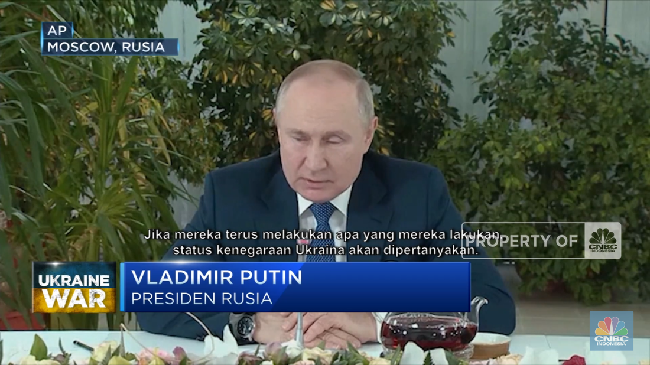

Jakarta, CNBC Indonesia – The war between Russia and Ukraine has been going on for almost three months. This has happened since Russian President Vladimir Putin’s troops attacked his neighbor, 24 February.

The two sides have repeatedly held talks to reach a peace agreement. However, the purpose of the negotiations has not yet been achieved and the two continue to fight.

Although currently the warring countries are still between Russia and Ukraine, there is a potential that this war could become a war between the West and the East. Western weapons assistance and the potential for new countries to enter NATO are feared to make Putin heat up.

Latest, Putin is predicted to soon declare World War 3 (World War 3) in the near future. This was conveyed by the British Minister of Defense Ben Wallace as published Express.co.idquoted on Sunday (1/5/2022).

He said Putin could announce it on May 9, when Russia celebrates the Soviet Union’s victory over Nazi Germany in World War 2. This is to mobilize the Russian people against the world.

The war has undeniably brought the prices of a number of commodities soaring, including food and energy. A number of countries, such as Europe and the United States (US) are even predicting another recession due to high inflation and uncertainty.

Then can we still invest? Or is there a suitable investment in current conditions.

Following CNBC Indonesia Research:

1. Not

Gold can be a safe haven for assets so that their value is not damaged by war. In world history, several incidents have been recorded that caused a spike in world gold prices due to war.

During World War I, the world gold price reached US$ 536.69/troy ounce in April 1915. After the war subsided, the gold price fell and reached its lowest price at US$ 275.2/troy ounce.

More than 50 years later, world gold prices have skyrocketed by 290% since December 1970 to reach their highest level in March 1974. At that time, the peak of gold prices was at US$ 999.67/troy ounce. This safe haven asset skyrocketed because of the Middle East war that broke out in 1973.

Meanwhile, in the 2000s, tensions between the United States (US) and Iraq made gold prices soar up to 50% within a year.

Throughout 2022 alone, the price of gold has shot up 3.72%, although from the beginning of the Russo-Ukrainian war, namely last February 20 to Friday this week, world gold prices tended to weaken by 0.48%.

Gold is dubbed as a safe haven asset because it offers investors protection from uncertain economic conditions or crises. Because gold has stable price movements and minimal risk, so it is suitable as a hedging asset.

Moreover, war will also cause inflation to skyrocket because the government will be diligent in spending money to win the war. In addition, production will stagnate, causing goods or services to become scarce. When there is a shortage, the price will increase.

Inflation shot up causing the currency to become worthless. This is the reason why investors need to hunt for gold when war threatens.

2. Money Market Mutual Funds

Besides gold, money market mutual funds also tend to be considered as an alternative safe haven others for some investors. This type of mutual fund also tends to be relatively low risk compared to other types of mutual funds.

However, it should be noted that money market mutual funds should be chosen using currencies that tend to be stable during the war. If you choose a currency that tends to fluctuate during war, then the risk is not far from other mutual funds.

3. Bonds

Indeed, bonds, both corporate and government are one of the assets safe havenbecause the yield (yield) offered tend to be competitive and not too volatile.

In the Indonesian government bond market or government securities (SBN) only, especially for a tenor of 10 years, yieldis currently in the range of 8%. It means, yieldis already quite high and this is an attraction in itself.

Although it is considered to be one of the safe havenbut the current global government bond market tends to be less attractive because yieldit will still have the potential to rise. This is due to the tightening of global central bank monetary policy which makes yield government bonds tend to continue to rise.

CNBC INDONESIA RESEARCH TEAM

(chd / sef)

–