For the first time in recent years, the Russian currency has fallen below a psychological level amid problems with sanctions, exports and falling oil prices.

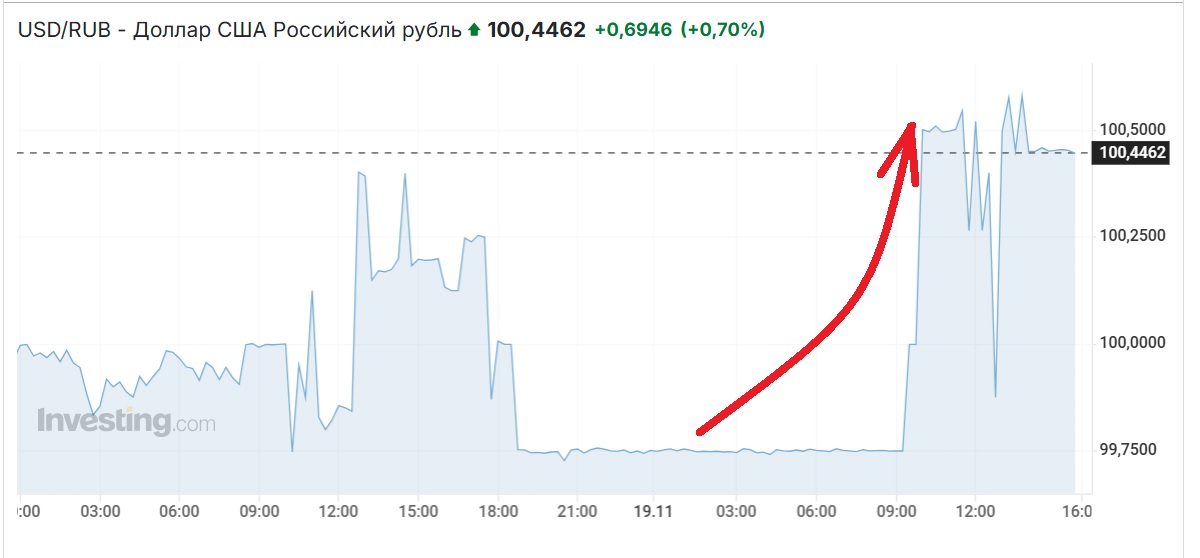

In the morning, at around 8:00 Kyiv time, the Russian ruble fell, falling below the psychological level of 100 rubles per dollar. This event attracted the attention of economists and investors, raising concerns about further weakening of the Russian currency and deterioration of the stock market situation.

According to experts, the current dynamics of the ruble exchange rate was the result of a complex of factors. First of all this a decrease in Russian exports both in terms of volume and currency. Restrictions imposed by international sanctions, as well as the fall in prices for Urals oil, which fell below 70 dollars per barreland in the summer they changed around 75-80 dollars, greatly reducing the money supply.

In addition, problems with cross-border payments led to higher prices for imported goods, which led to additional demand for foreign currency. As a result, all this increases the pressure on the Ruble.

The sharp increase in the exchange rate of the dollar in the past months has also become noticeable: back in early August, the American currency was worth about 85 rubles, and since then only in 3.5 months, the ruble to dollar exchange rate fell by more than 17%.

Interestingly, last week Russian economists expected the ruble to fall to 100 to the dollar but before the end of the year. However the fall happened much fasterwhich worries the market and raises questions about the prospects for further weakening of the Russian currency.

As before Discussion.UA described the situation complex a decrease in oil prices to $72 per barrel, which is 13% lower than a year ago.

2024-11-19 14:09:00

#Russia #ruble #exchange #rate #fallen #psychological #mark #media #predicts #fall

Beyond the immediate impact of sanctions, what are some potential long-term economic strategies that Russia could pursue to stabilize their currency and promote growth?

1. As a website editor, I would like to interview two guests, one an economist and another a financial analyst, about the current state of the Russian economy and the falling ruble exchange rate. Our first guest, Mr. X, is an expert on the Russian economy with over two decades of experience in the field, while our second guest, Ms. Y, is a renowned financial analyst who has been closely monitoring the global markets for the past decade.

2. We begin our interview by discussing the impact of sanctions on Russian exports and the subsequent fall in the ruble exchange rate. Mr. X, can you please share your insights on how these sanctions have affected Russian exports and how they have impacted the ruble’s value against other major currencies?

3. Ms. Y, how have these sanctions on Russia affected the global markets, and what are the potential ripple effects of the ruble’s fall on the international economy?

4. Mr. X, the article mentioned that there has been a decrease in Russian exports due to international sanctions, but could you also elaborate on the impact of falling oil prices on the Russian economy?

5. Ms. Y, as a financial analyst, how do you foresee the future of the ruble, considering the current state of the economic crisis in Russia and the ongoing conflict with Ukraine? Do you anticipate any further weakening of the currency or a possible rebound?

6. Looking at the larger picture, what are the long-term consequences of the Russian ruble’s decline for the global economy? Can you provide insights into the potential impact on the European and American economies, especially considering the dependence on energy imports from Russia?

7. Switching gears, could you share any suggestions or recommendations from your perspective on how Russia could stabilize its currency and improve its economic situation?

8. Lastly, with the upcoming elections in Russia, some observers suggest that the crashing ruble could play a role in President Putin’s popularity. Mr. X, from your experience, how do you think the Russian public is responding to the current economic crisis? And Ms. Y, how do you anticipate the political landscape will be influenced by the ongoing economic situation in Russia?

9. Thank you both for your insights. As the