In addition to inflation, strategists are looking for important indicators that could cause the Federal Reserve (Fed) to modify its aggressive rate hike plan Sexual contraction, turmoil in the foreign exchange market has deepened.

1. Widening of credit spreads

The average yield on US investment grade corporate bonds, relative to the yield on risk-free US Treasuries, is the so-called credit spread. Credit spreads have increased 70% over the past year and corporate borrowing costs have risen rapidly, especially as the US recently reported a higher-than-expected annual inflation rate.

Although the current spread has fallen from its peak of 160 basis points in July, the cumulative gain is still large, underlining the growing pressure on credit markets due to monetary tightening.

Chang Wei Liang, chief strategist of DBS Group Holdings, said: “Investment grade credit spreads are by far the most important indicator due to the high percentage of investment grade government bonds. If investment grade credit spreads widen beyond 250 basis points, close to the peak during the pandemic could prompt the Fed to fine-tune its policy guidelines. “

US financial conditions tightened in mid-August to levels not seen until March 2020 with rising financial costs and falling stock prices, Goldman Sachs compiled an indicator of credit spreads, stock prices, rates interest and exchange rates. Fed Chairman Powell said earlier this year that financial conditions are the Fed’s indicator of policy effectiveness.

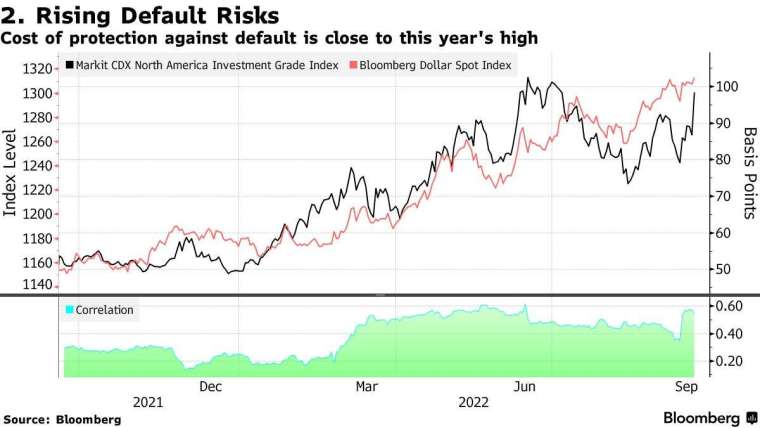

2. Increased risk of default

Another indicator is the cost of contracts to insure against the default of corporate bonds. Looking at the “Markit CDX North American Investment Grade Index Spread”, a measure of a basket of investment grade bond credit default swaps (CDS), it has doubled since the beginning of this year to 98 basis points, which is quite close to the peak of 102 basis points seen in June this year.

The risk of default is closely related to the appreciation of the dollar.

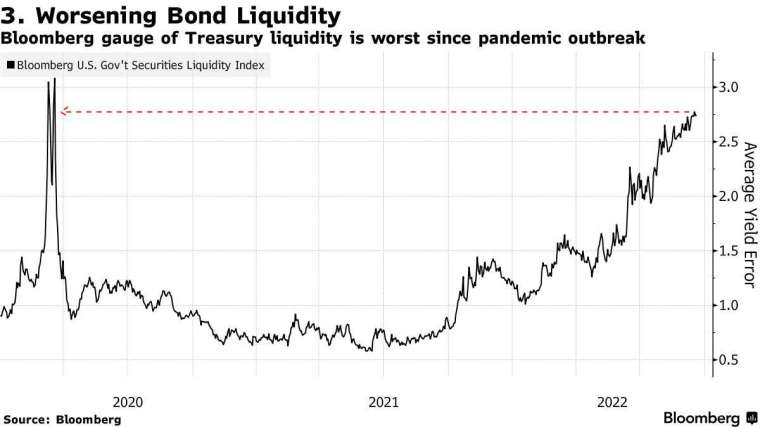

3. The liquidity of the bond market decreases

Liquidity in the US Treasury market is shrinking. Bloomberg’s metrics tracking U.S. Treasury liquidity are at their worst since the start of the pandemic in early 2020.

The depth of the 10-year US Treasury market followed by JPMorgan also fell to lows in March 2020. Even the most liquid government bonds of the time were hard to match.

Poor liquidity in the bond market will increase pressure on the Fed to reduce its balance sheet. The Fed currently matures $ 95 billion in Treasury and mortgage-backed securities each month without having to invest the capital, removing liquidity from the financial system.

4. Currency volatility increases

Another indicator that could make the Fed think twice is an increasingly volatile currency market.The US dollar has been on fire this year, reaching multi-year highs against all major currencies, even going so far as to win.EURbelow par.

The Fed does not usually see the dollar appreciating, butEURExcessive depreciation could raise concerns about the deterioration of global financial stability.EURAlthough the decline in value continued earlier this month, the relative strength index (RSI) did not continue to decline, which could representEURThe depreciation has slowed, but that does not mean that the long-term downtrend line has been broken.

John Vail, Nikko Asset Management’s chief global strategist, said the Fed won’t want toEURThe depreciation has depreciated to the point of being out of control: “This is already a global financial stability problem, not just because of the Fed’s dual responsibilities.”

(This article is not open to partners for reprint)

–