Are you about to get a mortgage? The next step is to purchase the best loan insurance for you. Even though it is not mandatory, the bank will not grant you your credit without this protection. Its role is to pay off your loan if something should happen to you.

Since 2010, you can take out your contract with an insurer other than the lending bank (delegation of insurance). This competition represents a significant advantage and can make you save between € 6,500 and € 15,000 over the life of the loan (source: ACPR, 2018).

Here are the steps to get your loan insurance at the best price, while respecting the principle of equivalence of guarantees.

1. I define my borrower profile.

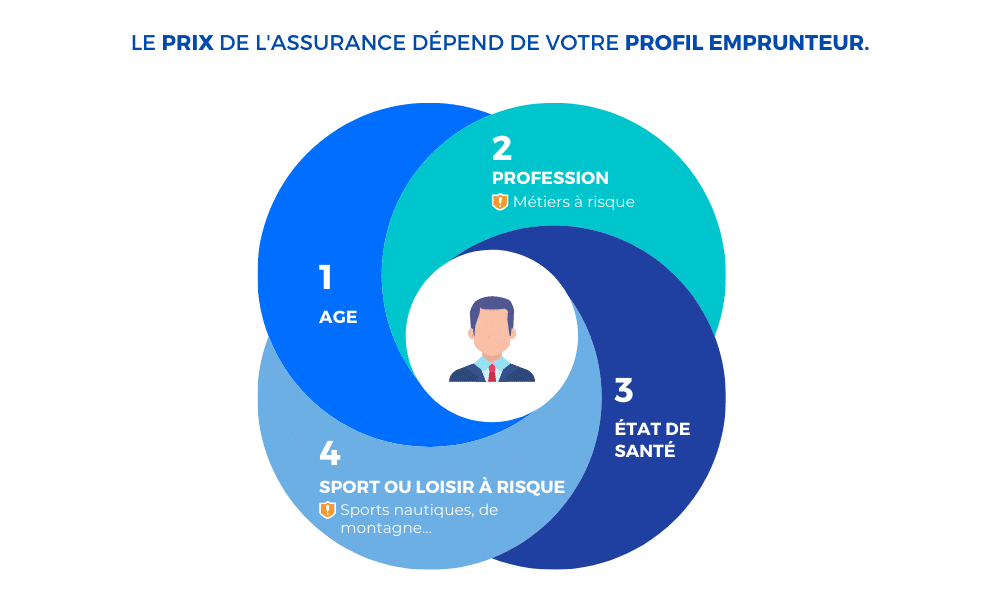

The price loan insurance differs from organization to organization, but it also depends on your profile. Indeed, the amount of your contributions varies according to your age, your profession, your state of health or your lifestyle. In other words: the risk you represent for the insurer.

–

If you exercise a profession considered at risk, that is, with a higher than average risk of an accident, you will pay more for your loan insurance. This particularly concerns:

- road

- policemen

- firefighters

- security agents

- pilots

- window cleaners …

Insurers also analyze your medical background. Before taking out your contract, you must complete a health questionnaire and state if you are a smoker, if you suffer from a chronic illness, etc. These elements allow the insurer to accurately assess the risk incurred in covering you.

Finally, the fact of practicing a risky sport or leisure (climbing, diving, parachuting…) once again increases the bill.

Certain hobbies or professions may also be the subject of disclaimer of warranty. In this case, the insurer will not cover you if these activities are the cause of a loss of autonomy or a death. And cover up the truth to lower the price of your loan insurance is not an option. If the insurer finds out that you lied, you will not be covered.

2. I choose the right guarantees.

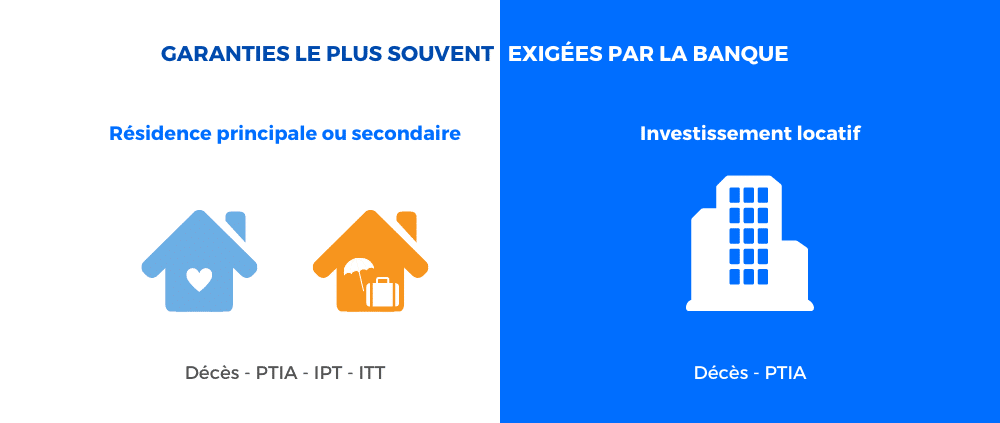

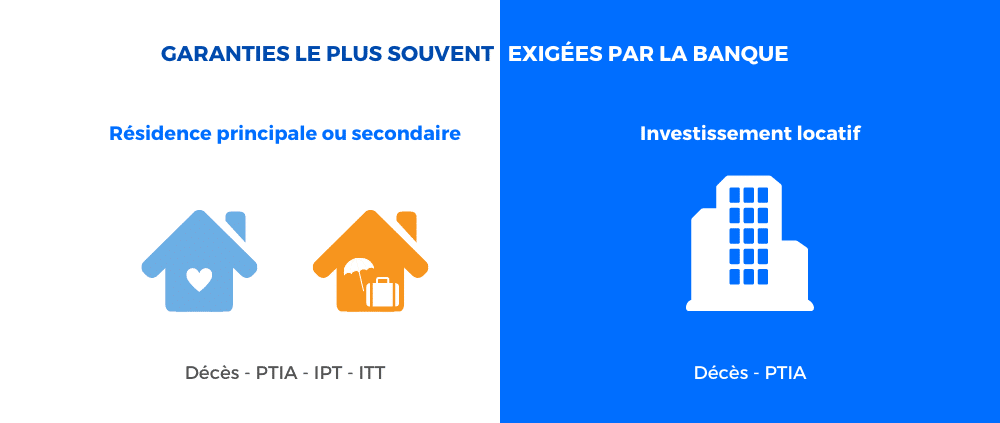

Your loan insurance must cover the risks associated with death and the total and irreversible loss of autonomy (PTIA). These two guarantees always go hand in hand and constitute the minimum coverage.

If the mortgage concerns a primary or secondary residence, the bank will certainly require the following guarantees:

- total permanent disability (TPI)

- temporary incapacity for work (ITT)

If you are retired, be sure to exclude these guarantees.

If it is a rental investment, the double guarantee death – PTIA generally sufficient for the granting of the loan. Indeed, the bank often considers that the rental income makes it possible to cover the monthly payments in the event of unforeseen circumstances.

–

Finally, with a higher contribution, you can choose to cover other risks such as permanent partial disability (PPI) or job loss. These guarantees are optional : it’s up to you to choose the guarantees that meet your needs.

To find out what guarantees are required, you can consult the standardized information sheet, which the bank will have given you in advance.

3. I determine the portion (if I have a co-borrower).

The quota is the share of the capital that your loan insurance covers. If you are borrowing alone, the question does not arise: it must be 100%.

On the other hand, if you borrow from two, you must distribute the portion between the co-borrowers. The property must be 100% covered but you can choose the distribution you want between you: 50-50, 70-30, etc. It is advisable to put the largest share on the one with the highest salary.

You can also choose a quota greater than 100% for maximum protection. For example, 100% per head, for a total coverage of 200%. In this case, if one of the co-borrowers were to die, the insurance would reimburse the loan in full.

–

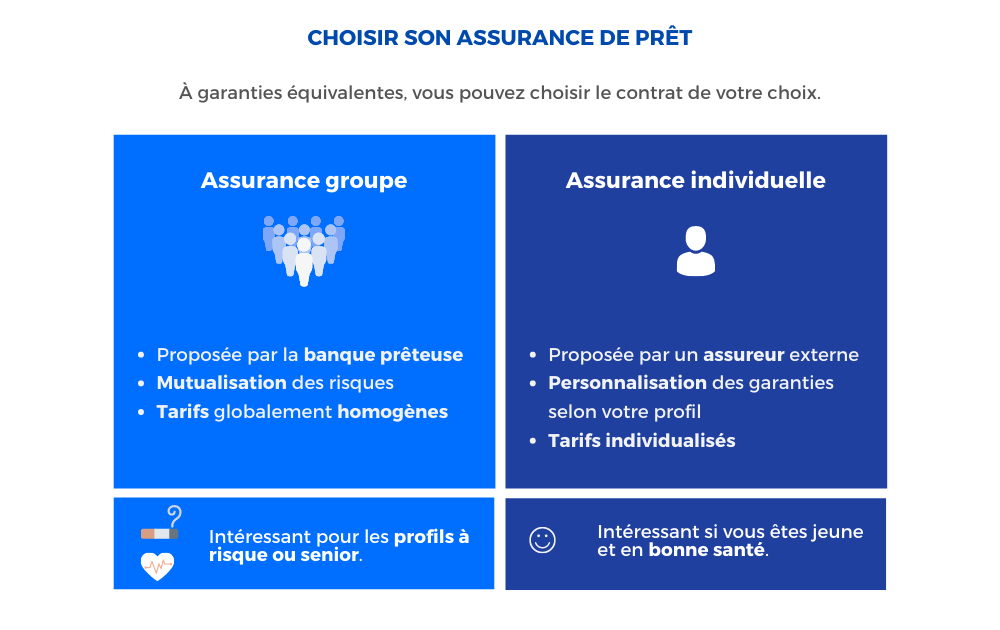

4. I compare loan insurance.

Thanks to the Lagarde law (2010), you have the choice between a insurance Group and an individual insurance. The loan insurance offered by the bank mutualises costs and risks between borrowers: it is an interesting option if you have a risk profile or if you are a smoker, for example.

On the other hand, if you are young and in good health, the individual contract can you do save up to € 15,000 because it adapts to your borrower profile. The only condition to be respected: the guarantees offered by the insurer must be equivalent to those of the bank.

–

To find out what is most interesting, compare insurance quotes. Nothing could be simpler: use an online comparator such as Hyperassur or call on a broker.

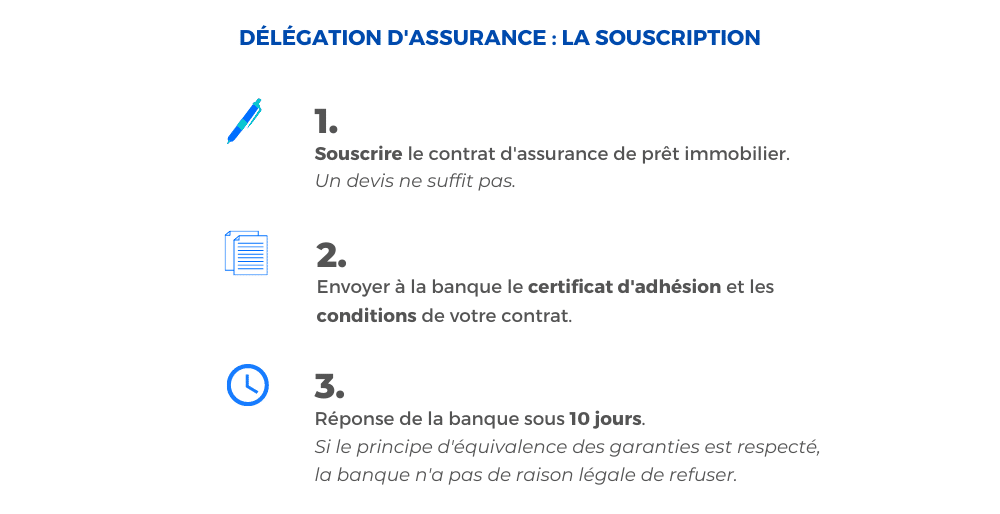

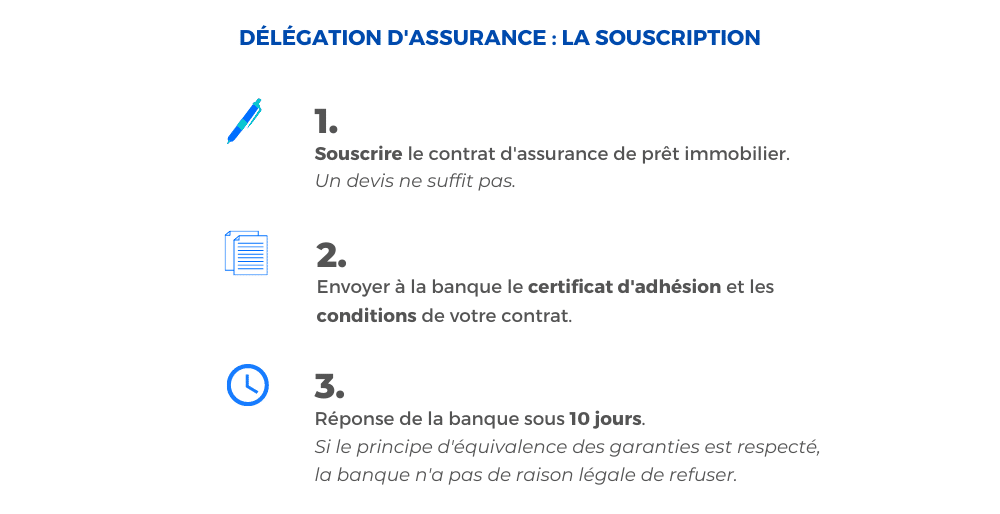

5. I take out the loan insurance contract.

If you opt for delegation of insurance (individual contract), you must take out the loan insurance contract. Then have your insurance certificate and the conditions of your contract with you. Send all the documents to your bank.

Be careful, a simple quote is not enough.

The credit institution has 10 days to answer you. If the contract offers equivalent guarantees, it has no legal reason to refuse. It cannot increase the credit rate either.

–

Nevertheless, too many banks still make the granting of credit conditional on taking out their loan insurance. In this case, you can accept the deal and cancel your insurance a few months later, as the law allows you to do.

(6. If the bank refuses: I change loan insurance within 12 months of granting the loan.)

The Hamon law allows any borrower to terminate his contract within one year of signing the loan. You can then:

- take out borrower insurance at a more affordable price (while respecting the principle of equivalence of guarantees)

- send your termination letter to your bank, accompanied by your insurance certificate and the specific conditions of the contract

And this, at least 15 days before the expiry date of the contract.

In the event that you exceed the required date, please note that the Bourquin amendment allows you to terminate your loan insurance contract once a year, on the anniversary date of the contract. The notice is then 2 months.