IONQ, call option trading surges… stock price surges 11.39%

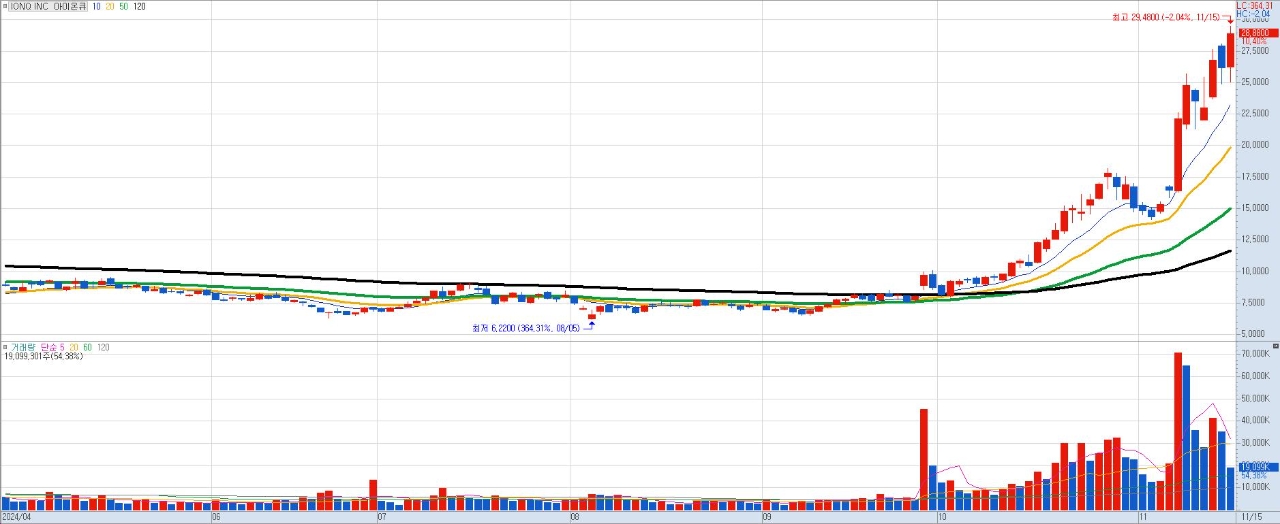

Enlarge imageIonQ daily chart. Data = Kiwoom Securities HTS While the New York stock market fell sharply on the 15th (local time), the stock price of quantum computing company IONQ soared, attracting the attention of investors.

On this day, IONQ finished trading at $29.14, up 11.39%, breaking the 52-week high.

Investment media outlets such as Market Beat and Tip Rank are providing various analyzes on AionQ’s stock price surge.

Call option trading volume surges

MarketBeat said, “IonQ call option trading volume increased 61% from usual to 42,889, reflecting the high interest of investors.” A call option is the right to purchase a stock at a specific price, and the surge in trading volume shows expectations for a rise in IonQ’s stock price.

TipRank also analyzed, “IonQ call volume is above normal, and the increased volatility of option prices shows that investors’ expectations have increased.” In particular, call option trading with strike prices of $27.5 and $30 expiring on November 24th was the most active, which means investors expect the stock price to rise to these prices in the short term, TipRank explained.

Strong performance in the third quarter, partnerships, and acquisitions… Accelerating Growth

Motley Fool, StockTitan, etc. analyzed the rise in IonQ’s stock price due to the recently announced strong third quarter performance, aggressive partnerships, and news of the acquisition of a quantum computing-related company.

According to Motley Fool, IonQ recently recorded reservations of $63.5 million in the third quarter, exceeding the upper limit of its sales target. In addition, the company is accelerating its efforts to strengthen its technological competitiveness and expand its business by announcing cooperation with companies in various fields, including Belgium’s imec, Denmark’s NKT Photonics, and America’s Ansys.

‘Spurring’ core technology development and commercialization

IONQ began developing photonic integrated circuit (PIC) and chip-scale ion trap technology through collaboration with imec. This aims to overcome the performance limitations of quantum computers, reduce hardware size and cost, increase the number of qubits, and improve system performance. In addition, we plan to jointly develop a next-generation laser system with NKT Photonics and supply a prototype optical subsystem by 2025 to accelerate the commercialization of quantum computers suitable for data centers.

Quantum computing ecosystem expansion ‘accelerates’

Through its partnership with ANSYS, IONQ plans to bring quantum computing to the $10 billion computer-aided engineering (CAE) industry and leverage ANSYS’ multiphysics technology to design and optimize key components of quantum computers. . Additionally, by acquiring quantum networking company Qubitekk, the company secured quantum networking hardware and security technology and expanded its professional workforce.

‘True aim’ to lead the quantum networking market

IONQ’s partnerships and acquisitions of related companies are interpreted as an attempt to strengthen leadership in quantum computing technology and secure leadership in the quantum networking market. In particular, the $54.5 million contract recently signed with the U.S. Air Force Research Laboratory (AFRL) is expected to accelerate entry into the $15 billion quantum networking market.

Taejun Lee, Global Economics Reporter tjlee@g-enews.com

[알림] This article is for reference only when making investment decisions, and we are not responsible for any investment losses based on it.