Worldwide demand for gold in this quarter it fell by 19 percent to 892.3 tons, which is at least in 11 years. Central bank tame at first for ten years gold delayed, the World Council said today gold (WGC).

Kvli coronavirov The pandemic has stopped the sale of perks, which is usually the biggest source of demand for gold. The demand for the Perka sector thus fell by 29 percent. In the third quarter, however, the market began to recover slightly, including demand in n and in India, which is one of the largest consumers metal. Compared to the previous quarter, the demand for mrn increased.

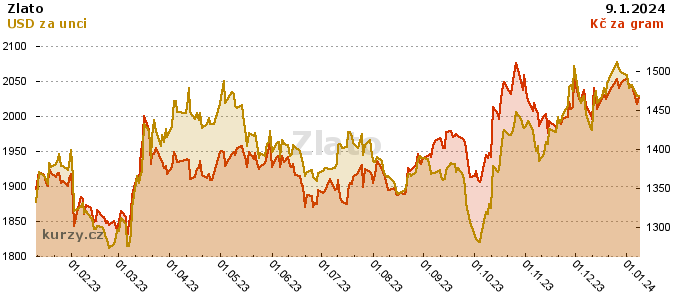

The decline in demand from perk was offset by investors who bought gold considered safe loit values. Request after gold as an investment, it increased by 21 percent, of which the demand for gold bars and coins by 49 percent and the purchases of exchange traded fond ETF by percentage point. I will eat fond O gold but against the previous quarter fell sharply. This contributed to the dream price gold around 1900 dollar per troy ounce of 2072.5 dollar in August.

Central bank in the third quarter they sold 12.1 tons in the same week gold, a year ago, on the contrary, 141.9 tons metal bought. Most for sale pisply central bank Uzbekistnu a Turkey, quarterly sales, but for the first time in 13 years reported rusk centrln banka. Nkup gold central banks in recent years, on the contrary, has been in favor gold support.

Financial position Citigroup missed the forecast predicted that demand from central banks will recover again in five years. In the years 2018 and 2019 The purchases of central banks were a record, Bloomberg warned.

According to WGC analyst Louise Streetov, it is not surprising that in the current economic situation of the bank gold reserves. Dark evening sales according to n origin from banks that buy from domestic sources, and take advantage of high prices gold at a time when they are sttn trouble their land tense.

For the ninth msc letonho term is poptvka after gold decreased by ten percent to 2,972.1 tons and was equal to the lowest since 2009. The WGC n and in India in the last quarter again will grow a central bank they could then shop again. Continuing economic uncertainty, low years of rates and government stimulus patent The way that the market will be driven by investors, Reuters reported.-