The Bank of England Urged to Revamp Economic Model to Avoid Inflation Surprises

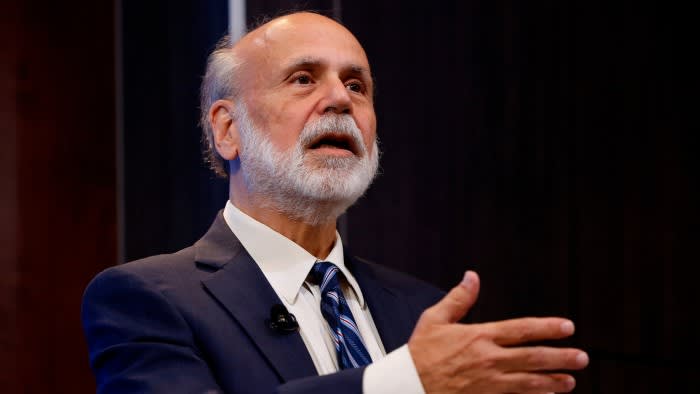

The Bank of England must revamp its main economic model if it is to avoid repeating its recent failure to forecast surging inflation, advised by former Federal Reserve Chair Ben Bernanke.

Bernanke Criticizes Bank of England’s Economic Model

The Nobel laureate, who conducted a review of the BoE’s forecasting and related processes, found significant shortcomings in the bank’s baseline economic model, which were exacerbated by outdated software.

The Need to Eliminate “Fan Charts”

Bernanke called for the elimination of the Monetary Policy Committee’s current “fan charts,” which depict the probabilities of different outcomes for growth and inflation under various assumptions. He argued that these charts have outlived their usefulness.

Post-Pandemic Challenges and Recommendations

Bernanke was enlisted to assess the BoE’s forecasting performance following criticism for failing to anticipate a post-pandemic inflation increase. The review suggests the need for radical changes to equip the bank for a more volatile economic environment.

BoE’s Commitment to Implement Recommended Changes

The BoE expressed its commitment to implementing all 12 recommendations highlighted in the report. An update on proposed changes is expected by the end of the year.

Positive Response and the Importance of Modernization

BoE Governor Andrew Bailey recognized the review as a “once in a generation opportunity” to update forecasting approaches and adapt to a more uncertain world. He acknowledged that the bank’s scale and the unpredictability of recent shocks posed challenges.

Urge for Immediate Investment and Future Model Revamp

Bernanke urged the BoE to urgently invest in modernizing software and, in the longer term, revamping its economic model, Compass. He emphasized the model’s need to address productivity, labor markets, trade, and include detailed models of financial, housing, and energy markets.

Publishing a Range of Scenarios for Transparency

Bernanke suggested that the bank should rely on publishing a range of scenarios to explain its decisions, forecast risks, and ensure robustness in the face of uncertainty, instead of using fan charts.

Avoiding the “Dot Plot” Approach

Bernanke did not recommend the adoption of the “dot plot” method, which he introduced at the US Federal Reserve. He did, however, propose that the MPC consider publishing its own interest rate forecast to improve transparency.

Considered Changes to Policymaking and Communications

Bernanke concluded that while the suggested changes carry significant consequences, the BoE should primarily focus on improving its forecasting tools before cautiously adopting alterations to policymaking and communications.