BOK Financial Stability Report’Warning Lights’

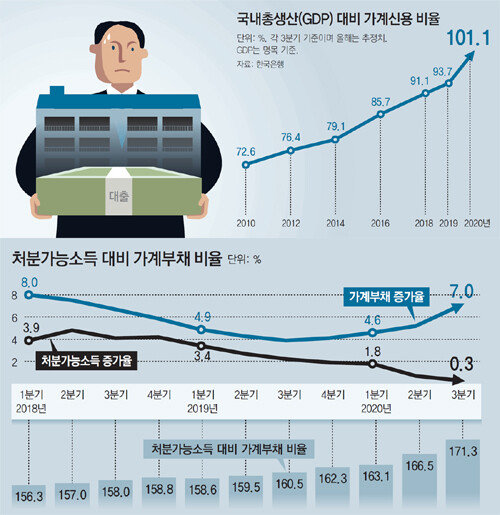

Household credit in the third quarter, 101.1% of GDP

Corporate debt combined is more than twice the GDP

Lower 30% debt, 3.3 times annual income

The maximum value since statistics were prepared in 2012

‘Yeongkeul-debt’ increases rapidly by 2030 degrees

According to the’Financial Stability Report’ submitted by the Bank of Korea to the National Assembly on the 24th, the ratio of household credit to nominal GDP in the third quarter of this year (July-September) was 101.1%. This means that households owed more debt than goods and services produced domestically during a year. Private credit, including corporate debt, was found to be 211.2% of GDP. It is the highest since related statistics were written in 1975. Household credit also includes debts owed by self-employed persons and non-profit organizations.

The BOK explained, “The increase in household credit has expanded since this year, as loans related to home sales and jeonse have increased significantly, as well as demand for livelihood funds and stock investment funds.” Korea’s household credit increase exceeded the global average. The ratio of household credit to nominal GDP in the second quarter of this year (April to June) rose 3.4 percentage points from the end of last year. It exceeded the average (2.1 percentage points) in 43 countries surveyed by the Bank for International Settlements (BIS), and was the 11th largest increase.

As household debt has soared, the debt repayment burden is also increasing. The low-income class (average annual income of 16.4 million won), which is the bottom 30% of income, had a loan-to-income ratio (LTI) of 328.4%. This means that they owe more than three times their annual income. This is the highest since the statistics were written in 2012. LTI increased by 15.5 percentage points from the end of last year. This is more than twice the rate of increase (7.1 percentage points) for high-income people (upper 30% of income). This is because, as the damage from Corona 19 was concentrated on the low-income group, the impact of income was large. Income of the low-income class increased 0.3% from the end of last year, while debt increased 5.3%. The rise in debt in their 20s and 30s, who started investing in stocks and real estate out of debt, also sharpened. LTIs in their 30s and under were surveyed at 221.1%, up 14.9 percentage points from the end of last year. The LTI rate itself is lower than those in the 60s and over and 40s, but the increase is the largest in all age groups. The BOK estimates that the default rate of household loans will rise 0.36 percentage points if the impact of falling house prices and rising market interest rates amid sluggish economic recovery. As a result, if households’ debt repayment ability weakens, the size of household loan insolvency of financial institutions was estimated to be 18.700 billion won, an increase of 5.5 trillion won from the time there was no shock. If self-employed people’s sales slump due to Corona 19 continues until the end of next year, it is estimated that more than 50,000 households will go bankrupt. Min Jwa-hong, head of the Bank’s Financial Stability Bureau, said, “It is difficult to believe that the decline in interest rates will continue. If the situation changes, the ability to repay households could quickly deteriorate.”

Last year, Narat debt (public sector), including non-financial public corporation debt, rose to 1132 trillion won, an increase of 54 trillion won in one year. The ratio to GDP also rose to 59%. The public sector debt ratio has declined for four consecutive years since 2015, and then turned upward last year. The ratio of general government debt, excluding public enterprises, was 42.2%, up 2.2 percentage points from a year ago. As the central government’s debt has risen sharply in response to Corona 19 this year, there are concerns that the rate of increase in overall debt will increase further.

Park Heechang [email protected] / Sejong = Reporter Joo Aejin

Copyright by dongA.com All rights reserved.

—

–