–

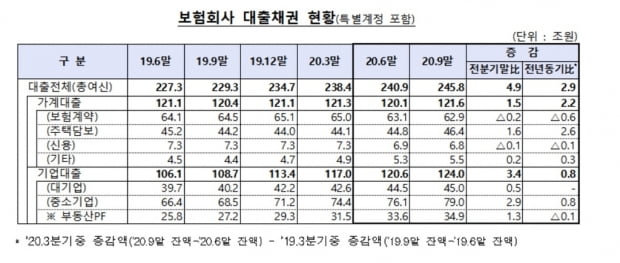

Loans received by households and businesses from insurance companies increased by 4,900 billion won in the third quarter of this year.

The delinquency rate was maintained at a good level of 0.2%.

According to the Financial Supervisory Service announced on the 22nd,’The status of loans from insurance companies at the end of September’, the balance of loans given by insurance companies to businesses and households is KRW 24.5 trillion as of the end of September.

Household loans increased by 1.5 trillion won from three months ago, mainly on home mortgage loans, and corporate loans also increased by 3.4 trillion won, mainly on SMEs.

In the same period last year, household loans decreased by 700 billion won and corporate loans increased by 2.6 trillion won. As a result, total loans increased by 2 trillion won, but this year the increase is steep.

Looking at the detailed items, in the case of households, mortgage loans and other loans increased by KRW 1.6 trillion and KRW 200 billion, respectively.

Other loans include cheonsei loans and non-housing loans.

The Financial Supervisory Service believes that housing transactions have been more common than in previous years, and some insurance companies’ interest rates have fallen to the level of banks due to low interest rates, leading to an increase in mortgage loans.

On the other hand, insurance contract loans (term loans), called’recession-type loans’, rather decreased by 200 billion won.

Credit loans also decreased by 100 billion won.

An official from the Financial Supervisory Service said, “The economy was difficult due to the new coronavirus infection (Corona 19), but it seems that loans for terms, which are relatively high interest rates compared to banks, have decreased due to the supply of liquidity.

“The increase in mortgage loans is a phenomenon that occurred in all sectors due to the increase in transaction volume,” he added. “I don’t think there was a balloon effect (as bank loan demand moved to the second financial sector).”

Corporate loans increased by 500 billion won and 2.4 trillion won respectively for large companies and small and medium-sized enterprises.

It is interpreted that this is the result of insurance companies adjusting their portfolios in the direction of expanding corporate loans as restrictions on household loans increase due to the government’s real estate measures.

Although loans have increased more than last year, the Financial Supervisory Service estimates that insurance companies’ loan soundness indicators are still at a good level.

As of the end of September, the delinquency rate for insurance companies’ loans was 0.2%, down 0.02 percentage points from the end of the second quarter.

The household loan delinquency rate fell 0.06 percentage point to 0.42%, and the corporate loan delinquency rate was 0.1%, the same as at the end of June.

The ratio of non-performing loans, which indicates the ratio of fixed or below loans to total loans, is 0.15%, down by 0.01 percentage points.

The Financial Supervisory Service said, “We will continue to monitor the soundness of loans and induce insurance companies to accumulate sufficient provisions for bad debt in response to the Corona 19 incident and to develop their ability to absorb losses.”

/yunhap news

–