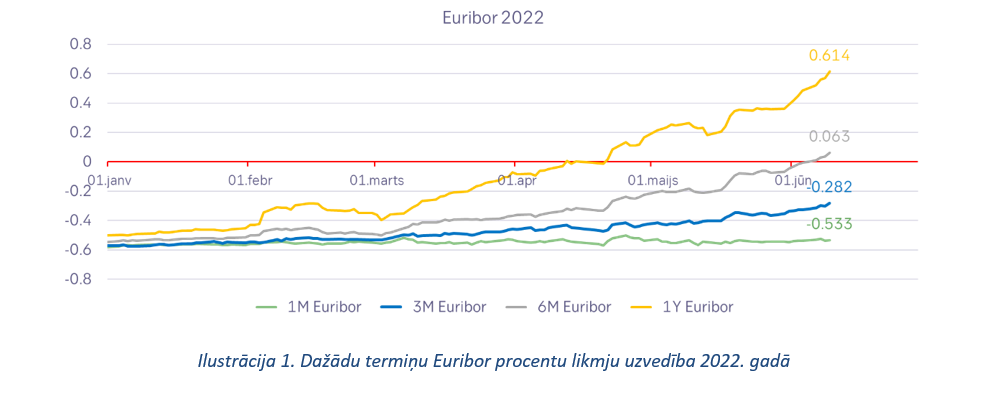

The management of the European Central Bank (ECB) at the June monetary policy meeting decided not to change the interest rates of the euro and decided to stop net asset purchases (no more injecting additional money into the market) as part of the asset purchase program (AIP) as of July 1, 2022.

Also, the ECB announced its intention to raise the key ECB interest rates by 25 basis points at the July 21 monetary policy meeting, and also promised to raise rates at the September 8 meeting. The size of the September increase will be determined by the medium-term inflation outlook.

The ECB, along with the central banks of Japan and Switzerland, are the only major central banks that have yet to touch interest rates. A number of central banks have already raised several interest rates over the past year.

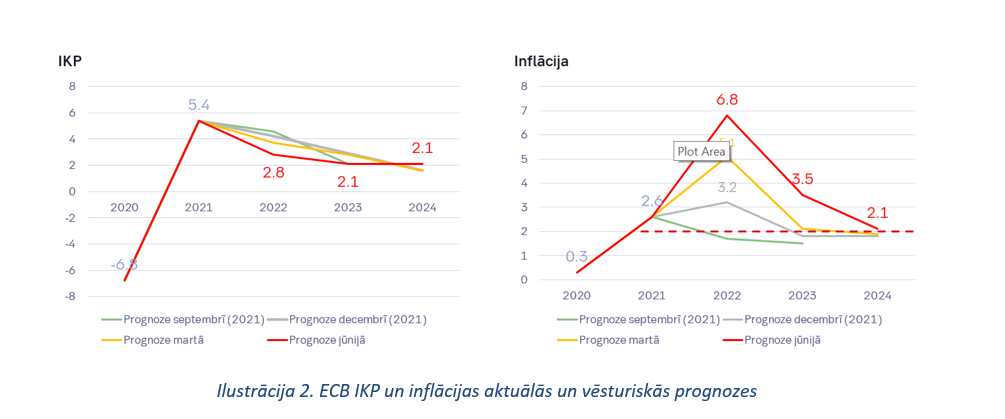

The ECB also released its latest euro area GDP and inflation forecasts this month. As expected, the inflation forecast for this year has been significantly revised upwards – to +6.8%, while GDP indicators have been revised downwards – to +2.8%.

–

–

The high level of inflation is mainly determined by the rapid rise in energy and food prices, incl. as a result of the impact of the war, however, according to the ECB’s assessment, inflationary pressure has become wider and stronger, with a rapid increase in the prices of many goods and services. The ECB believes that a potential drop in energy prices, the easing of supply disruptions linked to the pandemic and the normalization of monetary policy will help moderate inflation.

Conclusions for loans

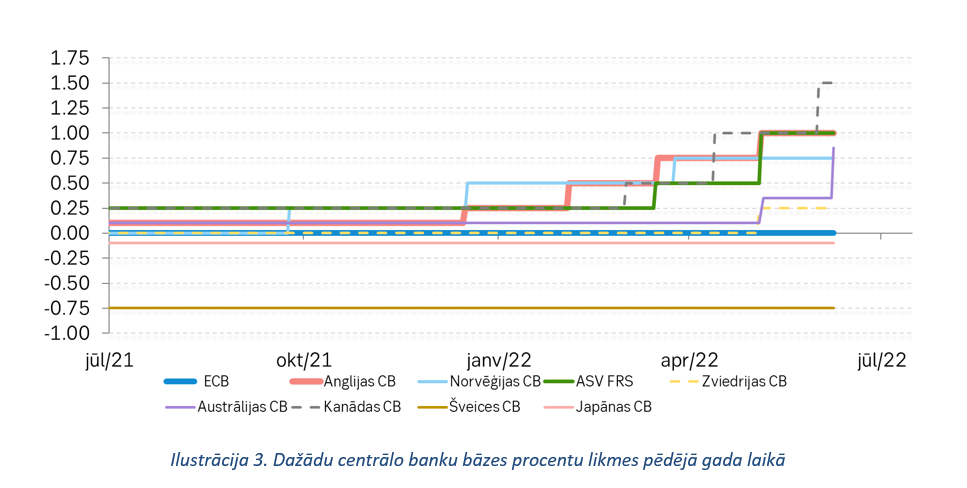

This is also where the pain is gradually felt, because looking at the euro interest rate tables long before the ECB’s planned interest rate changes in the market, positive interest rates are visible.

–

–

In real life, everything is not so simple, because usually the principal amount of the loan is gradually repaid, which reduces the interest payments at constant interest rates. At the moment, market prices show that the negative impact of the increase in interest rates will still exceed the positive impact of the gradual repayment of the loan (in short, higher interest payments will be calculated on a smaller remaining loan amount).

At the moment, it looks like the popular 3-month Euribor rate could exceed the 1.50% mark within the next year. Much, of course, depends on how the situation with the war in Ukraine will change and what will happen to consumption, wage trends and economic growth. One of the negative side effects of high interest rates is the slowing down of economic growth and the threat of recession.

Conclusions for deposits

Little by little, the possibility of seeing something more than zero in the sphere of euro deposits appears on the horizon. But the changes will not happen quickly, because in the background of the expected increase in the interest rates of the euro, there are the consequences of the money “printing” of previous years. There is a surplus of euros in the market, which is evidenced by the holding of short-term interest rates in the market at or below the deposit interest rate set by the ECB -0.50%. If the “retail” market will have to wait longer for positive rates, then in “wholesale” positive rates can already be observed today, but then we are talking about long terms (around a year and more). The conditional euro “surplus” can also be observed in Latvia, because according to the data of the Bank of Latvia, by the end of March, Latvian households and companies (non-financial corporations) have borrowed 10.38 billion euros, while 16.8 billion euros are available in their accounts. The ratio of deposits to loans is 62%, which is a very low indicator and reduces the demand for deposits in the financial market.

About the harsh winter

The high level of deposits is good news, as high energy prices, rising food prices and rising interest rates will be a triple whammy for consumers’ wallets, which will be easier to survive with higher account balances. But the mentioned trio will most likely have a negative impact on economic growth indicators (which is why the ECB, World Bank, OECD and a number of other global institutions have recently significantly lowered GDP forecasts) and will also reduce the appetite for lending in such a risky market. Money for loans is available, only its price increases and the view of risk may become more cautious.

–