Sentiment has been good in recent weeks and today we have nothing to complain about. The AEX (+0.0%) was in the red all day, but in the end the main index managed to make up for the entire loss.

This means that we perform considerably worse than the other European indices. The DAX for example, gains 0.9%. Today’s agenda was largely empty. Only at 4:00 p.m. did a U.S. consumer confidence figure come through as measured by the University of Michigan.

Joe Sixpack remains pessimistic

The score was 55.1. Although this is better than the 52.5 economists were counting on, the fact remains that Joe sixpack gloomy. I don’t blame him, because inflation is still high.

The market reacted positively to Wednesday’s 8.5% inflation rate, but it is not a figure to be proud of. Inflation is expected to decline further in the coming months. Consumer confidence may also pick up again.

The broad picture is that the results today are relatively limited. What stands out is that Ahold (-2.9%) once again had to give up part of its profit in figures. Furthermore, there are no visible movements that will be talked about for years to come.

The chippers are finding their way up and this year’s two bleeders – Just Eat Takeaway (-1.8%) in Philips (-0.6%) – have to give up ground again. The uncertainty about possible claims for damages and the disappointing business performance keep the share price of the percentage of high-quality medical devices low.

Ontex

Reported at the end of last month Ontex (+2.4%) are half-year figures. The share is popular among IEX-Premium members, so it is not wrong to treat the share once in this closing call.

The Belgian diaper manufacturer is a typical example of a turnaround candidate. Five years ago, the share was still trading at €30, but now there is just over €6 left. The biggest pain point is the profit development

Lots of interest despite problems

This was also apparent from the first half-year figures. Although turnover increased by 17% to €1.15 billion, the operating result halved to €49.4 million. Ontex is suffering from high cost inflation. The market for baby diapers is highly competitive and parties such as Procter & Gamble and Kimberly Clark have a long life.

In addition, the debt burden hangs like a millstone around Ontex’s neck. As a result, the company has to sell part of its non-core activities. Among other things, the company is in talks with the Brazilian diaper manufacturer Flora about the sale of its Brazilian activities.

Do not be surprised that when the debt position is in order, the entire company is taken over. It has already been confirmed that AIP Partners is interested. You can read how the IEX Investors’ Desk judges the share in the article below.

Every reason to give Ontex the benefit of the doubt #Ontex https://t.co/SuI06VOHom

— IEX Investors Desk (@Beleggersdesk) August 12, 2022

Disney

A much more wealthy party is Disney (+2.5%). The company is well on its way to taking market share from Netflix, as online streaming services grew by 19% year-on-year in the second quarter.

This has its price, as the division’s operating loss amounted to $1 billion. Disney’s other activities – including the theme parks – must compensate for this.

Disney is trading at 20 times the expected profit for 2023. This is a solid price, although the share has historically been valued above average. This is due to the strong track record and favorable growth prospects. You can read whether you can buy the shares in the article below.

Disney positively surprised #WaltDisneyCompany(The) https://t.co/x9QWhtIRrw

— IEX Investors Desk (@Beleggersdesk) August 12, 2022

Annuities

The fees on ten-year government paper are increasing broadly today. The exception to the rules is the American interest rate.

- Netherlands: +2 basis points (+1.29%)

- Germany: +2 basis points (+0.99%)

- Italy: +7 basis points (+3.09%)

- United Kingdom: +6 basis points (+2.12%)

- United States: -4 basis points (+2.85%)

The weekly lists

- AEX this week: +0.3%

- AEX this month: -0.6%

- AEX this year: -9.1%

- AEX reinvestment index this year: -7.3%

Recovery continues

The stock markets worldwide are looking forward to it and then the plus of 0.4% for the AEX is actually a bit disappointing. On Wall Street, gains range from 2.0% for the Nasdaq up to 2.5% for the S&P500.

Even the German stock exchange (+1.7%) finds its way up. Over a longer period of time, the picture will look very different. The DAX is trading at the same level as in November 2017. This includes the dividend. In short, in 5 years German stocks have not created any value.

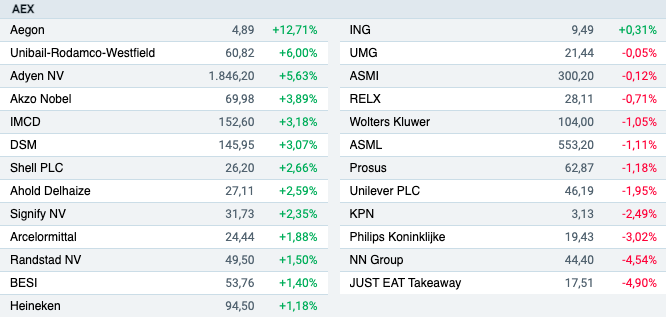

AEX

Aegon (+12.7%) is rewarded for its strong second quarter results. Both the capital generation and the solvency ratio were significantly higher than expected. With the numbers of NN Group (-4.5%) was nothing wrong, but the market secretly counted on an outlook increase. It was left behind.

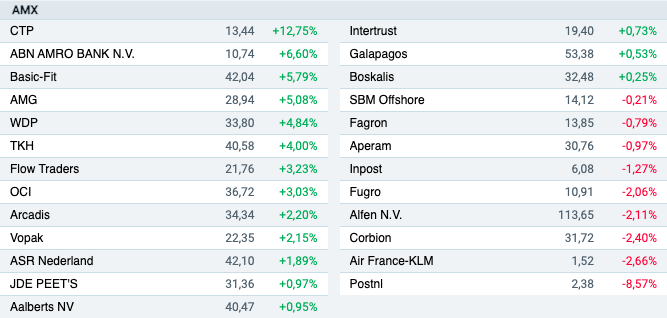

AMX

PostNL (-8.6%) went ex-dividend this week, but the fact remains that the second quarter figures were downright dramatic. Turnover is under pressure and the operating result plummeted by no less than 80%. CTP (+12.8%) saw profits rise by 20% in the first half and the value of its real estate portfolio was revised upwards by 5%.

ASCX

fastned (+31.4%) blows everything and everyone away on the Damrak. On Monday I will try to come up with an analysis of the figures of the fast charging company. Pharming (+13.5%) penny stock is down since this week.

Finally, I wish you a nice weekend. This week Arend Jan writes the preview.

–