The last quarter gave basically no room for investors to breathe because the big players in the market (mainly large funds, author’s note) they sold equity positions and bought US Treasuries due to the prospect of a recession and monetary policy tightening.

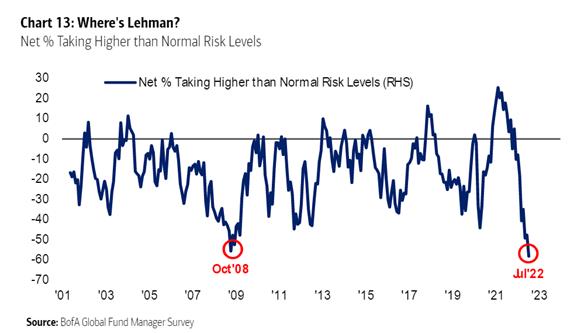

The last time such a preference for bonds over stocks was after the collapse of the American bank Lehman Brothers from the financial crisis of 2008 and 2009. The picture below illustrates this very nicely.

Better to lend to the government…

So pessimism reigned in the market, where investors see no light at the end of the tunnel. They would rather lend their money to the government than hold stocks and actively participate in capitalism. Bank of America (BofA) surveyed its portfolio managers about their willingness to hold more risky assets, such as stocks, in their portfolios now than they normally would.

The image below illustrates that their willingness is at freezing point. That is, it is even lower than it was at the time of the financial crisis.

Another piece that could tell us that investors have already capitulated is also the optimism of investors regarding the profitability of companies that are traded on the stock exchange. As we can see in the graph below, almost one hundred percent of the investors contacted do not observe any optimism now.

So what does that mean? If everyone sees everything negatively, investors have probably already capitulated. As we know, markets usually behave forward, i.e. with regard to future developments. So could this mean that the current extreme pessimism is already priced into share prices?

Look at the last graph again. The red circles show when investor pessimism has bottomed out. But it is not for nothing that they say that lows are there to bounce back from them. If we look at what happened after these moments to the performance of the stock markets in the following months and years, we find that there has always been a significant rise in stocks.

I don’t think that investors should have a bed of roses in the current half-year, but a light is starting to flicker at the end of that dark tunnel, which will hopefully make this investment journey more cheerful than it has been so far.

The author is a member of the investment committee of Broker Trust

(Editorially modified)

––––

––––

–