Photo = Getty Image Bank

–

In the stock market,’ant defeat’ was like a formula. Individuals followed the foreigners belatedly and repeatedly beaten them to the top. After opening the stock market to foreigners in 1992, there were no exceptions. Most individuals felt helpless and left the stock market and headed for real estate. While the KOSPI index has been locked in the box for 20 years, the myth of real estate failure has solidified. But this year’s winner is’Donghak Ant’. I gained the experience of’collective success’ for the first time by blowing away all kinds of prejudices in the stock market.

According to NH Investment & Securities on the 20th, the average return on all accounts of the company (as of the end of November) is 10.81%. The average return on newly opened accounts this year reached 20.32%. This is the result of bold betting on the Korean market since last March, when Corona 19 hit the stock market. After foreigners left, the empty market was the first opportunity for individuals to buy stock from the bottom. There was a belief that no matter how difficult the global economy is due to Corona 19, Samsung Electronics and Hyundai Motors will not fail.

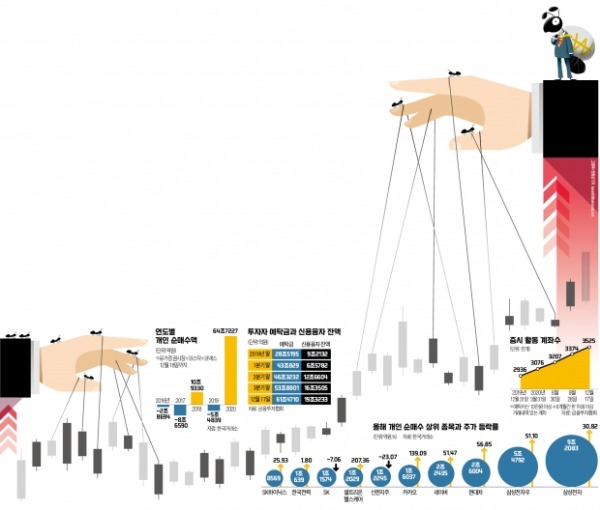

Individuals have bought stock all year round. It was a’game to buy time’ to hold on until the stock price rises. This year’s personal net purchase amount reached a record high of 64,722.7 billion won (as of the 18th). Thanks to that, the KOSPI index is breaking through the 10,000-year box-pee (the KOSPI index trapped in the box sphere) and is breaking an all-time high. On the 18th, the KOSPI index (2772.18) rose 90% from the March low (1457.64). It exceeds the rate of increase in the NASDAQ index (86%). Kim Hak-gyun, head of the Research Center at Shinyoung Securities, said, “This year has been a year for Korean stock investors to have a new belief through the first’experience of collective success’.”

–

–

Breaking the’three prejudices’ in the stock market… ‘2020 Donghak Ant’, the winner of the profit rate

“The stock market carries a lot of ants and doesn’t go up.”

While the KOSPI index reached its lowest point in March and reached the 2400 line, the securities firm’s research center made such a beep several times. It was said that the individual-led marketplace could easily collapse. The empirical prejudice that individuals have always entered the end of the bull market and have been bitten has also been added. Analysis that the stock market overheating was similar to that of the dot-com bubble was followed.

Donghak ant, who claims to be a’stock market firefighter’

Individual investors didn’t care. The era of’zero interest rates’ came as the huge money was released by Corona 19, and the intensity of real estate regulations increased. The only investment left was the stock market. By the end of October this year, individuals net bought 62.72 trillion won. It took the shares sold by foreigners and institutions intact. With only individual strength, the KOSPI index broke through the 2400 line again last month.

Even on the road to the 2700 line, individuals took on the role of stock market firefighters. On the 30th of last month, foreign investors sold Korean stocks on the largest scale ever. In the securities market, it sold a net worth of 2.437.7 billion won. Instead of panicking, the individual bought stock. It net bought 2,2205 billion won worth. This was also the largest. The KOSPI index declined only 1.60%. It was just after breaking through the 2600 line. Despite the concern that “it has already risen a lot,” individuals actively picked up stocks because they knew that foreign sell-offs were’mechanical selling’. This was the day when the MSCI Emerging Markets (EM) index was reorganized. The KOSPI index recorded 2772.18 (as of the 18th), an increase of 6.98% in 15 days. It is an all-time high.

Follow the ant’s footprint

The prejudice of’buying on the news and selling it in the box’ was also thrown away. It was the exact opposite. They invested when they were adjusted and realized profits when stock prices surged.

The day when individuals net sold Samsung Electronics stock the most this year was on July 28th. After a long absence, a foreign investor net bought Samsung Electronics worth 900 billion won. The news of Intel’s 7-nano process delay reflects the expectation that Samsung Electronics will enjoy reflected profits. The individual threw 900 billion won worth without hesitation on this day. Since March, when the stock price has already bottomed out due to Corona 19, it has been buying Samsung Electronics one by one and making profits. On this day, the share price of Samsung Electronics surged 5.4%.

In the third week of July, when President Moon Jae-in announced the Korean version of the Green New Deal, Hyundai Motor’s stock price rose nearly 20%. Individuals did not miss this opportunity and net sold 300 billion won worth of stocks. In addition, it showed a’new construction’ that bought leading stocks such as LG Chem at the box zone and sold at the highs.

At each major inflection point, the investment strategy also evolved. In March, when the fluctuation was large, companies that would not fail like Samsung Electronics were moved to BBIG (bio battery internet game) companies, including Kakao and Naver, who were beneficiaries of Corona 19 from April. From July, when policy momentum grew, it has shifted to policy beneficiaries such as the Green New Deal, and economically sensitive stocks such as semiconductors, which are expected to benefit from economic recovery from November. The market has come to analyze’individual taste’. This is because the stock price could rise only after receiving personal choice. Dae-Joon Kim, a researcher at Korea Investment & Securities, said in a September report titled’An individual’s bizarre taste.’ “Now, the individual has become a representative player who moves the market.”

The new companion between the company and ants

It is analyzed that a full-fledged “companion” of companies and individual shareholders has also begun with the’Donghak Ant’ fever this year. As of the third quarter, there were 1.75 million minority shareholders who owned less than 1% of Samsung Electronics’ shares. It is more than the number of residents of Gangwon (1.54 million). Compared to the third quarter of last year (610,000 people), this is three times the number.

Individual’s’different status’ is found everywhere. Individuals also voiced louder voices than organizations in the process of material division of LG Chem’s LG energy solution. It is noteworthy that not only traditional dividend stocks but also growth stocks such as Samsung Electronics and LG Chem are increasing dividends. In order to persuade the opposing shareholders, LG Chem has devised a shareholder return strategy to pay more than 10,000 won per share every year for three years.

It is a homework that the interests of management and minority shareholders may differ for individual issues. However, the fact that they ultimately want the same direction is an analysis that it can be an opportunity. This means that an individual can be a strong support force for a company. Jeong Seong-han, head of Shinhan BNP Paribas Asset Management Alpha Management Center, said, “When the executives produce results and increase shareholder value, the era will come when individual investors become’Avengers ants’ who support and protect corporate decision-making. I will,” he predicted.

■ 64,722.7 billion won

Net purchases of individual investors this year (the largest ever). Individuals who net bought 10.93 trillion won in 2018, net sold 5,483.9 billion won to avoid the uncertainty caused by the US-China trade dispute last year. This year, it bought 11.49 trillion won only in March, when the Corona 19 was hit.

Reporter Go Jae-yeon/Go Yoon-sang [email protected]

–