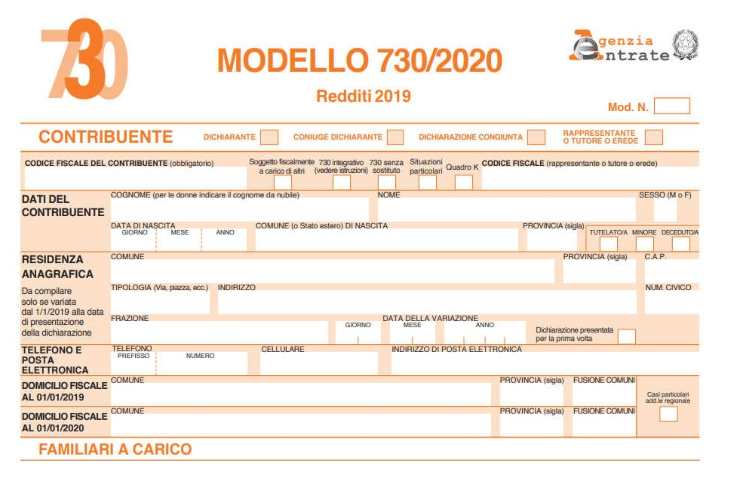

There is an important communication concerning the pre-filled 730 form and which comes directly from the Revenue Agency.

Model 730, there is a novelty as regards the possibility of being able to use the pre-filled forms made available by the Revenue Agency. Previously, a first date was available, which coincided with next 30 April. The new date to refer to is now May 23, 2022.

The provision comes from the Budget Commission of the Senate, which has included the matter in the Sostegni ter Decree. The precompiled model 730 is in fact now submitted to an extension. There will be more time available to be able to comply with the Revenue Agency.

The submission must be completed by connecting to the official website of the Organization, after having logged in to your reserved user area. To be able to do this you must have Spid, Electronic Identity Card or National Service Cardas is now common practice as regards the use of the services offered by the various bodies of the Public Administration.

You may also be interested in: Transfer problems, what to do if the transaction does not take place

Precompiled 730 form, which items it includes

All this if we are familiar with the use of a computer. Otherwise we can make use of the advice of a CAF Patronage who will check the document for us, verifying that it has already been filled in automatically and integrating or correcting it with any appropriate changes.

You may also be interested in: Health ticket, bad surprise in the mailbox: fines on the way

The pre-filled document usually contains all the expenses incurred during the reference year. Expenses duly tracked and covering multiple areas. They range from those in the medical and health sectors to those for education, up to the exits linked to any insurance and social security contributions.

You may also be interested in: INPS check, there is time until March 31 to have 500 euros per month

And funeral expenses are also included in the category, together with the expenses related to any restructuring and redevelopment works. To consult the pre-filled 730, simply enter your user area on the website of the Revenue Agency. Which must be communicated by September 30th for the classic 730 or by November 30th in the case of Individuals’ Income.

–