/ world today news/ Despite an improving economic outlook, bolstered by the launch of the Covid-19 vaccine and an unprecedented stimulus package, the greenback’s appeal is waning as it suffers the impact of rising fiscal and current account deficits that show no signs of losing weight.

The US dollar has fallen to multi-year lows against its peers, driven by a combination of factors that financiers believe will see the US currency halved in value.

How that forecast plays out will largely depend on the US Treasury Department, which is set to be headed by Janet Yellen, who served as the 15th chair of the Federal Reserve from 2014 to 2018.

The question is – how low can the dollar go?

The overheated printing press

In late December, the dollar index fell 5.5 percent as investors acted on concerns raised by the large-scale injection of freshly printed unsecured dollars into the U.S. economy.

“US politics is fueling a Wall Street bubble, Bank of America strategists warn,” Namita Jagadish tweeted.

In 2020, the US Congress and the Federal Reserve worked in tandem to deflect the negative effects of the economic effects of the coronavirus pandemic, juggling fiscal spending, near-zero interest rates and a series of subsidized loan programs.

The Federal Reserve in Washington, Monday, November 16, 2020. President Donald Trump’s unusual pick for the Federal Reserve Board of Governors, namely Judy Shelton, could be approved by the Senate this week, according to Majority Leader Mitch McConnell’s office. Associated Press photo by Jay Scott Applewhite.

The printing press will inevitably spur inflation, experts say. Last year, the Federal Reserve signaled a major shift in its approach to managing inflation, with the central bank now aiming for an “average” of 2 percent inflation, rather than making that figure a fixed target.

According to Federal Reserve Governor Jerome Powell, this will give it more flexibility, allowing the bank to keep interest rates lower for longer.

Although it seeks to support the economy, it cannot help but have a negative impact on the dollar.

Spurred by concerns about rising volatility, investors are eyeing other, albeit riskier, options, a Reuters survey of currency strategists shows

More than two-thirds of the analysts surveyed (51 of 72) surveyed expected the dollar’s downward trend to continue at least through mid-2021.

“You can’t have a dollar that overvalued, that’s the way it is, and it’s simple. The dollar has become and still is vastly overvalued by almost every measure I can think of as a result of monetary policy divergence, and convergence takes away all the reasons for that ” said Keith Jukes, head of currency strategy at Societe Generale, quoted by Reuters.

In November, experts warned that under the incoming Biden administration, the value of the dollar would increase as Democrats promised additional fiscal stimulus and new aid packages.

Faisal Khan

The dollar index starts off the week with the Greenback strengthening – a lot of risk events with data like FOMC rate decision & GDP growth in the U.S, along with German & UK employment numbers #forex @gvalan @dak970 @junjudapi @ProjectReaperPW @FXResearchBlog @stanleychen0402

See Faisal Khan’s other Tweets

“Dollar index starts week with greenback strengthening – lots of risk events with data like FOMC rate decision and US GDP growth, along with German and UK employment numbers,” expert Faisal Khan succinctly tweeted on 25 January.

This would weaken the dollar in the long run, leading to a ballooning budget deficit and a spike in the external borrowing needed to cover it.

The stepped-up coronavirus vaccination drive is also seen as negative for the U.S. currency — the greenback is typically sought after in times of chaos, reflecting its traditional role as a haven for investors and savers, as seen at the start of the virus outbreak in March. Many currency watchers believe the coronavirus vaccination program will change that.

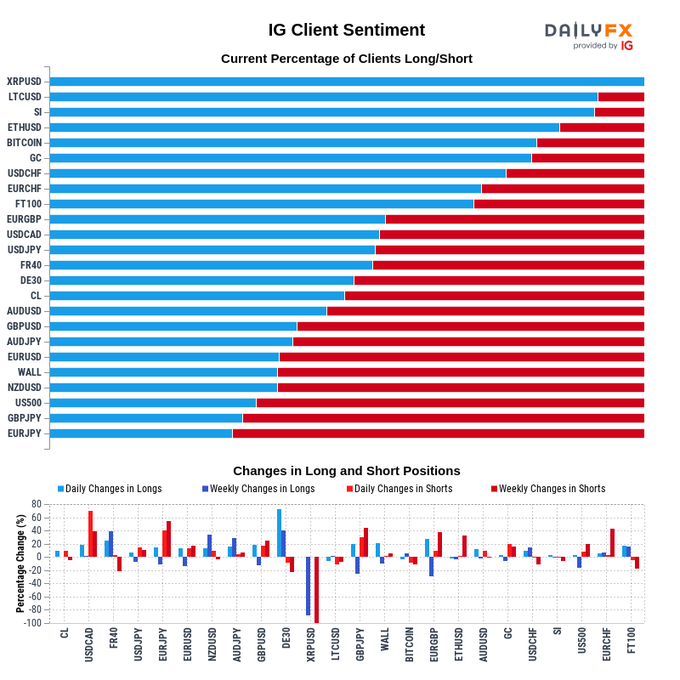

“Hedge funds raised net short positions in the US dollar to the highest position since April 2018,” wrote the AMEGA Forex broker.

AMEGA Forex broker

Hedge funds boosted net short positions in the US #Dollar to the highest since April 2018

See AMEGA Forex broker’s other Tweets

“The vaccine rollout that we believe will happen will change all of our bear market pointers, allowing the dollar to follow a path similar to the one it experienced in the early to mid-2000s,” when the currency was in a multi-year decline, according to a report from Citigroup strategists.

The greenback fell in December to its weakest level in more than 2.5 years on optimism about Covid-19 vaccines.

Gloomy predictions

Looking ahead, economists’ forecasts are far from optimistic, with Citigroup estimating that a Democratic takeover of the White House would “significantly increase” the likelihood that the dollar will weaken by 20 percent in 2021.

As the Treasury Department announced at the start of 2020, it plans to borrow $3 trillion in the second quarter alone to foot the bill for coronavirus damage relief.

The ballooning budget deficit will “torture US lawmakers for years to come,” according to Morgan Stanley’s former Asia chairman.

Janet Yellen, US President Joe Biden’s nominee for Treasury Secretary, spoke as the Democrat announced his nominations and nominees for various posts that will carry out his economic policies. The photo was taken at the transition headquarters in Wilmington, Delaware, US on December 1, 2020.

The inflation outlook is further bolstered by the likelihood of more stimulus packages, on top of those Congress has already passed in 2020. These will have to be financed through debt issuance.

American economist and investment banker Jim Rickards, who has 35 years of experience in the capital markets on Wall Street and was the lead negotiator for the bailout of Long Term Capital, argues that the US will eventually have to deal with its debt problem and that solving it will led to a 50 percent devaluation of the dollar.

The famous financier added that the United States is under pressure from a number of countries that have challenged American dominance in the international financial system, mainly the Russian Federation and China.

“China is not alone in its efforts to achieve creditor status and acquire gold. Over the past few years, Russia has significantly increased its gold reserves and has little foreign debt. Russia’s move to accumulate gold is no secret, and the ruble is the most the world’s gold-backed currency,” Rickards said.

“Strong Dollar Policy”

As Joe Biden’s team begins to address the issues, the president-elect’s pick for Treasury secretary Janet Yellen, a former head of the Federal Reserve, has repeatedly touted the benefits of a weaker currency for exports.

However, it faces pressure to return the US to a “strong dollar” policy.

“It would be unwise to appear actively devaluationist or indifferent to the dollar,” said Larry Summers, who was Treasury Secretary under Bill Clinton and national economic adviser under Barack Obama, quoted by Bloomberg.

Opting for a strong dollar would be “sensible,” according to the new minister, he insisted, especially given Biden’s plans for an “expansionary policy.”

Translation: SM

#greenback