As a result of the continued rally in GameStop shares, the Wall Street hedge funds that have relied on their decline are suffering significant losses. According to a manager at Melvin Capital, the hedge fund closed its short position at GameStop on Tuesday afternoon after a huge loss.

CNBC was unable to figure out the size of Melvin Capital’s loss on the short position. However, Citadel and Point72 are known to have poured about $ 3 billion into Gabe Plotkin’s hedge fund to support his finances.

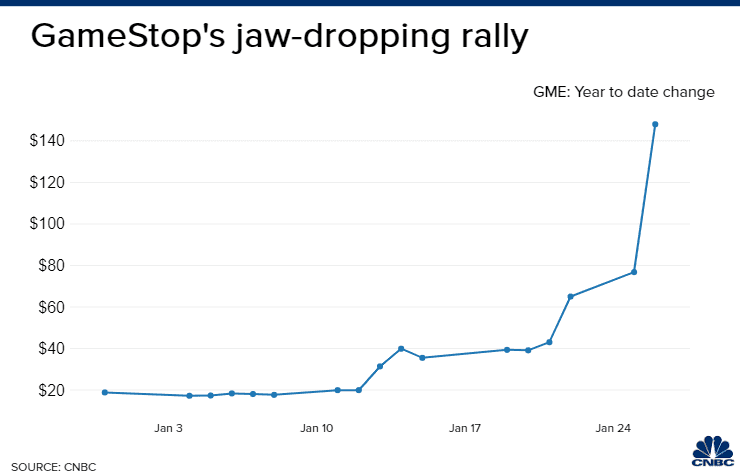

GameStop’s shares have more than doubled in value this week alone, bringing them up 685% in January. Four months ago, the retailer’s share was only $ 6.

GameStop, a chain of stores selling video games and game consoles, closed trading on Wednesday with a further 140% share price increase, bringing its market capitalization to $ 21 billion, CNBC reported.

–

–

According to Deutsche Bank strategist Jim Reid, GameStop was the most traded company in the US stock market on Tuesday, overtaking Tesla and Apple, although their market caps are 81 and 233 times larger, respectively.

According to S3 Partners, amid the explosive growth of GameStop, sellers in the short position have currently accumulated more than $ 5 billion in losses, including losses of $ 917 million on Monday and $ 1.6 billion on Friday last week.

And even joke Elon Musk, who questioned the advisability of investing in GameStop, led to the opposite effect, as the retailer’s shares rose even more in price.

–

If you notice an error, select it with the mouse and press CTRL + ENTER.