The AEX closes 1.6% in the red, making us by far the worst stock exchange in Europe. The main index is full of technology stocks and these are actually underperforming today. Heavyweights such as ASML (-5.5%) and Adyen (-2.4%) get a big slap on the nose.

Sentiment around growth stocks has deteriorated after Fed Chair Jerome Powell was reappointed. He is more hawkish than his opponent and as a result, interest rates on the capital market go up. This is unfavorable for stocks where the profits lie in the future, such as technology stocks.

The biggest blows, however, take place in Turkey. The Turkish lira is losing almost 12% against the euro today. Last week, the Turkish currency has seen more than a fifth of its value evaporate. This fall in prices is the result of some statements by President Erdogan.

The good man could not resist emphasizing that the high interest rates are precisely the cause of the high inflation in his country. I don’t think there is even one independent economist who agrees with him. Investors are speculating on a further fall in the official interest rate by selling their positions in lira. Companies with exposure to Turkey can therefore prepare a write-off in advance.

Intertrust

The battle for Intertrust (+15.4%) is not yet a battle. CVC announced last week that it was offering €18 for a share of Intertrust, but it has not yet received the financial services provider. There are various parties in the market that are willing to pay a significantly higher price. Even an amount of €22 is mentioned.

For the investment banks JPMorgan Cazenove and Bank Degroof, this is reason to increase their target price to €22. The current price is about 9% below this. It is always tempting to take this 9%, but on the other hand, there must still be a party that actually offers €22.

Now that there are several parties in the market, there is little chance that an acquisition will not go through. This lowers the risk profile of an investment in Intertrust, causing the price to rise sharply. The rumors that CVC is being outbid, of course also help.

The game is on the wagon at Intertrust #Intertrust https://t.co/JNws5aTyOe

— IEX Investor Desk (@Investor Desk) November 23, 2021

PostNL

PostNL (-3.2%) is in the corner where the blows fall. The share has been in bad shape in recent months and now the problems are piling up in Belgium. Things are very wrong at three depots of the postal and parcel deliverers, because things are said to be happening here that are not acceptable.

This concerns, among other things, violations regarding undeclared work and sham constructions with regard to independence. Underage employees may also be employed. The problem lies with the subcontractors who do not respect Belgian law. However, PostNL does not monitor this sufficiently.

Analyst Martin Crum does not expect the debacle to have major financial consequences, but it does lead to the necessary image damage. The postal and parcel delivery company is currently quoted at 9 times the estimated profit for 2022. You can read in the article below whether the share is worth buying.

Belgian labor inspectorate has PostNL in its sights #PostNL https://t.co/BBCpnIl0rF

— IEX Investor Desk (@Investor Desk) November 23, 2021

Annuities

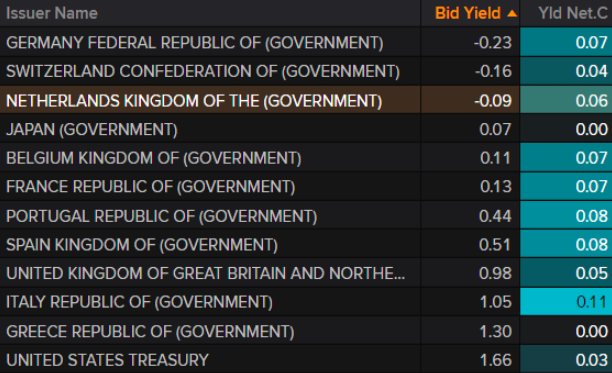

The fees on ten-year government paper are soaring. The Dutch interest rate rises no less than six basis points to -0.09%.

broad market

- From AEX (-1.6%) and with that we are well behind the DAX (-1.1%) and CAC (-0.7%).

- Wall Street hands over the opening win. The Nasdaq is the biggest loser with a minus of 1.0%

- From euro gains 0.3% and trades at 1.127 against the dollar.

- From Much Ado climbs 2.6% to 19.7 points.

- Gold (-1.0%) in silver (-3.6%) have an off day.

- Oil: WTI (+2.6%) and Brent (+2.1%) on the other hand are finding their way up. This is remarkable, because the US, China, India, Japan and the United Kingdom announced that they would reduce their strategic oil reserves in order to contain the high oil price.

- Bitcoin (+1.4%) stays close to home.

The Damrak

- The chippers are getting a beating today. ASML (-5,5%), Iron (-3.9%) in ASMI (-6.0%) dive. The latter even opened 10% lower, but that was probably a fat finger.

- Adyen (-2.4%) is suffering from the poor sentiment regarding technology stocks.

- Defensive ports like Ahold (+0,3%), Royal Dutch Shell (+ 1.1%) in Unilever (+0.8%) are picked up on the other hand. A typical case of sector rotation.

- The financials are still relatively dry. ING (-0.5%) keeps the damage limited thanks to rising interest rates.

- Bee Philips (-1.8%) it goes from bad to worse. It is unclear how many claims the company can expect from the US, which is why investors are already heading down the road.

- It is a mystery to me why retail real estate is in such good shape today. Unibail Rodamco (+ 1.2%) in Eurocommercial Properties (+0.6%) go up slightly in a declining market.

- Lucas Bols (-1.3%) cannot benefit from a buy recommendation from Kepler Cheuvreux. The price target goes up by $2 to $14.

- The half-year figures of Accsys (+0.3%) for the broken financial year 2021/2022 there were no surprises. Nevertheless, the market reacts positively. Perhaps because the Hull factory has not been delayed again.

Accsys: All eyes on the future #Accsys https://t.co/XPtDob7MFE

— IEX Investor Desk (@Investor Desk) November 23, 2021

Advice

- Intertrust: to €22 from €17 and buy – JPMorgan Cazenove

- Intertrust: to €22 from €19 and buy – Bank Degroof

- Lucas Bols: to buy from keep and to €14 from €12 – Kepler Cheuvreux

- OCI: to €31 from €30 and buy – Kepler Cheuvreux

Agenda Wednesday 24 November

Consensus

- 10:00Germany IFO business climate Nov97,9

- 14:30US durable goods orders Oct+0,2% MoM

- 14:30US GDP Q3 (revised)+2,2% QoQ geanualiseerd

- 16:00US Consumer Confidence Michigan Nov66,9

- 16:00US sales of new homes Oct802K

- 16:00US Personal spending Oct+0,8% MoM

- 18:00HAL Q3 numbers

–