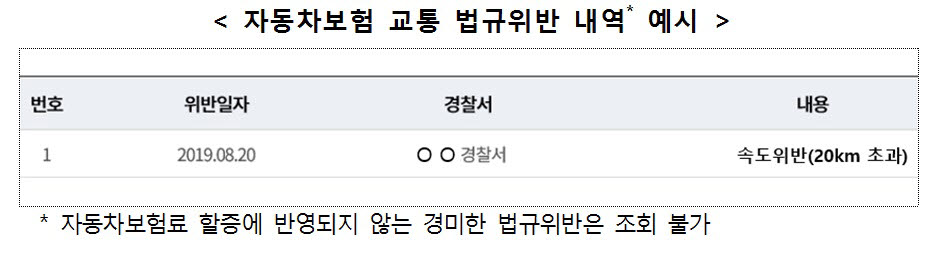

#Park Mo, who usually drives safely. Last year, he was caught driving over the 20km speed limit in the school zone and paid a penalty of 70,000 won. After several months, Mr. Park complained to the insurance company that he forgot to pay the past penalty when renewing his auto insurance and that the insurance premium was raised by 15% even without an accident.

A system that checks information related to the auto insurance that I subscribed to and the cause of changes in insurance premiums comes out. When auto insurance is renewed, the factors that change insurance premiums can be identified, which is expected to improve the convenience of consumers in reading insurance information.

The Financial Supervisory Service announced on the 13th that it will establish a’auto insurance premium discount and premium inquiry system (hereinafter referred to as inquiry system)’ and start service from the 14th.

Auto insurance is a compulsory insurance that more than 23 million people have subscribed to. Last year only the average annual premium per unit was 740,000 won, accounting for a significant portion of household expenditure. However, there are many cases where insurance premiums are increased even though there are no accidents when renewing auto insurance, but there is a limitation in identifying the cause of the premium by the driver, causing consumer inconvenience.

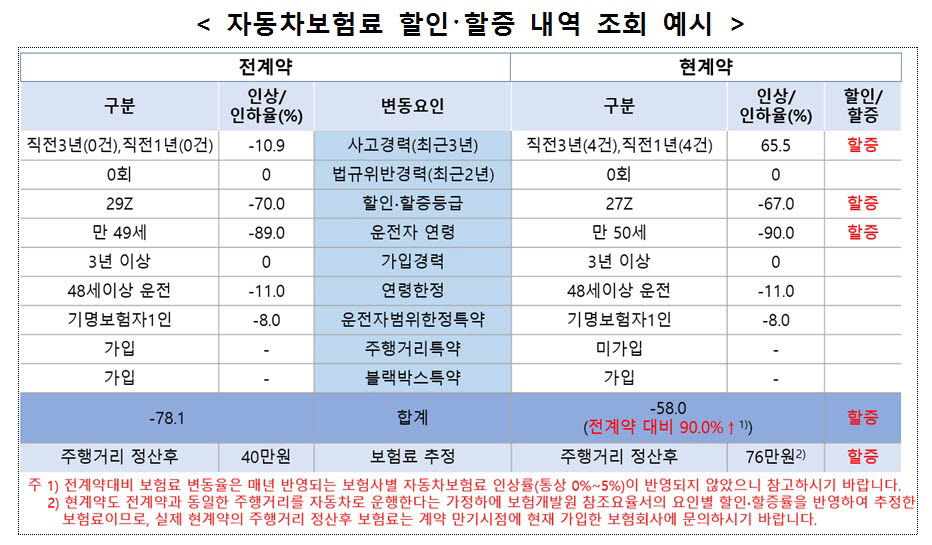

However, in the future, it will be possible to search the renewal insurance premium discount and premium details (grade, accident, violation, etc.) through the inquiry system. The inquiry system provides details such as the number of accidents related to insurance premium discounts and premiums of the contract before and after the driver’s automobile insurance renewal, the number of violations of the law, discount/premium grade, age, subscription history, and whether or not to subscribe to an age-limited special agreement. In addition, you can receive information about insurance premiums after settlement of the estimated premium discount or premium rate for the current contract compared to the previous contract, and mileage (mileage).

Past car accidents and legal violations can also be viewed. In the inquiry system, it is possible to search the date and time of a car accident, insurance payment details for each car insurance collateral, and premium premium points for the past 10 years.

You can also easily check the details of your auto insurance subscription. If you simply verify your identity by text message, etc., you can view the driver’s vehicle number, vehicle type, and insurance subscription (insurance company name, insurance period, etc.) information. Through this, it is recommended that drivers with a lot of auto insurance maturity check the details of premium discounts and premiums for the entire contract and the current contract, and drivers with maturities of less than one month additionally check the expected premium discount and premium details of the current and renewal contracts. It is possible.

An official from the Financial Supervisory Service said, “In the case of automobile insurance, even if a large number of citizens subscribe as compulsory insurance, complaints have been frequently raised that it is difficult to confirm how the insurance premium is calculated unless it is directly passed through the insurance company. I expect it to work.”

Reporter Park Yunho [email protected]

– .