The contribution of the shopping cart to general inflation is increasing.

–

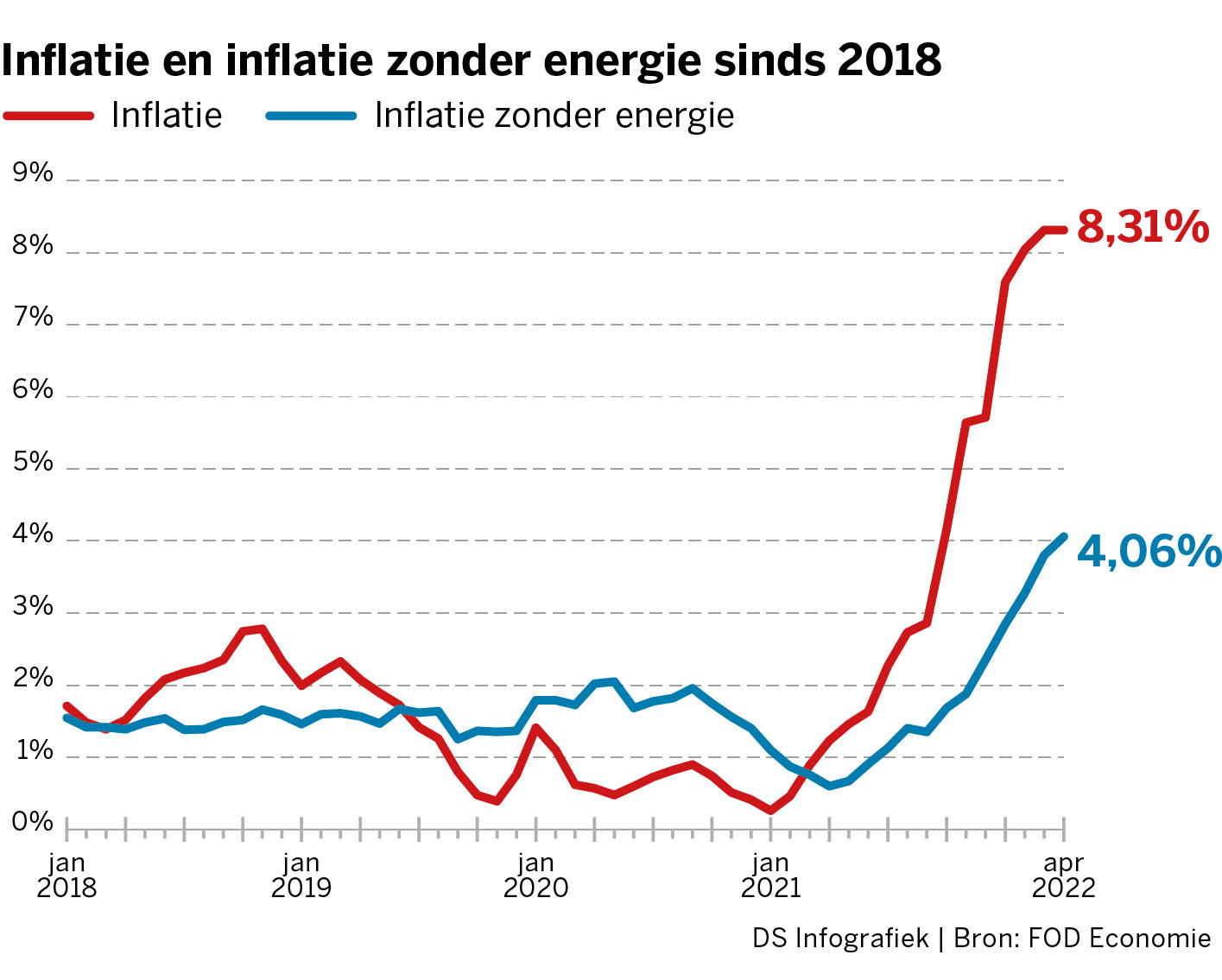

With a price increase of 25 percent in one year, vegetable oils have entered the inflation top 10. For the time being, that ranking is still dominated by energy products, with natural gas leading the way. That fuel became 140 percent more expensive in one year, according to the inflation figures for April from the Belgian statistical office Statbel on Thursday. The general price level rose by 8.3 percent, the same as last month.

While the contribution of the energy products to the general inflation in april decreased, the contribution of food products increased. This indicates that inflation is slowly but surely changing in character. The higher costs for transport, heating and energy are having an increasing impact on the wider economy. And the fact that the prices of some foodstuffs are rising faster than those of other products and services has to do with the war in Ukraine. That country is an important producer of grain and sunflower oil. Uncertainty about exports from Ukraine has pushed up the prices of these and related commodities worldwide. That is why bread (+10 percent), pasta and couscous (+12 percent), and breakfast cereals (+9 percent) have shot up in price. But food products whose availability has not been affected by the war also rose sharply in price: fresh fish by 10 percent, milk by 9 percent, eggs by 7 percent, butter by 14 percent, coffee by 12 percent and mineral water by 7 percent. Inflation for all food products together was 5.09%. In March that was 4.63 percent.

Inflation also remains a persistent problem elsewhere in Europe. In Spain, the figure fell from 9.8 to 8.4 percent. In Germany there was a slight increase. In April, the figure was 7.4 percent, according to a preliminary estimate, compared to 7.3 percent in March. It was the highest level since October 1981.

‘A decrease is not yet in sight,’ said ING economist Carsten Brzeski. On the contrary, inflationary pressures are broadening. As in Belgium, the emphasis in Germany is slowly shifting from energy to food. In some states, food prices are already rising by more than 10 percent. This hurts German consumers all the more, because wages and benefits are not linked to inflation. That is the case in Belgium. Brzeski takes into account that German inflation will exceed 10 percent next summer, and that the average for 2022 will be 8 percent.

Interest rate hikes

Continued high inflation rates are putting pressure on the ECB to end its support program and begin rate hikes. It is virtually certain that the bond-buying program will end after June. After that, the way will be open for interest rate hikes. The pace of this will depend on two things: inflation and growth. An interest rate hike is not a panacea. The central banks have no influence on energy prices.

Yet more and more central banks are raising interest rates. Yesterday, the Swedish central bank decided to raise interest rates from 0.00 to 0.25 percent. It’s a remarkable turnaround. Until recently, the Riksbank thought that an interest rate hike would not be necessary for the time being. The rampant inflation (in March 6.1 percent) made the Swedish bankers change their mind. An interest rate hike will not change energy prices, the Riksbank acknowledges. However, it may be possible to prevent inflation from getting stuck in the economy through price and wage formation.

Luis de Guindos, the vice-president of the ECB, said yesterday that inflation is ‘close’ to peak, and that price increases will be less pronounced in the second half.

To guarantee purchasing power, we have automatic wage indexation in Belgium. But is that always good news? Economics journalist Stijn De Cock weighs in in the video below.

–