Posted on Dec 5, 2019 2021 at 14:28

“A friend is a road, an enemy is a wall,” says a Chinese proverb. And when you are, like Didi, the taxi of half a billion people in the second largest economy in the world, but who chose the first, the United States, to be listed on the stock market, it is a question of zigzagging for avoid obstacles. At the end of six months of regulatory wandering, the Chinese Uber, five times the size of its colleague, act of the dead end to which the Sino-American cold war led it.

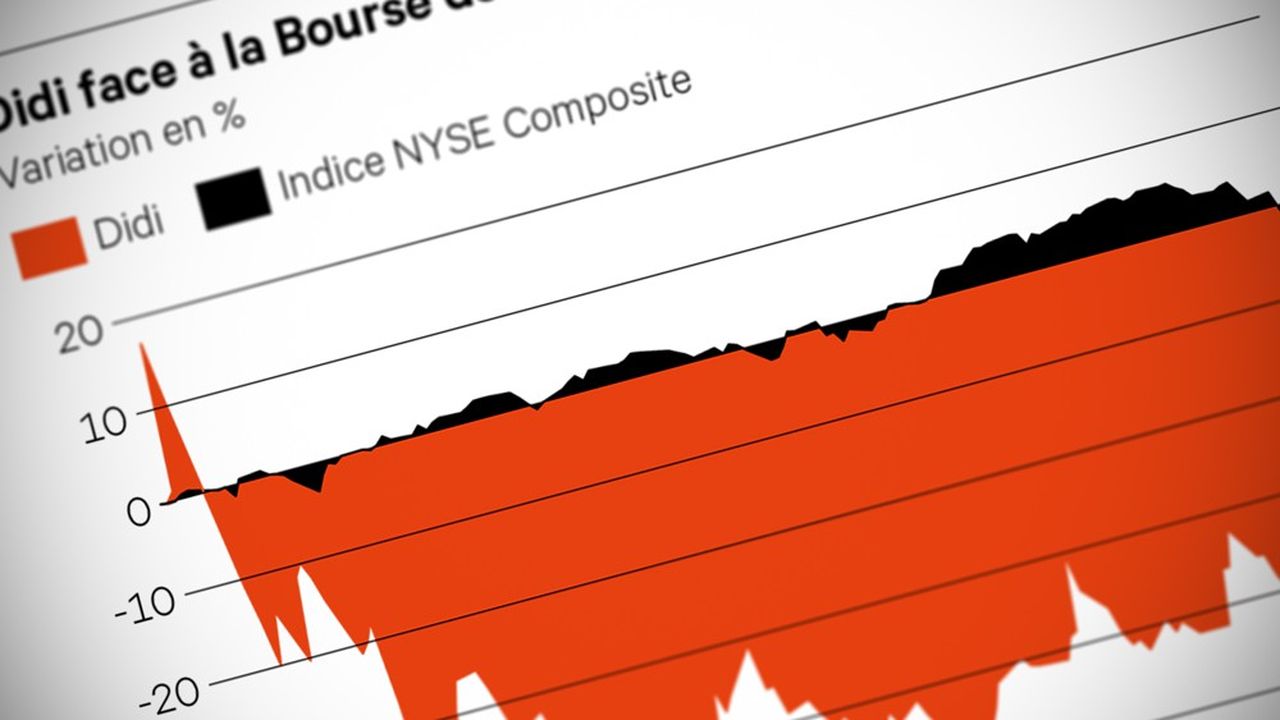

Its decision to leave New York to transfer its listing to Hong Kong only worsened the bill for the race for its shareholders. The fall of the title (-22.2% Friday) brings to 39 billion dollars the destruction of stock market value since June. Ironically, the VTC driver punished by Xi Jinping returns with a low tail to the fold when his Singaporean rival, Grab, sets out to conquer Wall Street.

The sensational eruption of the “super-app” of transport, food deliveries, online payments and financial services, valued at $ 35 billion, signals a strange crossover between the Chinese digital giants and their rivals from Southeast Asia. Grab, his compatriot Sea (140 billion dollars in capitalization, multiplied by 30 in four years) and the Indonesian GoTo (estimated at 40 billion) are together worth the equivalent of two-thirds of Alibaba. The race is accelerating.

Softbank, the Japanese that plays on all fronts

Didi’s December 2 listing on the Nasdaq is great news for Softbank. Masayoshi Son’s holding has played all three roles at Didi, Uber and Grab. If he lost money with the first two, the Japanese potentially more than doubled his stake in the third, even after the entry correction of the title Grab.

Its 18.6% stake in the “Singaporean super-app is worth $ 6.6 billion, for a total investment of $ 3 billion.” The Chinese Didi, also a shareholder in Grab, will find financial consolation in the success of its potential competitor.

Although not making a profit and continuing to burn cash, Grab recorded the largest merger in the United States in history with a SPAC, a blank check vehicle that initially valued it at $ 40 billion.

The record remains even after the stock fell 18% in two sessions on Wall Street, partly due to technical factors (sale of shares by employees not part of management, amplified by short positions in “hedge funds “).

Although twenty times smaller than Didi in terms of active users, Grab, founded nine years ago and present in eight Southeast Asian countries, is worth a fifth more than the Chinese stock market.

–