November 23, 2024, 977 characters

Social comments on the winners/losers

BSN Podcasts

Christian Drastil: Vienna Stock Exchange chat

SportWoche Podcast #136: Formula Austria Young Driver Programs as an investment, turning kart talents & sim racers into F4 racers

Photo credit

1. Varta AG on November 22nd 8.41%, volume 137% normal days

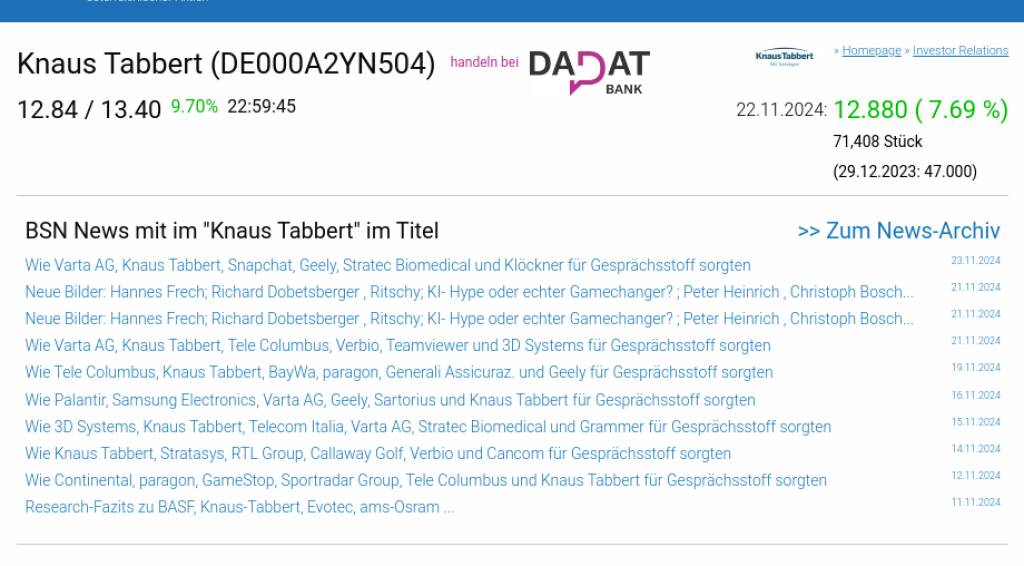

2. Knaus Tabbert on November 22nd. 7.69%, volume 371% normal days

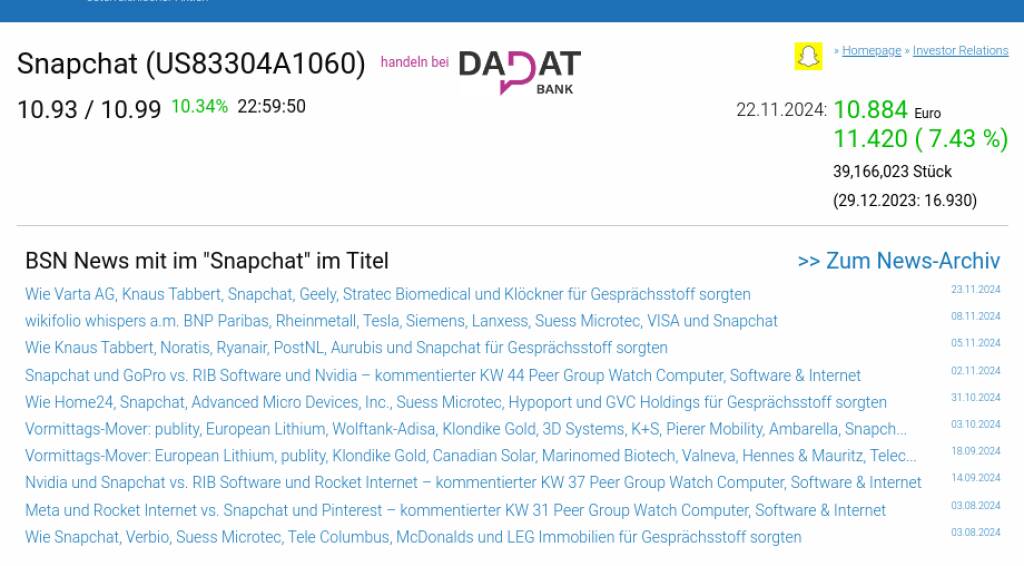

3. Snapchat on November 22nd 7.43%, volume 141% normal days

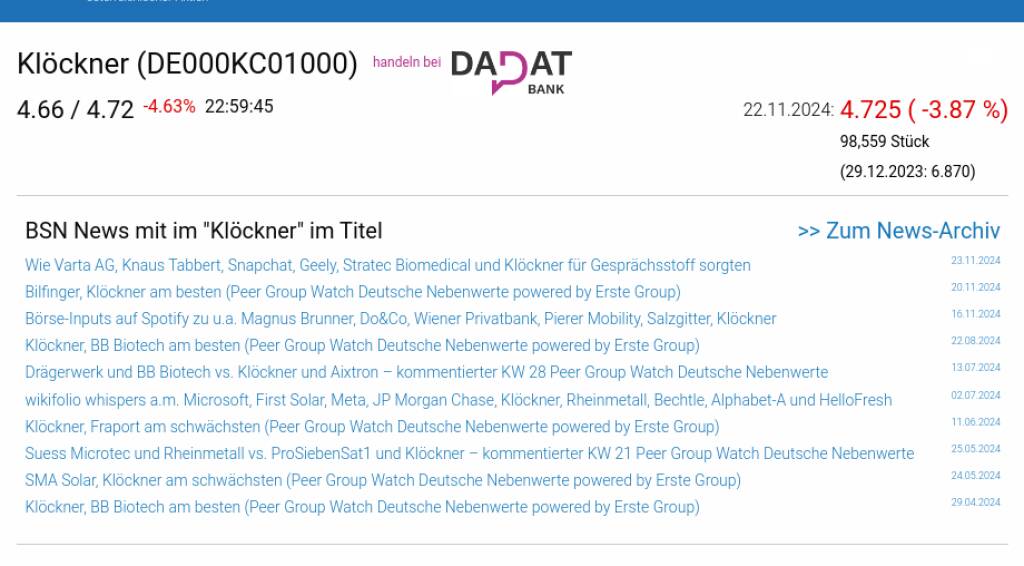

4. Klöckner on November 22nd -3.87%, volume 108% normal days

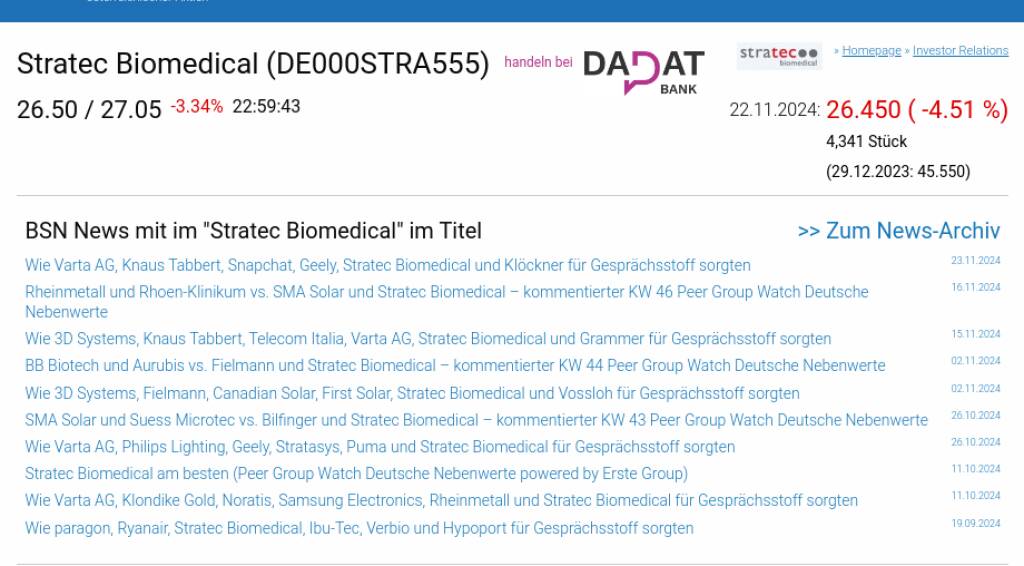

5. Stratec Biomedical on November 22nd -4.51%, volume 70% of normal days

6. Geely am 22.11. -4.63%, Volume 148% normal Take

Stocks on the radar:Pierer Mobility, Warimpex, Semperit, Austriacard Holdings AG, Addiko Bank, Immofinanz, Verbund, VIG, CA Immo, Vienna Airport, Uniqa, AT&S, Cleen Energy, Kostad, Porr, Wolford, Oberbank AG Stamm, UBM, DO&CO, Agrana, Amag , Erste Group, EVN, OMV, Palfinger, Austrian Post, S Immo, Telekom Austria, Wienerberger, Zalando, SAP.

Random Partner

CA Yes

CA Immo is the specialist for office properties in Central European capitals. The company covers the entire value chain in the commercial real estate sector: leasing and management as well as project development with a high level of in-house construction expertise. The company, founded in 1987, is listed on the ATX of the Vienna Stock Exchange.

>> Visit 68 other partners at boerse-social.com/partner

Varta AG on November 22nd 8.41%, volume 137% normal days

Knaus Tabbert on November 22nd. 7.69%, volume 371% normal days

Snapchat on November 22nd 7.43%, volume 141% normal days

Klöckner on November 22nd -3.87%, volume 108% normal days

Stratec Biomedical on November 22nd -4.51%, volume 70% of normal days

Geely am 22.11. -4.63%, Volume 148% normal Take

Considering the significant volume increase for both Varta AG and Knaus Tabbert alongside their price surges, could this indicate a speculative bubble forming around these stocks?

## Questions for Discussion Based on the Article:

Here are some open-ended questions that delve into the key topics presented in your text:

**Market Performance & Trends:**

* What factors might explain the significant price increase for stocks like Varta AG and Knaus Tabbert on November 22nd?

* Comparing the volume of trading for these stocks (371% and 141% respectively), what could be inferred about investor sentiment towards these companies?

* The article highlights several stocks that experienced decreases in price. What potential reasons could be behind these downward trends? Considering the different industries represented, are there any common economic factors at play?

* Looking at the “Stocks on the radar” list, which sectors appear to be generating the most investor interest? What factors might be driving this interest?

**Analysis & Interpretation:**

* How reliable are short-term stock price fluctuations as indicators of long-term company performance? What other factors should investors consider when making decisions?

* The article mentions “volume” as a percentage of normal trading days. What insights can we gain from analyzing trading volume alongside price changes?

* Does the information presented in the article raise any red flags or concerns about specific companies or sectors? Why or why not?

**Broader Economic Context:**

* Considering the global economic climate, how might events like inflation or geopolitical instability be influencing the performance of the stocks mentioned?

* What can investors learn from past market trends and how might historical data inform their current investment strategies?

**Remember:**

* Encourage participants to support their opinions with evidence from the article or their own knowledge.

* Foster a space where diverse perspectives are welcome and actively listened to.

Keep in mind these are just starting points. Feel free to adapt and tailor these questions to the specific goals and audience of your discussion.