Photo: Toms Svilans www.doozy.lv, Toms Svilans www.doozy.lv

If some time ago Indexo’s name was associated with direct marketing in supermarkets for a large part of the population, recently Indexo is often mentioned in connection with its plans to expand its sphere of activity by founding a commercial bank. Perhaps it is precisely because of the relatively aggressive marketing strategy that Indexo has managed to successfully gain a stable position among Latvian pension managers and has secured recognition for itself, which will be beneficial in attracting customers to the newly established commercial bank.

In this article we will study how successful Index has been in its core business – attracting and managing pension assets – and we will analyze the group’s financial data, as a result of which we will conclude whether Index stocks could be a smart investment right now.

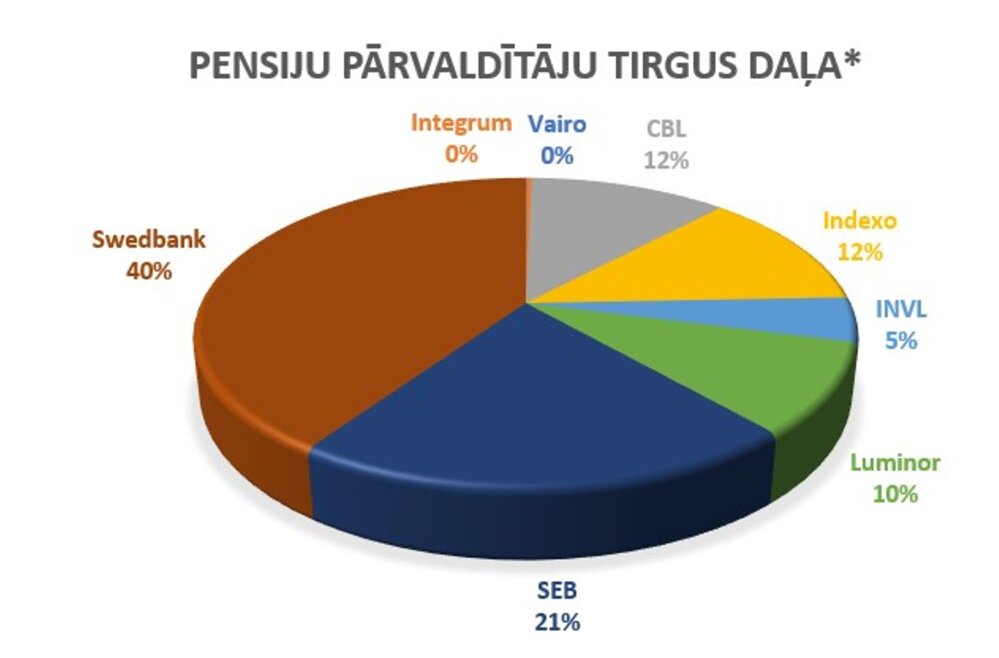

Market share

Indexo ranks third among pension managers in Latvia since the summer of this year, when it surpassed CBL. In accordance with Index according to forecasts, the amount of managed assets of level 2 of Latvian pensions will reach 10 billion by 2027. euros (currently they are about 6.5 billion euros) and Index plans to serve around 20% of this market.

Data as of 07.11.2023, from the total asset value of the 2nd pension plansPhoto: Source: manapensija.lv

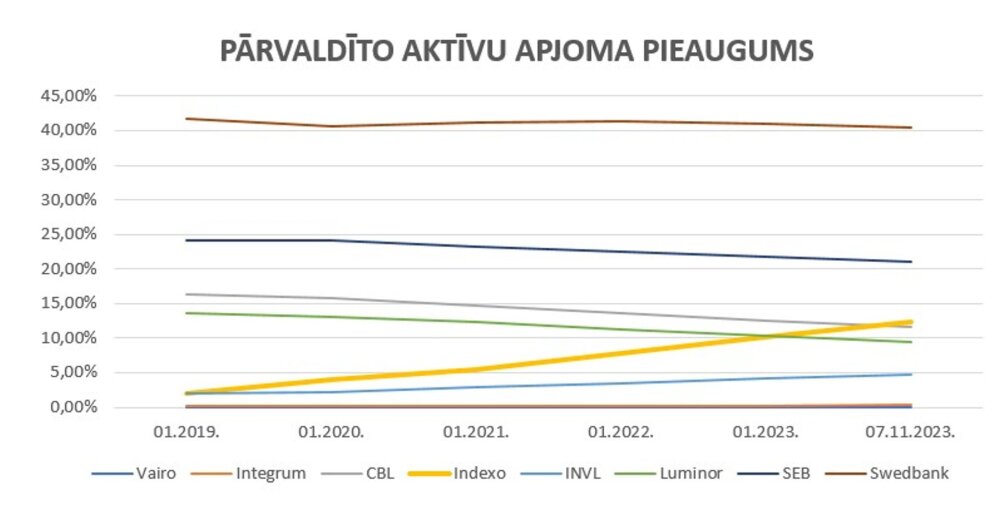

If we take a closer look at the dynamics of all pension managers’ assets since the beginning of 2019, Index the only one that has shown stable and significant growth. Index the share of managed assets from the total asset value of the 2nd pension plans increased from 1.94% to 12.39%, showing a 537% growth in this time period.

On the other hand, when evaluated in absolute numbers, the growth was even greater – the amount of managed assets increased more than 10 times from 69.8 million. EUR at the beginning of 2019 to less than 810 million euro 07.11.2023 (The significant difference between the percentage and absolute growth is explained by the fact that the total value of the assets of the 2nd pension plans has almost doubled during this time period, thus reducing the percentage share).

% of the total asset value of 2nd pension plansPhoto: Source: manapensija.lv

In comparison, INVL the share of managed assets from the total asset value of the 2nd pension plans increased from 1.93% to 4.65%, showing a 140% growth in this time period. On the other hand, CBL, SEB, Luminor and Swedbank the proportion of managed assets decreased.

Analyzing the above-mentioned data, it should be remembered that often a new market player manages to surpass the growth indicators of more stable competitors in the first years of operation. For example, during 2019 Index managed to double its market share from 1.94% to 3.98%. On the other hand, under normal market conditions Swedbank would never have managed to show the same growth, doubling its market share from 41.76% to 83.53% in the same time period. Also, new market participants often use more aggressive marketing campaigns and particularly advantageous conditions to attract customers. This can be reflected in an increase in the number of customers and assets, as well as in lower profitability.

Long time Index was the only “new” player in the market of Latvian pension managers. However, very recently, a new pension manager has announced himself in Latvia Steering wheel. Although it is not yet possible to compare qualitatively Steering wheel results with other pension managers, over time we will be able to look at its first growth indicators and compare them with Index growth in the first years of operation. It should also be noted that a new competitor may mean lower growth rates (or even a decline in assets under management) for other managers, including Indexo.

How much does Indexo cost new customers?

2023-12-04 19:00:41

#Indexo #indepth #analysis #companys #stock #smart #investment