconductors can be made. TSMC and Samsung Electronics’ Foundry Division currently produce chips by receiving orders from customers in 7nm and 5nm processes. US AMD, which is competing fiercely in the CPU market, which is Intel’s flagship product, is a major customer of TSMC 7nm or less process. In the market, “AMD produces products in the 7nm process, while Intel comes out of the 10nm process,” and voices that cut down Intel products came out.

–

–

Intel CEO Robert Swan. Hankyung DB

–

As this situation continued, there was a story that’Intel will outsource some semiconductor production.’ In July of last year, Intel announced at a conference call (telephone performance briefing) for the second quarter of 2020 that “the 7nm process development is sluggish, so it is possible to use an external foundry (consigned semiconductor production).” Concerns poured over Intel’s confession,’Isn’t there a problem with technology?’ Share prices plunged 9% in overtime trading.

In October of last year, three months later, Intel CEO Robert Swan said, “In 2023, we will be able to supply products with Intel’s 7nm process, external processes, or a combination of the two.”

At the end of last year, I was also humiliated by being criticized for technology from activist hedge funds. “Intel made several mistakes and allowed Samsung and TSMC to pursue it,” said Dan Love, CEO of Hedge Fund Third Point, which owns 0.5% of Intel’s stake. did. He also emphasized the need to find a’strategic alternative’.

On the 21st, Intel is ahead of the 4Q 2020 earnings release and conference call. At this time, analysts say that Swan’s CEO will reveal a plan to use a foundry to produce chips. Ahead of this, when Bloomberg reported that “Intel is discussing a plan to give TSMC and Samsung Electronics some chip outsourcing,” the attention of the semiconductor industry was focused.

In this regard, it is known that Intel, TSMC, and Samsung Electronics declined to comment on the article.

Intel 10nm is not inferior to TSMC and Samsung 7nm process

If so, will Intel really entrust its chip outsourcing to foundries such as TSMC or Samsung Electronics’ Foundry Division?

First of all, criticism of Intel’s technological prowess, that is, claiming that it is’the reality is different’ about being evaluated as’one number below’ than Samsung Electronics or TSMC is considerable. Samsung Electronics and TSMC are saying that process names such as 7nm and 5nm are merely’marketing terms’.

Some argue that Intel, Samsung Electronics, and TSMC compare the’transistor density’ of semiconductor chips produced in the same process, and that Intel’s technology does not decline. In July of last year, an IT specialist said, “When comparing the chips produced by the same process that the three companies named ’10nm’, Intel’s chip produced 100 million transistors per square millimeter, TSMC 52 million, and Samsung. The former was 51 million,” he reported. In other words, Intel’s 10nm technology does not decline compared to TSMC’s and Samsung Electronics’ 7nm and 5nm.

–

–

Intel, Samsung Electronics, TSMC’s semiconductor process technology roadmap. Mirae Asset Daewoo

–

It is also a story in the foundry industry that TSMC and Samsung Electronics are more tolerant of the number in front of the process compared to Intel. Of course, it is not a blank number, but it means’marketing term’ to indicate that’production technology is more advanced than the previous process’.

Nevertheless, Intel’s outsourcing production potential is considered quite high. However, there is also a claim that it will target the GPU, not the CPU, which is Intel’s flagship product. In fact, recent reports do not clearly state’CPU’ for chips that Intel is considering outsourcing.

For Intel CEO Robert Swan, outsourcing production of non-core chips can be a not bad card. Swan’s CEO is not an engineer, but a CFO (financial officer). That means that they value management efficiency. There are already observations that the outsourcing production card can put tension in the organization and at the same time start restructuring in a’crisis situation’. You can also defend against attacks from hedge funds by saying, “Intel also outsourced”.

Intel outsourcing production is Samsung’s’flower viewing plaque’

Intel’s outsourcing production, whether it has become a GPU or a CPU, is the industry’s opinion that TSMC is likely to take it so far. Of course, the’reversal’ could come out as if Samsung Electronics received an order for Qualcomm’s latest smartphone AP (application processor)’Snapdragon 888′. There is also a high possibility that Intel will divide the quantity by model to TSMC and Samsung Electronics.

What will be the impact on Samsung Electronics’ earnings? It is positive because if you win the quantity, sales will increase. You will also get a medal saying’We have beaten TSMC with technology’.

Some analysts say that even if Intel’s supply is missed, there will be no’big blow’. Above all, it is expected that Intel will not leave its own production facilities and leave’large quantities’ to external companies.

The second is the limitation of foundry production capacity. Even now,’top-ranked’ foundry companies such as TSMC and Samsung Electronics are unable to handle the pouring orders. Even if they want to increase their production capacity, they cannot. This is because the Netherlands ASML’s annual production of extreme ultraviolet (EUV) equipment, which is essential for ultra-fine processing, is only about 40 units.

–

–

Aerial photograph of Samsung Electronics’ Pyeongtaek semiconductor plant. Provided by Samsung Electronics

–

For this reason, if TSMC receives Intel’s supply, TSMC may have to subtract orders from other customers as much as the Intel supply. Samsung Electronics is the only one that can be considered for customers who have been “fung” at TSMC to find an alternative. This is because there are only two Samsung Electronics TSMCs in the world that can handle ultra-fine processes below 10nm.

The order receipt is unlikely to have a significant impact on this year’s and next year’s earnings. Intel points out the timing of mass production of semiconductor products that can be outsourced in 2023. 2021-2022 is expected to be a period of preparation for mass production. Of course, orders themselves can be positive news for the stock price.

Reporter Hwang Jeong-soo [email protected]

–

:strip_icc():format(jpeg)/kly-media-production/medias/3343954/original/040693100_1610101113-EOS_M50_MII-vlog_a.jpg)