Today the AEX is on fire (+ 1.9%). We are therefore climbing much faster in Amsterdam than in the large European market. The trigger is falling interest rates.

The Dutch 10-year interest rate is currently plunging 15 basis points to 2.49%. An unprecedented movement in the interest rate market. It is mainly growth companies that benefit from this decline in interest rates, and the AEX index is well filled with technology companies.

In short, it is therefore not so surprising that we are outperforming the broad market today. Eat takeaway only (+ 11.5%) is one of the big winners. It’s a question of feeling, because we don’t come across big news.

AG (+ 11.6%) is also a fraction better. Citigroup analysts say the record label benefits from the price hike Apple is making for Apple TV and Apple Music. This should increase UMG’s earnings per share by 5%.

Proso

After the Chinese Communist Party (CCP) Congress, there is no longer any doubt about the direction President Xi wants to take with China, the monkey is out of his sleeve. More domestic tech development, a reunification with Taiwan, a more hostile position overseas and more government control over tech companies and pretty much everything in between.

On the score scale for what investors invest in Proso (+ 2.9%).

President Xi will be here for more than five years, so investors shouldn’t count on an improvement in the business climate for Chinese tech giants during that time. However, analyst Paul Weeteling is taking a step too far to throw in the towel. Below you can read the full analysis of him on Prosus.

Prosus: Bloedbad in Chinahttps://t.co/5pTmJRBqJR #Proso #AEX #Invest #Actions

– Paul Weeteling (@PaulWeeteling) October 25, 2022

Preview of third quarter data on breweries

Presentation next Wednesday Heineken (+ 1.2%) are the updates on the third quarter and next Thursday will be the turn of the world market leader AB InBev.

Heineken has to contend with high inflation: costs for packaging material, transport and energy have soared. Fortunately, Heineken is covered by 50 to 60% against rising gas and electricity prices thanks to a permanent contract for the year 2023.

The Dutch brewer therefore has a little more time to pass it on to the consumer. In the analysis below you can read an extensive preview of both Heineken and AB Inbev.

Presentation next Wednesday #Heineken its third quarter update and it’s Thursday’s turn #ABInbev.

Reason enough for me to look forward. You can read my full analysis below. Including, of course, an explicit opinion.https://t.co/nQ3b6LBLC3 pic.twitter.com/oynL8eeILq

– Niels Koerts (@KoertsNiels) October 25, 2022

Wolter Kluwer

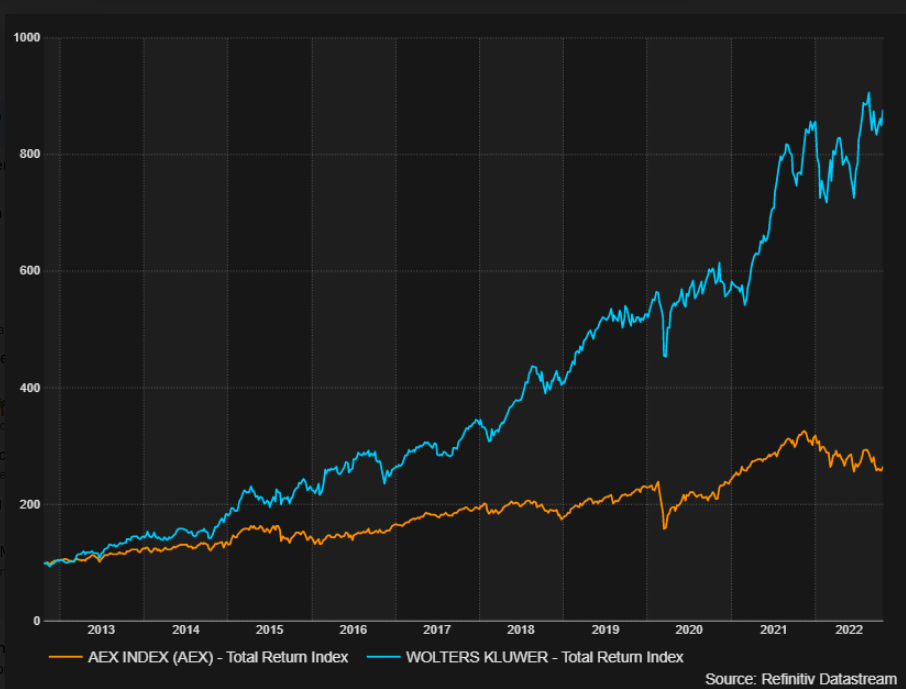

The price of Wolter Kluwer (+ 4.1%) is on the rise today and is now noticeable around his all-time high. It shows the success of the transition that the data provider has had.

Where Wolters Kluwer had to rely primarily on physical science journals and trade journals at the beginning of this century, the company now mainly sells online subscriptions. Printing represents only 6.5% of the group’s total turnover this year.

The print-to-digital revolution is benefiting the company significantly, which means Wolters Kluwer sees its profitability grow faster than its revenue.

The result is clear: the Wolters Kluwer stock has gained around 750% (23.9% per annum) in the last ten years, while the AEX has to settle for a plus of 150% (9.6% per annum).

However, past performance is no guarantee for the future. In the article below you can read why we take a conservative stance on this title.

Wolters Kluwer Current Rating Asks IEX Premium Incidents https://t.co/DquNrHnA6d through @IEXnl

– Niels Koerts (@KoertsNiels) October 25, 2022

Wide market

- The AEX rises by 1.9% and thus outperforms the DAX (+ 1.1%). Only the French (+ 1.9%) can keep up with us.

- The CBOE VIX (Volatility) index fell 2.6% to 29.1 points.

- Wall Street is trading firmly in green. The highlight is the Nasdaq with 2.0% higher

- The euro is up 1.0% and is trading at 0.997 against the US dollar.

- Gold (+ 0.4%) and silver (-0.1%) cannot benefit from the dollar’s weakness.

- Oil: close to home WTI (+ 0.4%) and Brent (+ 0.0%).

- I was expecting something more from bitcoin (+ 1.4%) today.

The Damrak

- ASMAS (+ 3.8%) only reports that third quarter revenues increased by 41% to 609.8 million euros. The expectation was 583 million euros. The number of new orders was 676 million euros. here Read the full press release.

- It’s the tech stocks that are rising fastest. Mainly Eat takeaway only (+ 11.5%), Adien (+ 5.8%) a Iron (+ 4.4%) are doing well.

- Even the defensive Wolter Kluwer (+ 4.1%) grows mercilessly. It’s that interest rates are falling so fast, otherwise the ten-year interest rate in the US would have been higher than the data provider’s cash flow return. A signal that the stock is well on price.

- Insurers should not benefit from falling interest rates. So it’s not that strange Group NN (-0.1%) a ASR (+ 0.2%) is slightly behind today.

- Gas prices have come under severe pressure in recent days. The same goes for the share Shell (-1.5%).

- It’s a complete mystery to me why IMCD (+ 5.0%) fits so well. On the other hand, the share has also decreased significantly. Exactly one year ago, the chemical distributor was still trading above 200 euros.

- Real estate funds have been severely punished for rising interest rates. With yields falling again, we see a surge of relief Unibail Rodamco (+ 4.7%), WDP (+ 6.0%) a Construction (+ 5.0%).

- A fund that is fundamentally defensive like VA Peet’s (-1.5%) instead takes a step back. The share is on the sales list of various investment banks.

- The decline in electricity prices is also good news for Ebusco (+ 5.1%). Does this signal the start of a recovery rally?

Tips (source: Guruwatch.nl)

- Akzo Nobel: at 80 € from 106 € and buy – Sanford & Bernstein

- Akzo Nobel: at 82 € from 85 € and buy – UBS

Agenda: Wednesday 27 October

- 08:00 Heineken Q3 data

- 08:00 KPN Q3 digits

- 08:00 Melexis Q3 numbers

- 08:00 Deutsche Bank Q3 data

- 08:00 Basf numbers Q3

- 09:00 OCI price € 3.55 ex dividend

- 13:00 Boeing Q3 data

- 13:00 Bristol-Myers Q3 numbers

- 18:00 Unibail data Rodamco Q3

- 18:00 Large numbers of the third quarter

- 22:00 Goal Numbers Q3

/cloudfront-eu-central-1.images.arcpublishing.com/prisaradio/ANXUFAF6FII5OO35NOBMFLOSWY.jpg)