When we buy a home and sign a mortgage to finance the operation, we need a good sum of money to cover all expenses and taxes. When we go to the bank, it is very important to know that, if as a general rule they do not finance more than 80% of the purchase price, we must not only have the remaining 20% saved, but also the taxes and expenses inherent to the transaction.

Between the ITP or VAT, the AJD, the notary, the Registry and the agency and other expenses of the mortgage loan, the disbursement is usually between 8% and 13% of the amount of the property. The final figure will depend on variables such as whether the house is new or second-hand, the region in which it is located or its price.

In general terms, Basque Country registers the lowest disbursement (approximately 8% of the property price), while Madrid, the Canary Islands, La Rioja or Navarra are in the middle of the table (the percentage does not usually exceed 10%) and Catalonia, Galicia or Valencian Community are in the upper part of the ranking (where appropriate, the disbursement can reach 15%), as it has a Tax on Patrimonial Transmissions (ITP) and a Tax on Documented Legal Acts (AJD) higher than other regions.

We review the taxes in each community, as well as the main expenses associated with the operation and signing the mortgage loan to acquire the house:

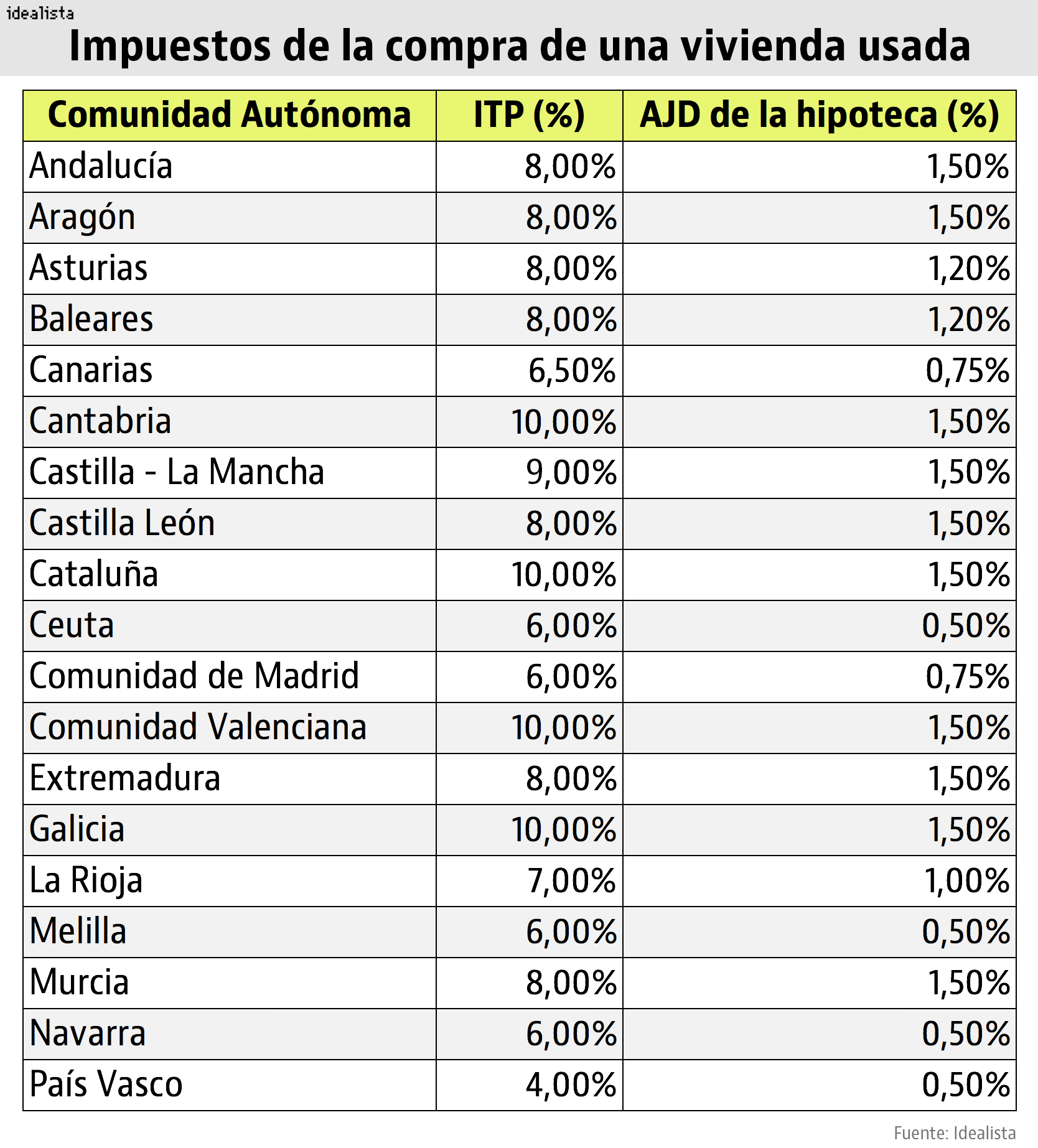

The case of a used home

Before listing each autonomy, we must bear in mind that the purchase of a second-hand house is associated with this battery of taxes and expenses: the Property Transfer Tax (ITP) which is applied to the purchase price; the Tax on Documented Legal Acts (AJD) on the mortgage, the amount of which may be similar to or less than that of the property; the Property Registry of the sale and mortgage, the notary, the agency that handles the paperwork and the appraisal of the home that determines the amount that the bank lends to the client to finance the operation. We explain what they consist of:

The ITP, between 4% and 10%. The Property Transfer Tax (ITP) is the one that affects the sale of used houses and depends on two things: the amount of the notarized price and the location. Depending on the autonomous community, we can pay 4% or 10% as a general rule.

The Basque Country is the one with the lowest rate (4%), followed by Navarra, Madrid and the autonomous cities of Ceuta and Melilla, with 6%. In the Canary Islands, the usual rate is 6.5% and in La Rioja, 7%. In Andalusia, Extremadura, Aragon, Asturias, the Balearic Islands, Murcia and Castilla y León 8% is applied, a figure that rises to 9% in the case of Castilla-La Mancha. However, the regions with the highest ITP are Catalonia, Cantabria, Galicia and the Valencian Community with 10%.

The AJD of the mortgage, between 0.5% and 1.5%. If the purchase of the house is financed by a mortgage, the other tax to pay is the Documented Legal Acts (AJD). It represents between 0.5% and 1.5% on total mortgage liability, not on the amount of the loan.

Andalusia, Aragon, Catalonia, Valencian Community, Galicia, Castilla-La Mancha or Murcia apply 1.5%, double that of Madrid (0.75%) and three times more than Navarra and the autonomous cities (0.5%) .

Other expenses of the sale and mortgage. Apart from taxes, there are also expenses that must be taken into account, such as the notary, the Registry, the appraisal and the agency. They all depend. The notary, for example, usually costs between 600 and 875 euros, while the Registry It is approximately between 400 and 650 euros. To this must be added the simple note, to know if the house has charges, which are approximately another 10 euros.

In the event that a mortgage is also signed, the expenses continue. There is, for example, the appraisal of the property, necessary for the bank to decide how much money it is going to give the client via mortgage and whose cost is between 250 and 600 euros.

The notary’s office and the Registry must also be paid to formalize the mortgage and they can represent around 1% of the mortgage. Finally, there is the agency that the bank selects to carry out all the procedures, although in this case, and since they are free professions, there are no specific fees.

A practical example for a house of 150,000 euros

To understand the differences it makes for your pocket, nothing like an example: we are going to calculate how much money all the taxes and expenses would mean for a used house of 150,000 euros those different levels of ITP that apply to the Basque Country, Madrid, Andalusia or Catalonia.

In general terms, and according to the idealista / mortgages simulator, in any province of the Basque Country about 10,000 euros would be paid for expenses and taxes; of them, about 6,000 euros would be for the ITP (which stands at 4%). Therefore, the total cost of the purchase would amount to 160,000 euros.

In the case of Madrid, about 13,400 euros would be paid for expenses and taxes. Of this amount, the majority would correspond to the ITP: about 9,000 euros. Thus, the total price of the house would rise above 163,400 euros. In Navarra and the autonomous cities these equivalences would be worth, since they also have an ITP of 6%.

If the house were in Extremadura, Andalusia or Castilla y León, where the ITP is 8%, taxes and expenses would amount to about 17,600 euros, of which 12,000 euros would come from the tax on property transfers. Thus, the total cost would be around 167,600 euros.

Finally, and if we go to the cases of Catalonia, Valencian Community or Galicia (with an ITP of 10%), the cost would rise by about 20,700 euros, shooting the final amount of the operation above 170,000 euros.

Thus, in those regions about 10,700 euros more would be paid in taxes and expenses than in the Basque Country for a house of the same price, and about 7,300 euros more than in Madrid.

The case of a new home

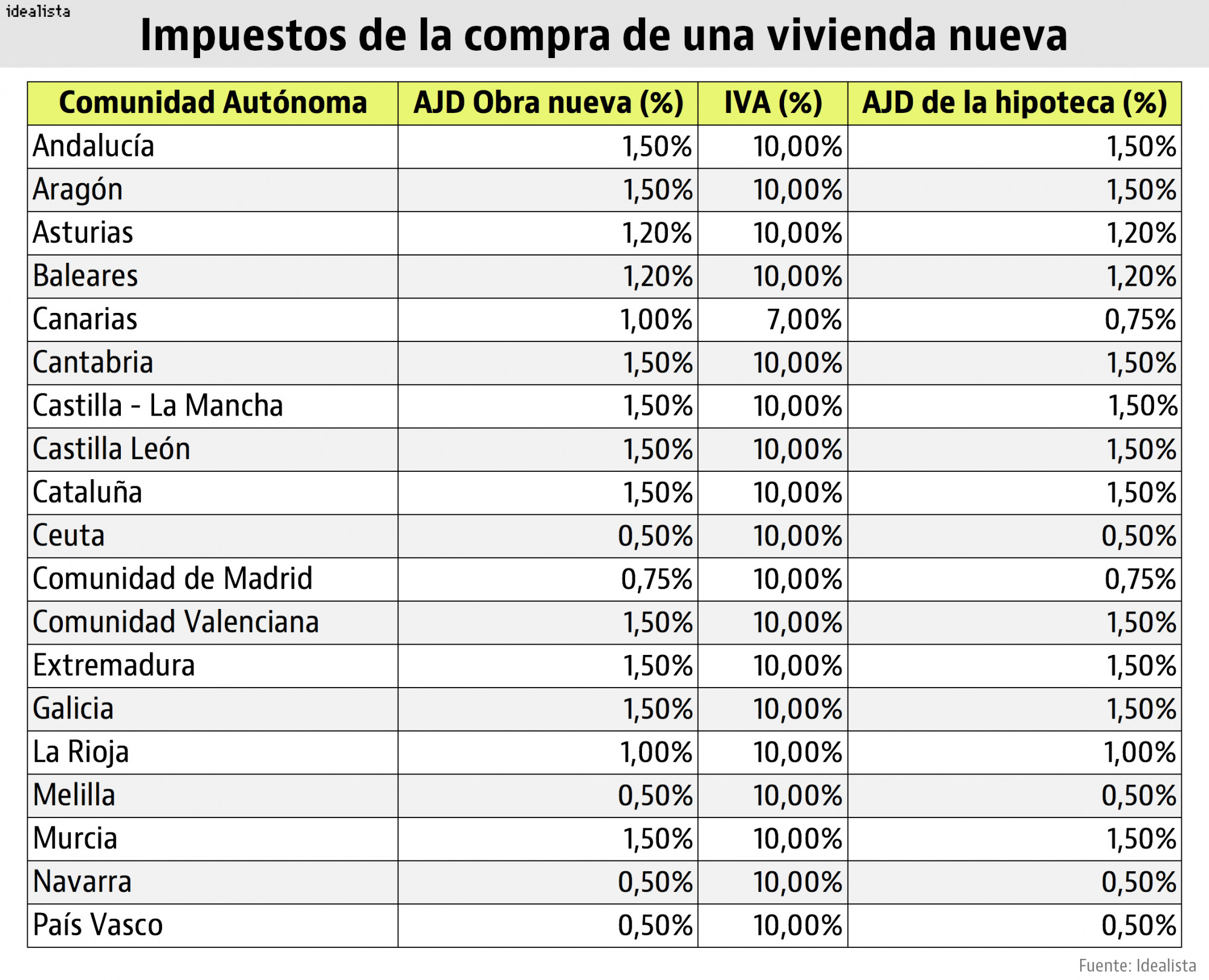

If it is a new house, the previous scheme changes. In a transaction of this type, the buyer must assume the VAT, the Tax on Documented Legal Acts (AJD), the notary and the Registry. If there is a mortgage involved, the AJD, the notary, the Registry, the appraisal and the agency appear again. We explain what they consist of:

VAT is 10%, except in the Canary Islands. Currently the VAT that affects the purchase of a newly built house is 10% throughout Spain, except in the Canary Islands, where 7% is applied.

The AJD, between 0.5% and 1.5%. This tax on the purchase is very similar to the one that applies to mortgages. Once again, Andalusia, Aragon, Catalonia, Valencian Community, Galicia, Castilla-La Mancha and Murcia lead the regional table by establishing 1.5%, double that of Madrid (0.75%) and three times more than Navarra and the autonomous cities (0.5%). The Canary Islands are once again the exception and a higher AJD applies to the purchase than in mortgages: in this case it is 1% (compared to 0.75% for loans).

Other expenses of the purchase and the mortgage. As we saw in the case of used housing, to these two taxes are added the expenses of the notary, the Registry, the appraisal and the agency, in the same previous conditions. The only unnecessary expense is the simple note, which is only 10 euros of the total ‘bill’.

A practical example for a house of 150,000 euros

To see the differences more clearly, we return to the example of the house of 150,000 euros to find out how much taxes and expenses represent according to autonomy.

In general terms, and according to the idealista / mortgages simulator, in any province of the Basque Country, the impact would be around 19,800 euros (taking into account a VAT of 10% and an AJD of 0.5%), while in Madrid It would amount to 20,600 euros (VAT of 10% plus an AJD of 0.75%).

If the home were in Catalonia or Castilla-La Mancha (VAT of 10% plus AJD of 1.5%), the approximate cost would be around 23,000 euros, raising the total amount of the operation to 173,000 euros, while in the Canary Islands (VAT of 7% and AJD of 1%) we would speak of an additional 16,450 euros to the 150,000 of the property (that is, almost 7,000 less than in Catalonia).

The final result

The purchase price of the home and the community in which it is located can give many clues to the buyer of how much money they will have to allocate to pay the taxes and expenses associated with the operation. A good way to calculate an approximate figure is to use online simulators, such as idealista / mortgages, although the final figure will be given by the bank before formalizing the sale and mortgage loan.

–