The stock market is great! Not only can it turn you into an entrepreneur or a lender into a bank, but it also offers you the opportunity to invest in real estate without a loan. You can do this without having to commit yourself for life, without having to decide on just one property and without having to buy an entire building.

Investing in real estate without a loan works like this:

The self-used property

Your first thought when you hear the word real estate investment is probably the property you use yourself: that Cottage in the countryside with a large property or the Old building apartment with high stucco ceilings in the city center. Having your own apartment or house promises a happy family life and a worry-free retirement, that’s something that’s deep within us. That’s why many of us buy property for our own use.

But it is one big decision in life. Because buying a property ties up an incredible amount of capital. You pay a lot of money to purchase it and commit yourself to making interest and principal payments on your loan for many years. There are also additional costs such as property transfer tax and costs for notaries and brokers. Your property doesn’t just tie you locally: if your living circumstances change, you can’t simply enlarge, reduce or move it. When you own real estate, you also assume obligations. If you also want to become a landlord, there are many additional costs and obligations, and at the same time the political framework must also be taken into account.

Buying real estate needs to be carefully considered. That alone Selection of property with the general conditions of location, size, construction condition or energy supply requires good analysis if there are any suitable affordable properties to buy in your region. And then there is the next science, financing, which you have to familiarize yourself with before buying, usually under time pressure.

So there are a few reasons why you might want to take a look instead of buying a property Financial products into the concrete gold want to throw. As you know, you can invest in securities with small amounts and trade them on every trading day. Of course, there are also stocks, bonds and ETFs on real estate, as well as some other securities that are specifically tailored to real estate.

Invest in real estate without a loan

Invest indirectly in real estate with stocks and bonds

Let’s start with Real Estate Stocks. Strictly speaking, they don’t exist, but there are shares in companies that are active in the real estate sector. A business model of such real estate companies is to buy properties cheaply, renovate them and sell them at high prices; Another thing is to rent out existing properties and generate returns from the rental income. Of course, such companies not only exist for residential properties but also for commercial and office properties. By buying such a share, you are indirectly investing in real estate.

Another option you can use to invest in real estate without a loan can be found on Bond market. For example, some of the companies described above issue bonds. Another special feature is that there are explicit mortgage bonds. They are secured by company assets, namely real estate. If the issuer defaults, the properties can be sold to ensure repayments. But only if the mortgage bond is secured by first-tier mortgages.

After purchasing such a share or bond, you are informed about the business model of the chosen company invested indirectly in the real estate market. By the way, Vonovia, a company from the real estate industry, is included in the DAX, so if you had an ETF on the DAX you would already have a small investment in real estate.

REITs allow small investors to invest in real estate in a relaxed manner without a loan

The special thing about buying real estate in contrast to all other asset classes is the very high purchase price and the lack of denomination options. After all, you can’t just buy one brick from a new office building, hospital or shopping center. Buying the entire hotel complex is also beyond your financial means.

It would be nice if you could only buy a fraction of one or more buildings. Similar to buying a stock with which you buy a share of a company. Such constructs actually exist, they are called REIT – Real Estate Investment Trust. Such REITs are collection points for money that is invested in real estate with attractive properties that allow investors to invest in real estate on a small scale without a loan.

I write about all the fascinating things about the stock market in my newsletter. Every Sunday you will become stock market smart in 5 minutes.

Invest worry-free in real estate with REITs and ETFs

REITs were developed explicitly for retail investors

Although they have the legal form of a stock corporation in Germany, REITs should not be confused with real estate shares. Because they are from the law especially for small investors designed and offer you two big advantages:

- They are not taxed at the company level, so your returns are not reduced. This is fair because it equates the indirect investment in real estate with the direct one.

- They are required to distribute 90% of the company’s profits to shareholders. The distribution is made in dividends, which are, however, taxable to you.

Of course, the assets of REITs are largely real estate; the profits are generated through renting and leasing, and less often through real estate trading. The focus is on holding real estate. In Germany, the legislature has excluded residential real estate, probably in order not to pump any more money into the inflated real estate market.

You trade REITs on the stock exchange as normal, just like stocks. REIT stocks have the term REIT in their name; in contrast to normal real estate stocks (for example Vonovia). I have you a list of REITs here pre-filtered.

Invest in real estate in a relaxed manner and without a loan with a REIT ETF

So if REITs are public companies, there is also the convenient option of just one financial product has several REITs to buy, as we have seen with ETFs on stocks and bonds?

Yes, actually, there are ETFs that contain REITs! Sometimes, in addition to the REITs, normal companies from the real estate industry are also included. This allows you to spread your risk across different companies in the real estate industry. You have low costs and your money remains liquid because you can trade an ETF on every trading day. Furthermore, you don’t need any real estate expertise and there are no expenses associated with owning real estate. So if you want to invest in real estate without a loan, then such real estate ETFs are the best choice.

You can find real estate ETFs in the well-known databases using the search or filter term ‘real estate’. I have for you extraETF.com already pre-filtered. As always, you should definitely read the fact sheet before purchasing.

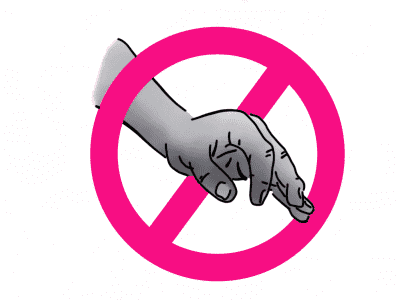

Stay away from open and closed real estate funds

There is another way to invest in real estate on the stock market without a loan: open and closed real estate funds. But please stay away from them! In this post I will write more about the reason to stay away from open and closed real estate funds.