Gold futures rates stabilized greater in early buying and selling on Friday, just after rising for three consecutive classes, as US greenback and 10-yr Treasury yields declined as traders took a cautious stance in perspective of Federal Reserve Chairman Jerome Powell’s speech at a key bankers conference, which will be adopted intently for advice on long run amount hikes.

By 7:35 GMT:

The charges of gold futures contracts for shipping and delivery in December 2022 rose by -.28% to stabilize at a value of $ 1,766.20 per ounce, just after mounting a little by .56% all through yesterday’s trading.

(Futures deal is a contract that obliges the customer to obtain a specific asset at a predetermined price and to be sent at a later on date in the potential)

Buyers will listen to Federal Reserve Chairman Jerome Powell on Friday when he speaks at the annual financial symposium in Jackson Gap, Wyoming, which could give clues about the strategy to elevate U.S. desire premiums and indications of a probable modify in system in the celebration of a economic slowdown.

Esther George, chairman of the Kansas City Federal Reserve, stated Thursday that it is unclear regardless of whether easing US inflation in July is the get started of the pattern.

“We have found a decrease in the July numbers, but I feel it truly is nonetheless substantial, so there is certainly nonetheless a good deal of get the job done to be carried out,” Esther explained in an interview with CNBC.

The Federal Reserve Bank of Kansas Metropolis hosts the summertime symposium in Jackson Gap, Wyoming, and George conducts a sequence of interviews that mark the casual start off of the convention.

The greenback index hovered near to 1-thirty day period highs, when 10-calendar year US Treasury yields remained flat.

Though gold is viewed as a safe expenditure in moments of economic volatility, bigger fascination costs enhance the opportunity value of keeping non-successful bullion.

On the US financial details front, the variety of People making use of for unemployment rewards fell to a a person-thirty day period low of 243,000 statements previous 7 days, indicating layoffs are nonetheless near all-time lows.

US GDP fell .6% yoy alternatively of the beforehand thought .9% in the course of the second quarter, right after a 1.6% drop in the first quarter, market anticipations have been for a decrease in .7%.

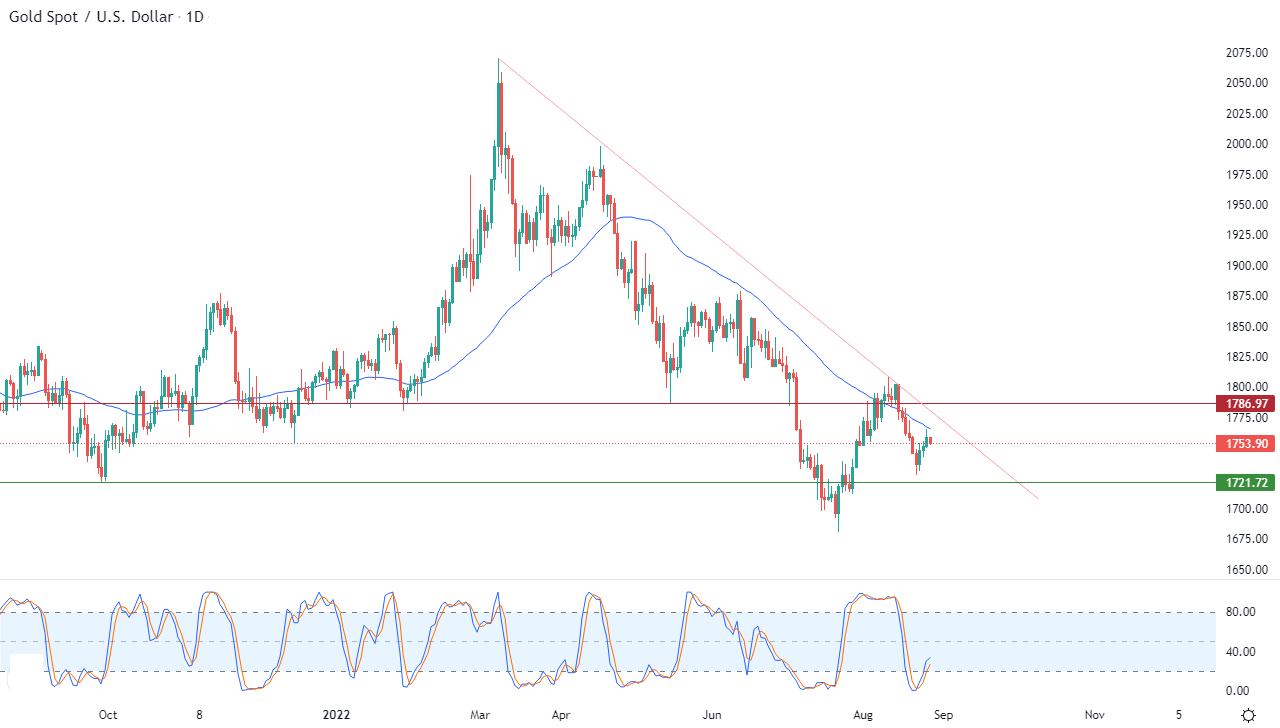

Technical analysis of gold charges in its place transactions: the metallic is subject matter to negative pressures

Gold rates declined in location GOLD Spot transactions in the course of its modern trading at intraday concentrations, submitting slight day-to-day losses up to the time of this report, by -.34% to stabilize at the value of $ 1,752.90L ‘ounce.

Gold has occur less than damaging tension next get in touch with with the resistance of its easy shifting regular from the prior 50 days, which forced it to rebound a little at the begin of its first buying and selling nowadays, specially amid the dominance of the pattern. bearish in the quick expression and together a slope line as indicated in the connected desk for a interval of time (day by day).

The chart was produced by .system TradingView

Gold’s performance came following its makes an attempt to make cash for three consecutive classes, offloading some of its apparent oversold rate into the RSIs, with constructive signals starting off to arrive from them.

Therefore, our anticipations level to a decline in gold for the duration of its impending trade, as lengthy as the 1.787 resistance stays intact, to reach the initially guidance concentrations at 1.722.

–