–

Right after a major deterioration in the fiscal weather through the corona pandemic, the scenario for providers in Germany enhanced a little past year. This is just one of the findings of a organization study executed by Kreditanstalt für Wiederaufbau (KfW) in the 1st quarter of 2022. The demand for credit rating has for that reason fallen once more a short while ago, possessing amplified drastically at the get started of the pandemic in 2020 owing to of the elevated liquidity demands of providers. According to the KfW review, the condition about company funds ratios is now somewhat extra good than it was a year ago. Thanks to the investigation interval, even so, the entire extent of the effects of the war in Ukraine is not integrated in the success.

The demand for credit rating has decreased

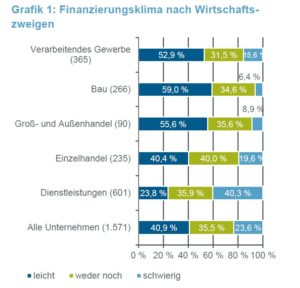

The further advancement of the money atmosphere is subject matter to a superior degree of uncertainty in look at of the deteriorating economy and the increasing tightening of financial policy. According to KfW, the financing local weather has a little bit improved compared to the past study. However, it stays down below pre-crisis concentrations. In last year’s study, only about 35% of firms rated obtain to credit as easy, in comparison to just under 41% in the existing survey. But the economical climate stays tense, particularly in the assistance sector and retail trade.

In 2021, the desire for credit rating lowered a bit again in comparison to the prior 12 months. About 44% of firms executed loan discounts in 2021, approximately a third less than the 2020 crown year. At that time, lots of organizations experienced taken out loans to fill liquidity bottlenecks. Lengthy-phrase financial loans have been the most in demand from customers: about 56% of all companies in bank loan negotiations led to financial loans with a maturity of no considerably less than 5 several years. In a lot more than 50 % of the instances, the mortgage negotiations, regardless of no matter whether they have been small, medium or extensive time period, were being profitable.

Sustainability ever more essential

The success of the hottest KfW study also present that the concern of sustainability is getting increasingly essential for organizations. It also plays a role in credit rating negotiations. At the exact time, the lack of fiscal sources is a fundamental obstacle for firms to be a lot more concerned in sustainability. All-around 78% of respondents believe that that sustainability will have a higher or really high precedence for their business in 3 to five decades. An raise in worth is expected in all economic sectors and in all sizing lessons of providers.

–

As editor of the Unternehmeredition, Alexander Görbing on a regular basis experiences on organizations and financial events. His places of desire include restructuring, merger and acquisition processes, financing and technological know-how commence-ups.

–

–

–

–

–

– –