Despite the congregation of buyers who creep in gold, piem stle spali a vidli the price of gold at 2,000 USD per ounce, I could not escape the truth. Drah metal fell by 4.5% from the same November highs due to the re-appointment of Jerome Powell, chairman of the Federal Reserve System, and an echo of “rhetoric” in the minutes of the last FOMC meeting. Investoi v, e novopeen f Fedu will be able to limit inflation rapid QE constraints and early federal rate increases fond. Investoi v, e novopeen f FED will be able to limit inflation rapid QE constraints and early federal rate increases fond. Ukonen mnovch stimul je pro bky na XAUUSD krajn nepjemnou zprvou.

Like SaxoBank and other companies now believe that the decline gold prices is caused by the selection profit from long hedge positions funds, her two weeks I insist that the growth of valuable metal is speculative. Nue, XAUUSD quotes cannot jump to the background of the index growth USD at 16msn maximum and the reluctance of the investor to increase the amount of ETFs. Yes, the real American sttnch bond skin gold to help, but Powell’s kind of function changed a lot.

Breakeven rate ptiletch bond decrease it for five days, which indicates a decrease in inflation rates. Against the background of the rally of nominal deposits of US debt, their real rates are also rising, what metal tracks deprives of a trump card. According to Swissquote Bank, the bulls on the XAUUSD will continue to retreat because of deposits sttnch bond have only one way up. The reason is death Fedu knock down rozbsnnou inflation on the knees help two normalization policy, not expected.

This theory has a clue. HSBC believes that the long-term factors in the decline in market debt rates will remain low for a long time. Pat to them stiffened the population and from behind the debts arrested Spojench sttwhich for the first time since the kind of worlds wolves peshlo 100% HDP.

Dynamics zadluen USA

According to the forecast of the American ad for stn lidu se podl Amerian starch 65 let zv of 17% v in 2020 at 21% v in 2023. Seniors have two priority investments with low risk and are likely to support strong demand for sttnch bonds.

That is, of course, true. But in this phase of the economic cycle, associated with the return HDP to the trend and normalization of policy changes Fedu, is probability zven sazeb ten-year debt at the level of current highs by 1.75% will significantly increase their return to the August bottom by 1.17%. This circumstance creates for metal tracks protivtr.

Technically speaking, the szka for the formation of the Wolf wave has regained 100%. Nvrat gold under 1 850 USD per ounce nm managed to create a short position with a duty of 1 790 USD, which were with the vigor of the real estate. spn exploded fair value at 1 788 USD a rovn pivot 1 778 USD in the future, the risk continues to peak towards 1,748 and 1,718 USD per ounce.

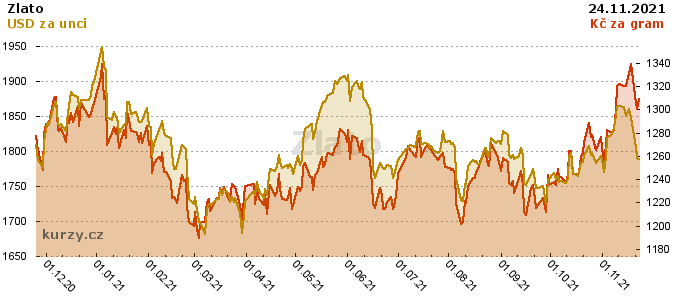

Gold, because count

_w670h379.jpg)

Author lnku: Tm Instaforex

Warning: The information in this article is for study purposes only and in this case it is not an investment recommendation.

InstaForex

Securities trader with a long tradition, regulated by the EU and the new NB, which allows clients to trade more than 1000 investment instruments – Cryptocurrency, ETFs, Currencies, Commodities, Indices and Shares on the MT4 and MT5 and Webtrader platforms.

More information at: www.instaforex.eu/cz/

—

:strip_exif()/i/2004607618.jpeg?f=meta)