In 2021, Konstantin Kuzikovs started investing 50 euros a week on the stock exchange. The goal is to reach a capital value of 36,000 euros within ten years. Raivis Vilūns has also started investing since January, but uses much more profitable and risky financial instruments. You can find out how Konstantin and Raivya’s portfolios are doing in this article, and you can learn about the plans and strategies of both investors in the program “Capital of the future“.

The content will continue after the announcement

Advertising

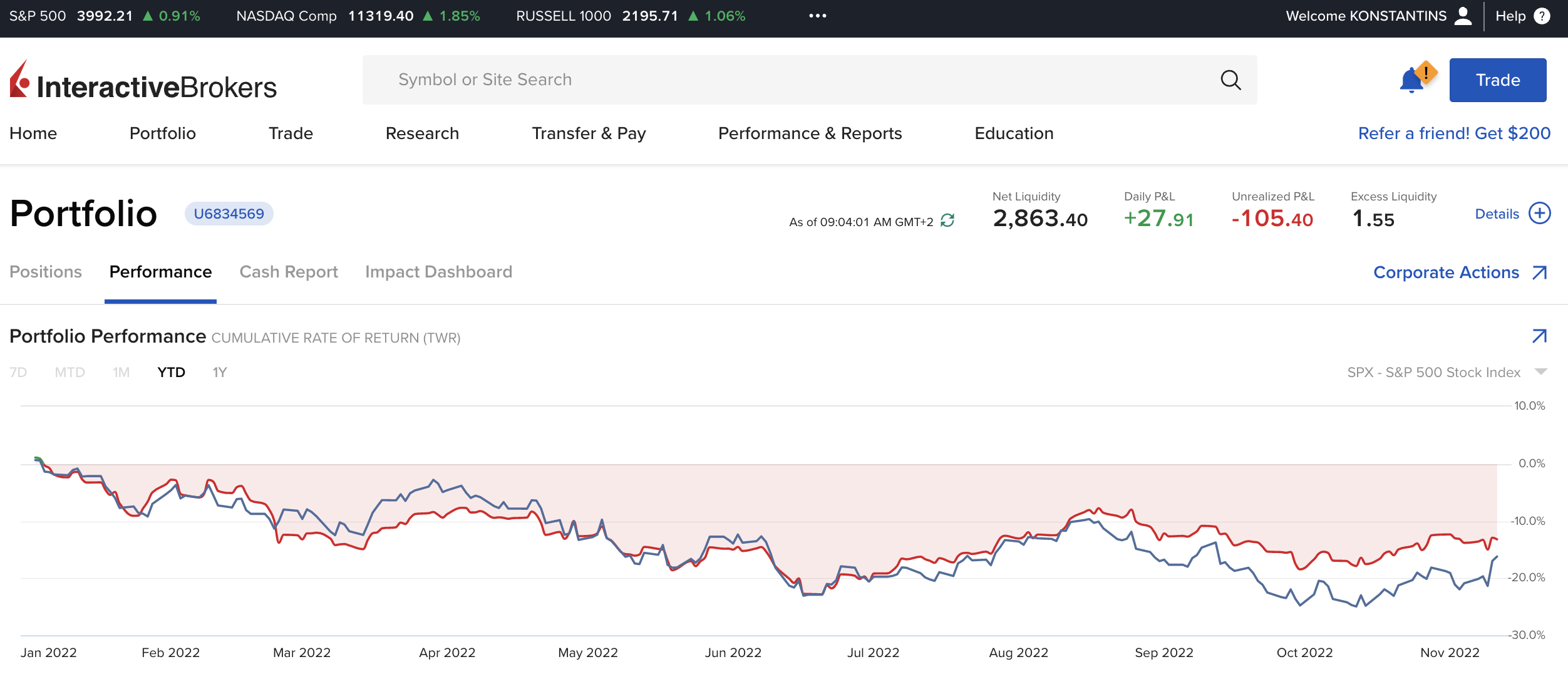

How has the capital of Kuzikov changed on November 11, 2022?

- Invested: EUR 3000 (+ EUR 50)

- Capital value: 2791.11 (+72.29 euros)

- Return on investment: -4.53 (+0.82 percentage points)

How did the capital of Vilūn change on November 11, 2022?

- Invested: 2901.55 euros

- Capital value: 2536.57 euros

- Return on investment: -12.57% (-4.8% for the week)

What happened at the market during the week?

Thursday was one of the best days on Wall Street in decades. Released data on US inflation has led investors to believe that the worst point has passed. Thus, the “S&P500” index rose by 212.22 points or 5.61% last week. But looking at all this, we shouldn’t fall into euphoria. The peak period of inflationary momentum is over, but it will be some time before the FRS can declare total victory. A strong labor market and strong wage growth in a context of slowing inflation will stimulate economic growth, which in turn could slow the inflation slowdown. The FRS needs the opposite, so the regulator’s rhetoric is unlikely to soften anytime soon.

The Baltic stock market also seems to have reacted somewhat to the fact that inflation in the US may have peaked. The Riga Stock Exchange Index “OMX Riga” increased by 0.6% this week. “OMX Vilnius” by 0.64%, while the Tallinn Stock Exchange by 1.12%. The overall index of the Baltic stock exchanges “OMX Baltic Benchmark GI” rose by 0.93% this week. The last two weeks in the Baltics have been positive and you can observe the overall growth in equity values.

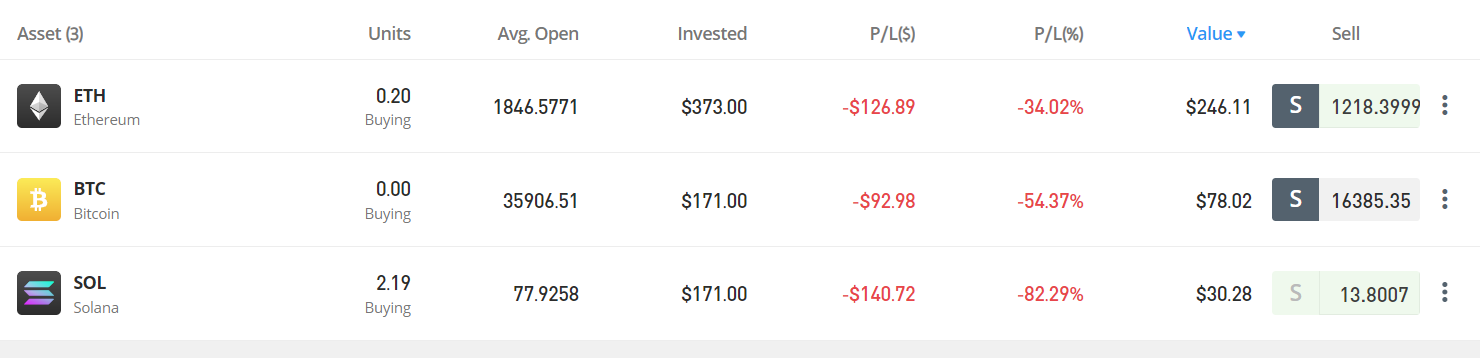

On the other hand, cryptocurrencies, which started a small rally last week, are experiencing yet another decline again. This time, the liquidity problem and the rapidly approaching bankruptcy of the cryptocurrency exchange “FTX” are to blame. “Delphi Bizness” already reportedthat “FTX” management ended the week seeking to raise $6 billion from investors to cover obligations to investors.

Portfolio changes

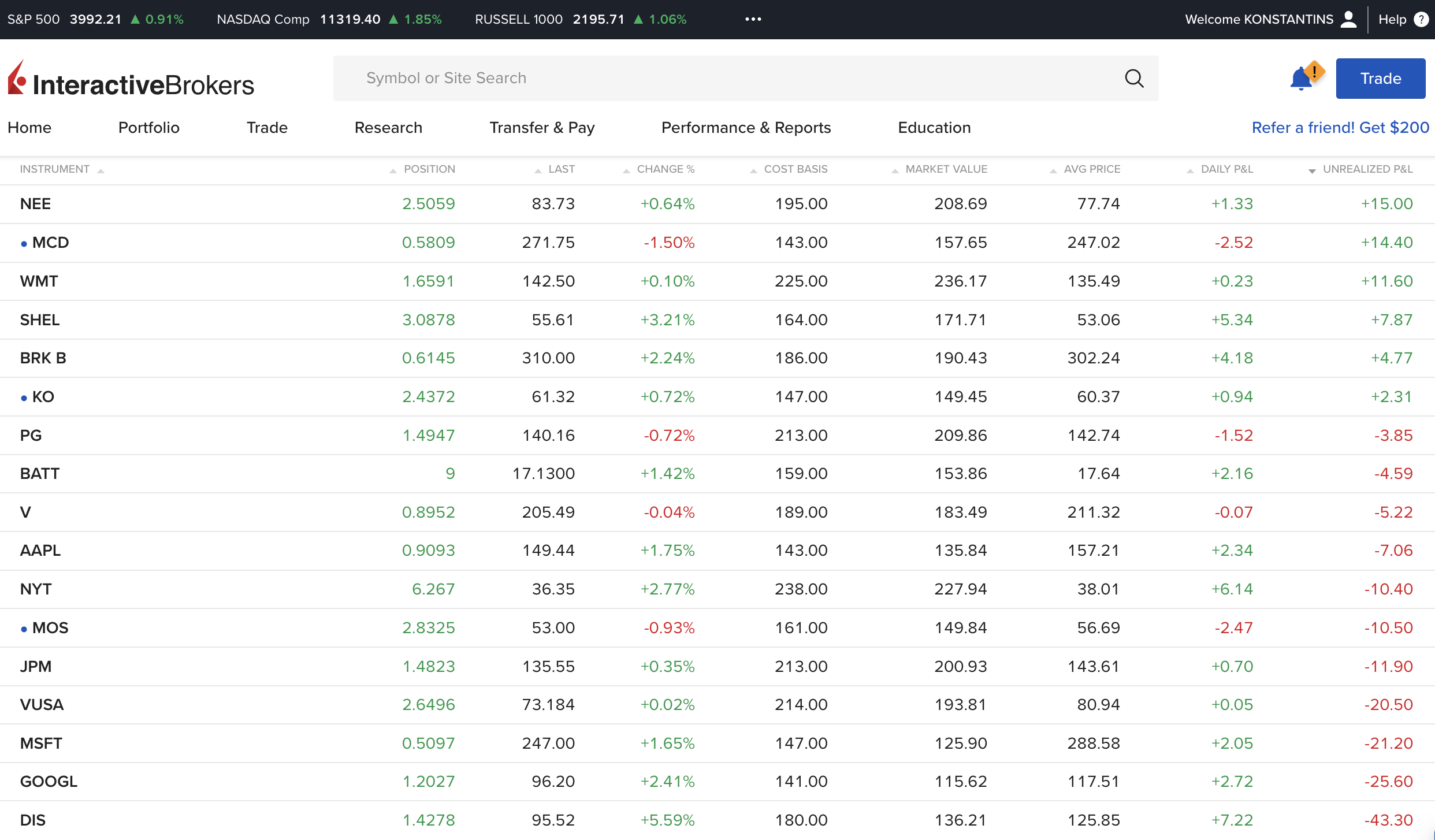

The common situation with Kuzikov shares is as follows:

- Already 5 stocks are showing positive returns (up from 4 a week ago)

- The total return of the joint portfolio decreased from -180 euros to -105 euros

During the week, 11 out of 18 stocks showed an increase in value. Among the leaders of the second week “The New York Times” (NYT) with +0.43% and “MICROSOFT CORP” (MSFT) with +0.3%. The largest decline in value was shown by the tech giants: “SHELL PLC-ADR” (SHEL) with -0.33% and “WALT DISNEY CO” (DIS) with -0.42%.

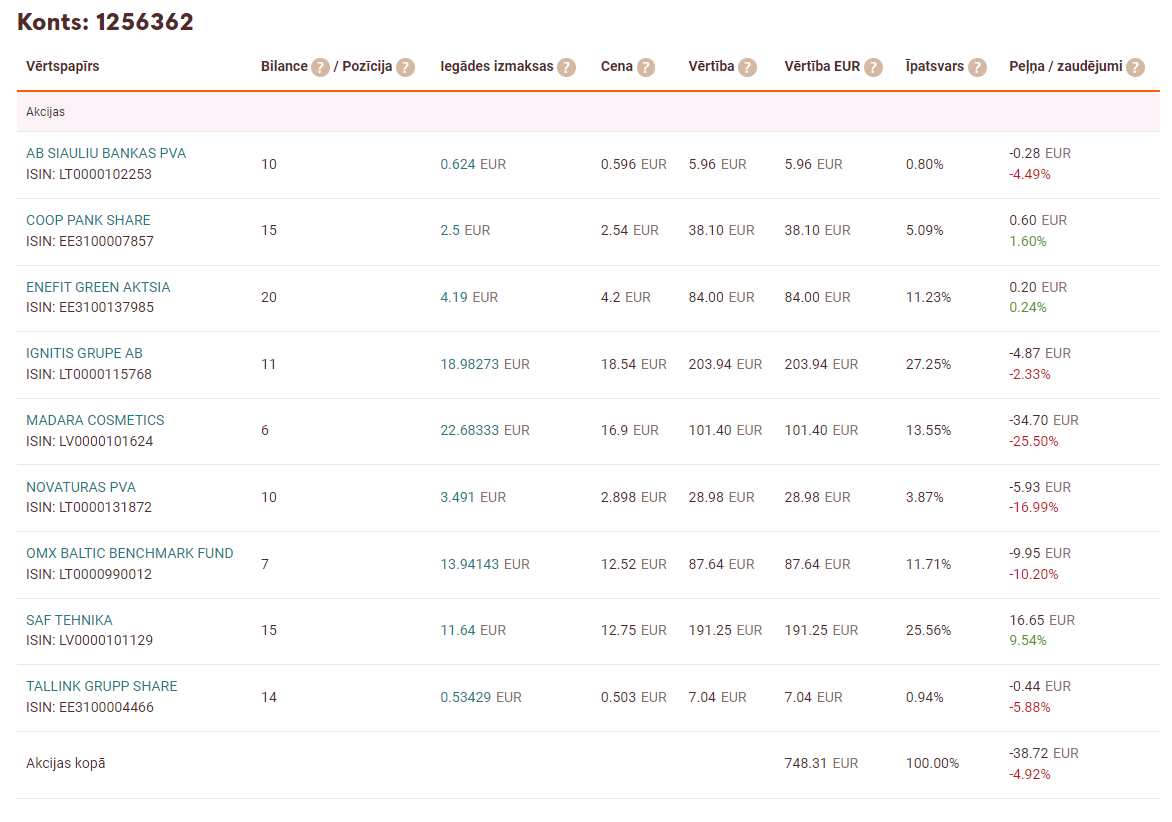

The situation with Vilūn Baltic shares is as follows:

- Three out of nine positions show positive performance: “SAF Tehnika”, “Coop Bank” and “Enefit Green”

- Negative growth for the total portfolio is -4.92% (previously -7.42%)

The situation with Vilūn’s cryptocurrency wallet is as follows:

- All three cryptocurrencies – “Bitcoin”, “Ethereum” and “Solana” show a decrease in value

- The biggest drop in value is “Solana” (-82.29%)

Kuzikov sells MasterCards and optimizes the financial sector

“I continue to follow my diversification strategy and invest in those segments where I currently have the least investment compared to the others. Last week it was food, but this week it will be ETFs and specifically all the money will be invested in “L&G BATTERY VALUE-CHAIN”. It is this segment that lags behind my goal of 20% of the entire portfolio, now it is 18.21%,” says Kuzikov.

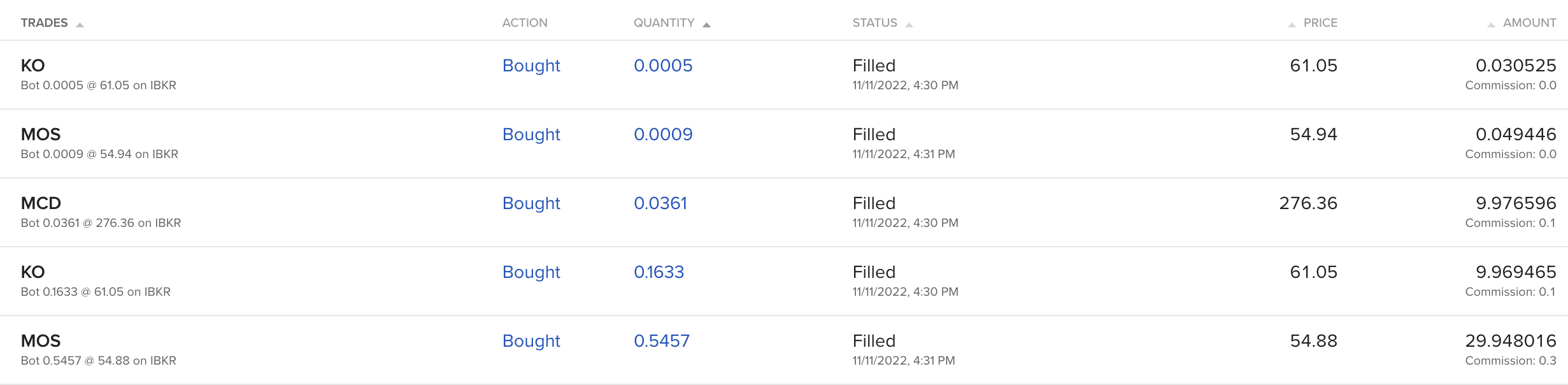

Vilūns continues to increase the Baltic portfolio and think about buying new shares

“I keep increasing the portfolio of Baltic stocks, because it seems to be the safest investment at the moment and also the most profitable one,” says Vilūn.