Some exponents of the center-right speak of the solution to the gas problem by saying yes to sanctions on Russia, but let’s stop speculation with futures at the TTF.

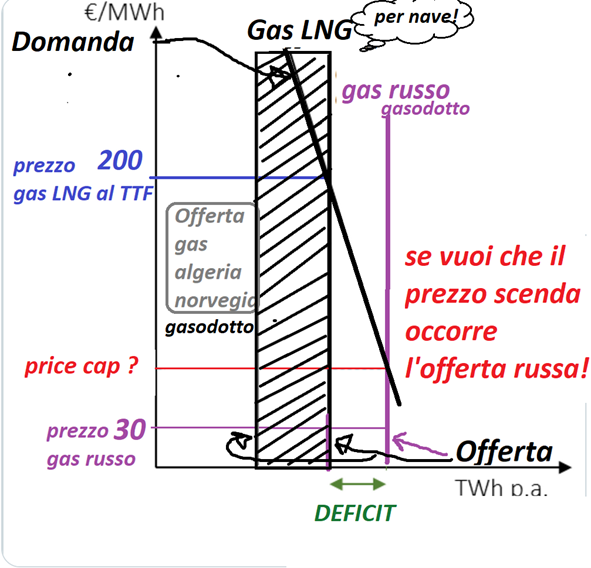

We then thought of helping them with a graph of gas supply and demand, as is done in economics to explain the price. Here we see how the demand falls with the price, if the gas costs ten times more, many close the factory or turn off the radiator. But the supply, that is, the production is not, that by pipeline almost nothing and that of liquefied gas by ship is also at the limit. If you cut the Russian gas supply, the price that was at 30 euros / MWh explodes to 200.

This graph shows how gas supply and demand can reach over 200 euros per MWh in Europe. We have indicated on the vertical axis on the left the various gas prices, from that Russian who was about 30 euros pre-crisis, at the “price cap” they talk about in the EU (40 … 50 euros?), at the current price at the famous market now in the Netherlands of the TTF which is now over 200 per MWH.

What do you see? We have also indicated on the horizontal axis the quantity of gas (measurable in TWH that is thousands of GWH per year).

The liquefied gas per ship is the dashed one. The liquefied gas bought has increased by double, before it was 13% and now 29% in Europe and it shows that it takes up a lot of space, but now it has a limit.

The supply of gas, therefore, does not vary with the price as it happens in other markets, in fact it appears vertical. Usually, however, if the price of some good triples, more is produced. The demand is reduced and then the market mechanism balances supply and demand at a lower price and it never happens that the price increases tenfold.

In the case of gas, supply or production is not very sensitive to price because ithe gas extracted in the world does not vary from one year to the next, Proof of this is that the price is ten times last year and world production is almost unchanged! Obviously, if the price remains at absurd levels like these, then the producers will make investments, but it takes years to increase the extraction, other years for the gas pipelines and also for the liquefaction and regasification terminals. Put simply, gas is not a market like any other.

Unlike oil, 85% of gas is shipped around the world by pipeline and it takes at least five to ten years to build. Then there is liquefied gas by ship, but until 2016 it hardly existed, it was an Asian phenomenon where gas pipelines are far away and by reducing coal they started to get it by ship.

Moral. For next year the offer is fixed or almost. Demand falls, a little but falls, supply is fixed. So if you cut the Russian gas supply, the price explodes anyway, speculation or non-speculation.

Furthermore, in the case of gas the demand is not very sensitive to the price, in the sense that if the price of anything else increases by ten times the demand collapses, but in the case of gas, being necessary for heating, electricity and industrial production, it cannot reduce consumption a lot or go back a hundred years.

So are those who say that it is not the derivatives speculation in the Netherlands that causes the price to explode tenfold, as many politicians now say in the electoral campaign are right? Is it just the supply and demand of gas? European governments are grabbing gas by ship that goes around the world to cut the Russian gas. So in fact it is the supply and demand that determines these absurd prices.

But it is the liquefied gas per ship that now determines the price of 200 (or 300 euros). For this type of liquefied gas, its “fair” market price is over 200 euros and speculation only makes it fluctuate a lot, but in the end, if you want it, you pay prices above 200 euros.

What many don’t realize is that the problem is all in the famous liquefied gas sent by ship. Europe pays most of all so those who liquefy it and then send it divert the ship to Holland where it costs 200 euros, while for example in Asia now about 150 euros (per MWh). Asia was the largest consumer of gas per ship because it has fewer pipelines. Because of Europe, which pays any price for not having to buy Russian gas, the price in Asia has also exploded.

And the gas that comes by pipeline from Russia, Algeria, Norway, Azerbaijan, which remains 70% of the total?

Let’s go back to the graph. The gas from Algeria, Norway, Azerbaijan per pipeline in most of the other years has a limit and you see the vertical line indicates it. If you reset the Russian gas, which has now dropped to only 9% of the total (for simplicity we reset it), you see that you have to pay 200 euros for the gas “on the market” at the TTF. So if you put a “cap” on the TTF you will have a deficit and you will have to reduce consumption a lot, you stay in the cold and the industry closes.

If you replace Russian gas with liquefied gas that previously went to, for example, Pakistan or China, those who sell it take advantage of it. If you put a “cap” at 40 euros, they sell it in Asia and you stay in the cold and with the companies closed. If you want the price to go down from 200 euros, even just to 50 euros, in short, you have to continue buying Russian gas.

But then there is the real problem. Gas for pipeline and liquefied gas for ship are two different things economically, one is cheap and the other if you want it costs you an eye. The point nobody talks about is that liquefied gas per ship has now increased to 30% of the gas arriving in Europe, but the other 70% is gas sent by pipeline which has NOT increased to 220 euros (price of today’s TTF).

There is no gas pipeline market, there are contracts signed years ago at a price that only partially reflects that on the market. How much does this gas cost?

If for example read the article by Fubini find out that it costs on average less than 120 euros. Eurostat publishes data on the cost of gas per pipeline because even if the contracts are confidential it has access to the data. It seems that in Germany they pay Gazprom only 40 euros, but also the rest of Europe and therefore Italy does not pay 220 euros to the TTF, but less than 120 euros.

We must then – we repeat – to ask to whoever buys by pipeline with contracts signed years ago how much he pays, because if he pays it 120 and sells it at 220 then certainly in this case the State should intervene. This is the real problem, not the gas price cap. The other problem is that if we want to have a decent winter, we cannot do without Russian gas.

Paolo Becchi and Giovanni Zibordi, 12 September 2022

–