On Wednesday, we learned something remarkable, his regular columnist Eddie van der Walt started his comment in Bloomberg’s early morning insight. The price of goods purchased in the US was 50 basis points higher in December than before the month. Meziron inflation b at 7 percent. If investors had received this information in advance, many of them could have decided to go to gold.

feb metal bv historically praised for its ability to act as a security guard inflation. Just from the end year 2020 gold did almost nothing or go me. In nominal terms, its price fell by about 4 percent. In real time, his losses are in double digits.

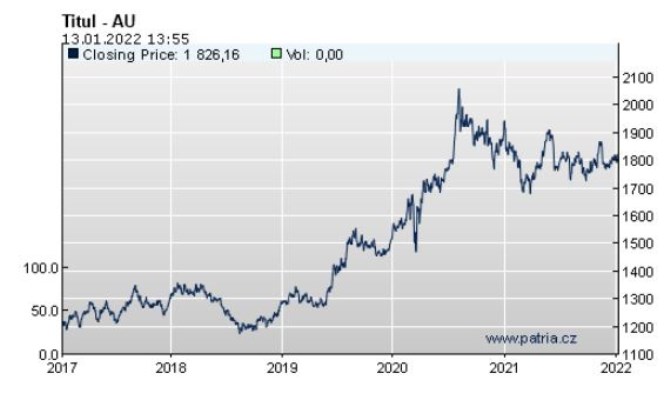

The following chart shows the spot prices gold, oitn o americká inflation. According to Bloomberg, the purchase gold she dreamed, though inflation pitom dila.

Maintaining the purchasing service is one of the most basic forms of pension management. At a time of soaring prices, and especially when the real returns are questionable bond, but it is tk. Time has typically been successful in these periods energetic action, but this is possible because our experience is associated with high prices in such events oil, by se van der Walt.

This time it would be different. Investors may prefer companies that produce products with low price elasticity of demand. In other words, they can raise prices, even if they drank customers. This suggests that we will get to a time when active management will bring ETFs to the wide market. as he says, he wrote such a column today.

price gold after stedench data about american inflation dr over 1800 USD per ounce, although the prospects for tightening monetary policy in investors have taken into account prices. Dollar meanwhile, it hit its worst session since May (named by Bloomberg’s dollar spot index) and fell again. Asset trustees are redeeming their growth for the US currency, which in turn will support me gold. Slab dollar exchange rate discounts gold, traded in dollars, from the perspective of dritel other currencies, which usually supports demand.

Gold reached the spot market today and to 1828.21 USD per ounce, the highest intraday value since January 5. The last time it fell by about 0.2% to 1821.7, USD per ounce. Vvoj metal prices for the last pt let indicates graph no:

Around 1800 USD for an ounce gold stuck in a few msc. At one page his vitality will be as important as before inflac, on page but there is a kind of fear of withdrawal patent for support american economy, which also helped this drachma metal.

Sources: Bloomberg, Patria.cz

–