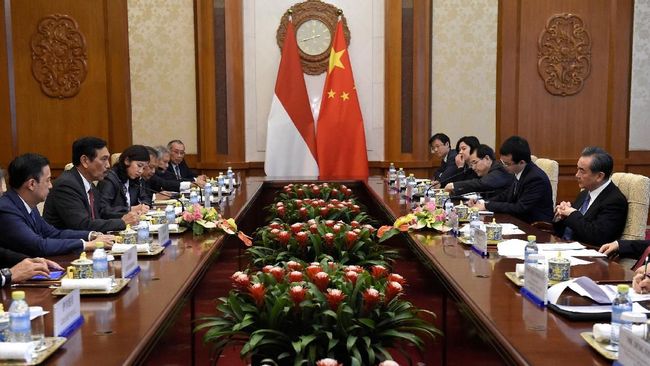

Jakarta, CNBC Indonesia – Bank Indonesia (BI) and China’s central bank (People’s Bank of China/PBoC) recently renewed the agreement swap bilaterally in local currency (Bilateral Currency Swap Arrangement/BCSA). With this agreement, the use of the United States (US) dollar will be reduced and BI will be better prepared to face the turmoil that could result from the normalization of monetary policy of the Fed (US central bank).

“The BCSA agreement allows exchanges in the local currency of each country of up to CNY250 billion or Rp. 550 trillion (equivalent to around US$38.8 billion),” BI wrote in an official statement released Thursday (27/1).

The agreement has been effective since January 21 last.

“This cooperation agreement is intended to further encourage bilateral trade and direct investment in the local currencies of each country in the context of economic development in both countries and demonstrate the commitment of the two central banks to maintain financial market stability,” BI wrote.

In addition to China, BI said it was also conducting financial cooperation with other central banks in several countries in the region.

The BI-PBoC cooperation agreement has been signed by BI-PBoC since March 2009, and has undergone several amendments and extensions, including this month, just before the Fed said it would aggressively raise interest rates this year.

The Fed early this morning indicated that it would raise interest rates in the near future, and most likely in March.

“With inflation well above 2% and the labor market strong, the Committee (the Federal Open Market Committee (FOMC)) expects to continue to raise the target range for the Federal Funds Rate (FFR) soon,” the Fed said in a statement.

Since the coronavirus disease (Covid-19) pandemic hit, the Fed cut interest rates to 0% – 0.25%. With this announcement, the market is increasingly convinced that the FFR will be raised by 25 basis points to 0.25-0.5% in March.

Not only that, the Fed is also expected to raise interest rates more than 3 times this year, seeing the statement from the Fed chairman, Jerome Powell, who said that inflation was still at risk of rising.

“Inflation risk is still rising in the FOMC’s view as well as my personal view. There is a fairly large risk that the inflation we are currently experiencing will persist for a long time. There is also a risk that inflation will continue to rise. We need to be in a position where monetary policy can overcome all the possibilities that exist,” Powell said at a press conference after the monetary policy announcement, as reported by CNBC International.

Renowned investment bank, Goldman Sachs, has predicted that Jerome Powell will raise interest rates 4 times this year, and did not rule out even more due to high inflation in the United States.

Not only raising interest rates, the Fed also confirmed it would reduce the value of the balance sheet (balance sheet) this year.

In a statement earlier this morning, the Fed said a reduction in the balance sheet value could be made after interest rates were raised and it would be done “in a predictable manner”.

The Fed chair also confirmed it would reduce the value of its balance sheet, but did not specify a time. The amount of the balance sheet value will be reduced by the Fed, meaning that the bonds held will be released so as to absorb liquidity again.

|

– – |

“The balance sheet is substantially larger than it should be. There needs to be a substantial reduction and that will take time. We want the process to be orderly and predictable,” Powell said.

Meanwhile, Goldman Sachs previously predicted that the Fed would reduce its current balance sheet of nearly US$9 trillion by US$100 billion per month. The reductions are expected to begin in July and will last for two to two and a half years, bringing the Fed’s balance sheet to $6.1 trillion to 6.6 trillion.

The Fed’s aggressiveness can certainly have an impact on the strengthening of the US dollar and pressure the rupiah. With the BCSA agreement, at least the need for US dollars will be reduced which can relieve pressure on the rupiah.

NEXT PAGE >>> BI Has Strong Capital To Face The Fed

–