The AEX (+0.4%) made another nice rollercoaster ride today. We opened generously in the red this morning, but around noon the main index suddenly traded more than 2% in the green. Russian leader Vladimir Putin had said positive developments were underway regarding talks with Ukraine.

However, this optimism soon faded. This is not very strange, since Putin is the same man who said three weeks ago that it was all about an exercise. In short, many are not worth words.

The big winner of the day is Just Eat Takeaway (+14.0%). The meal deliverer suddenly runs off at the lock. Rumors have surfaced that Uber may be willing to make an offer for US Grubhub† This would be good news, because the company would then suddenly be relieved of a headache.

#JustEatTakeaway +11% on the closing auction just now. I was out this afternoon and fall right in the middle but this is what I’m fishing through Reuters from Seeking Alpha https://t.co/pkp9pl1Ncw

#GrubHub #AEX pic.twitter.com/9cIyQ3j3Eg— Arend Jan Kamp (@ArendJanKamp) March 11, 2022

There was also a figure on US consumer confidence. The University of Michigan reported a stand of 59.7, where the market was counting on more than 61. A minor setback, although I don’t expect many investors to make a different investment choice because of this.

AMG

AMG (+1.9%) this year, with a gain of 25%, is one of the best-performing shares of the Damrak. The metal producer is benefiting from the rising prices of lithium and vanadium. Analyst Paul Weeteling expects the party to continue for a while.

According to him, there are a number of reasons why metal prices remain at a high level for a longer period of time. His main argument is that there is an overall acceleration in demand for renewable energy sources. All with the aim of becoming less energy dependent on the oil and gas industry.

This gives a significant boost to the demand for lithium and, to a lesser extent, vanadium for the production of lithium and vanadium batteries. There are a number of reasons why Weeteling is enthusiastic about AMG. If you want to know what the reasons are, you should read the article below.

AMG: vanadium price wakes up #AMG https://t.co/t6q9ayLrg2

— IEX Investor Desk (@Investor Desk) March 11, 2022

Better Bed

Better Bed (+6.9%) is today one of the absolute winners of the Damrak with a price increase of almost 7%. Both profitability and order book were higher than expected. The biggest surprise, however, is the announcement of a dividend payment.

The Beddenvendor from Uden is prepared to pay out €0.15 per share for the 2021 financial year. This implies a dividend yield of 3.3%. This announcement is striking because the solvency ratio is still below the desired level of 30%. The policy is that the company will not pay out anything.

Management is now pushing this conservative policy aside. So see this as a sign of confidence in the future. You can read in the article below whether I consider the stock worth buying at this level.

Beter Bed has a surprise for shareholders https://t.co/kvoQoJQf4H via @IEXnl

– Niels Koerts (@KoertsNiels) March 11, 2022

Annuities

Interest rates remain close to home today, but on balance the fees on ten-year government paper have risen sharply this week. Last Friday, the German Bund was still 0.10% negative. Currently there is already a plus on the board of 0.38%. A difference of almost 50 basis points. Unknown!

- Netherlands: +1 basis point (+0.54%)

- Germany: +0 basis points (+0.28%)

- Italy: -4 basis points (+1.88%)

- United Kingdom: -0 basis points (+1.52%)

- United States: -0 basis points (+2.01%)

The weekly lists

- AEX this week: +0.5%

- AEX this month: -7.5%

- AEX this year: -15.3%

- AEX reinvestment index this year: -14.8%

Divided image

Those who are overweight in US equities are having a bad week. The European indices, on the other hand, are doing well. In particular, the Germans (+4.1%) are looking forward to it. It is incidentally a snapshot, because if we look at the annual chart, the picture looks very different.

AEX

NN Group (+6.8%) is recovering somewhat, although the Dutch insurer is more than 20% below its peak. Iron (-4.3%) on the other hand, delivered some of its outperformance against . this week ASML (+1.7%) in ASMI (+3.0%) in. Why Wolters Kluwer (-7.7%) is so bad, is a complete mystery to me.

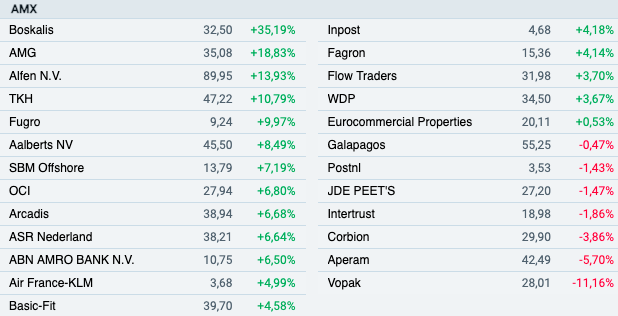

AMX

Boskalis (+35.2%) is in good shape thanks to .’s offer THING. Elves (+13.9%) since the publication of the annual figures as the fire brigade and in Fugro (+10.0%) the necessary takeover fantasy is creeping in. The latter does not apply to Vopak (-11.2%). Jefferies took the stock off the buy list this week.

ASCX

Bee ForFarmers (-6.6%) mopping with the tap open. The animal feed company is struggling with the increased raw material prices. In a low-margin business, this cuts extra hard. Vyvoryon (+11.3%) on the other hand is doing a lot better, but that could just be different on Monday. The biotech fund has been bouncing in all directions for years.

Finally, I wish you a nice weekend. This week Arend Jan writes the preview.

–