Ethereum Poised to Soar Past $4,000 Before Trump’s Inauguration, Analysts Predict

Excitement is brewing in the cryptocurrency world as analysts at BlockScholes and Bybit predict Ethereum (ETH) could surpass $4,000 before Donald Trump returns to the White House. This optimistic forecast is fueled by several factors, including growing investor interest and a potential shift in regulatory landscape.

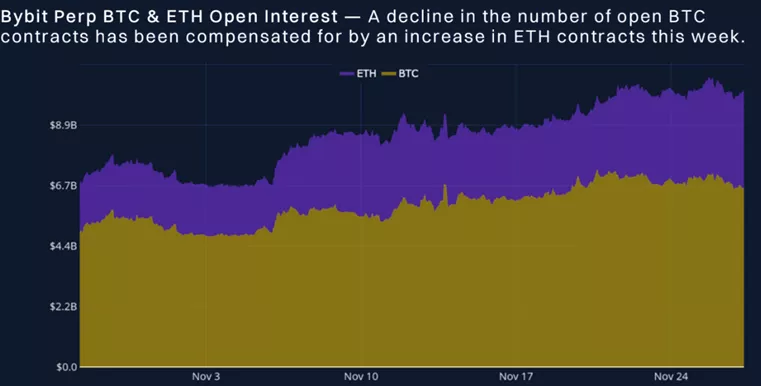

Data from Bybit shows a significant increase in open interest (OI) for ETH perpetual contracts, reaching $8.9 billion. This figure exceeds that of Bitcoin, indicating heightened bullish sentiment towards the second-largest cryptocurrency by market cap.

"This surge in OI isn’t due to mass liquidations but rather a carefully considered recalibration of investment strategies," stated the BlockScholes and Bybit report.

The positive outlook stems partly from outgoing SEC Chair Gary Gensler’s recent statements regarding his departure date of January 20.

Over the past month, Ethereum has exhibited a higher growth rate (34%) compared to Bitcoin’s (31%). This trend signifies investors’ growing preference for ETH.

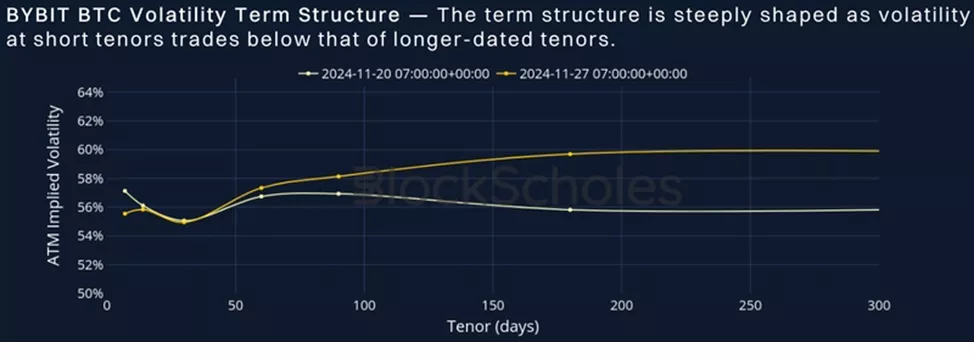

Furthermore, a highly inverted implied yield curve for ETH futures is bolstering confidence.

“Futures contracts expiring this week are trading nearly 25% above their annual rates, suggesting strong institutional interest in ETH," the analysts explained.

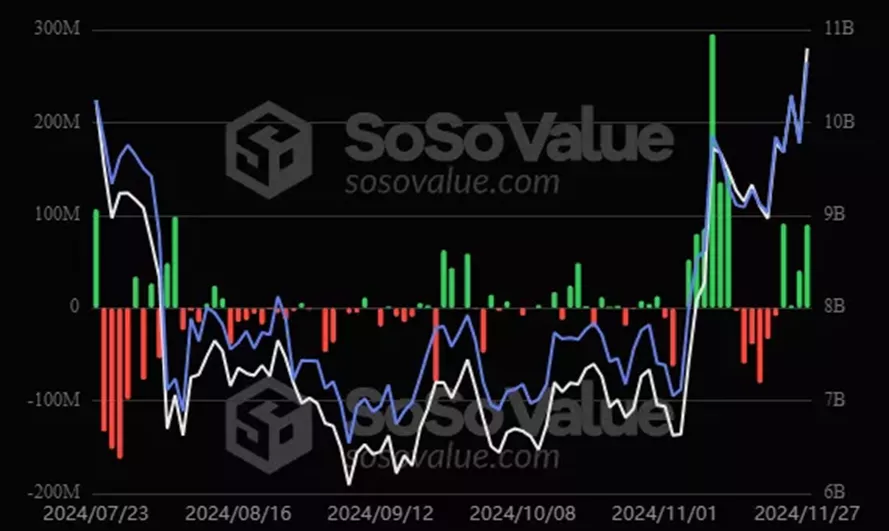

The rampant inflow into Ethereum spot ETFs further strengthens this argument. On November 27th, product receipts for ETH spot ETFs reached $90.1 million, marking the fourth consecutive day of positive inflows.

Independent analyst Wolf also shared a positive outlook, identifying a "Triangle" pattern on Ethereum’s chart dating back to November 2021. This pattern suggests a potential price target for ETH reaching $20,000.

Earlier predictions from Matrixport saw potential for a "DeFi renaissance" thanks to the incoming Trump administration, known for its pro-crypto stance. The combination of increased investor interest, positive institutional inflows, and potential regulatory easing might fuel Ethereum’s surge past the $4,000 mark before Trump’s inauguration.

2024-11-29 16:46:00

#Experts #expected #ETH #Trump

## Ethereum’s Bull Run: Can ETH hit $4,000 Before Trump’s Return?

Excitement ripples through the cryptocurrency landscape as analysts predict a potential Ethereum surge, driven by growing investor interest and a shifting regulatory horizon. Could Ethereum (ETH) breach the $4,000 mark before Donald Trump’s return to the White House?

To unpack this bold prediction, World Today News sat down with two esteemed cryptocurrency experts: **Dr.Emily Carter**, renowned crypto economist and professor at Stanford University, and **Alex Lee**, lead analyst at crypto analytics firm, Coinsights. Together, they examine the factors driving this potential bull run and what it means for the future of Ethereum.

### A Fundamentally Bullish Picture

**World Today News:** Recent reports from BlockScholes and Bybit highlight a surge in open interest for ETH perpetual contracts, surpassing even Bitcoin. What does this tell us about investor sentiment?

**Dr. Carter:**

“This surge in open interest signals a strong bullish sentiment towards Ethereum. Essentially, more traders are betting on ETH’s price going up, indicating confidence in its future prospects. The fact that it’s outpacing Bitcoin suggests a growing preference for Ethereum amongst investors.”

**World Today News:** The article also mentions a “highly inverted implied yield curve” for ETH futures. how does this phenomenon contribute to the bullish outlook?

**Alex Lee:**

“An inverted yield curve occurs when futures contracts expiring closer in time trade at a higher premium than those further out. This is unusual and typically indicates strong demand from institutional investors who are willing to pay a premium for immediate exposure to Ethereum.”

### The Regulatory landscape and ETH’s Ascent

**World Today News:** The outgoing SEC chairman’s anticipated departure fuels optimism. How might a shift in regulatory landscape impact Ethereum’s price performance?

**Dr.Carter:**

“Regulatory uncertainty is often a drag on crypto asset prices. A change in leadership at the SEC could potentially lead to a more favorable regulatory surroundings for Ethereum, which would undoubtedly boost investor confidence and drive prices higher.”

**World Today News:** We’ve seen a “DeFi renaissance” narrative emerging, primarily associated with the incoming administration. Could this contribute to Ethereum’s growth?

**Alex Lee:**

“Absolutely. Ethereum is the dominant platform for decentralized finance (DeFi) applications. If the incoming administration fosters a pro-crypto stance, it could lead to increased investment and innovation in DeFi, directly benefitting Ethereum’s price.”

### A $4,000 Target: Hype or Reality?

**World Today News:** Autonomous analyst Wolf predicts a potential $20,000 target for ETH. What’s your take on this and the $4,000 prediction specifically?

**Dr. Carter:**

“while predicting specific price targets is inherently risky, both the $4,000 and $20,000 figures are not entirely outlandish given the current momentum and potential for positive developments. However, it’s essential to remember that the crypto market is highly volatile, and many factors can influence price movements.”

**World Today News:** What are some potential risks or challenges that could hinder Ethereum’s upward trajectory?

**Alex Lee:**

“Regulatory setbacks, unexpected market crashes, and competition from emerging blockchain platforms could all pose challenges to Ethereum’s price growth. Additionally, Ethereum’s scalability issues continue to be a concern, although ongoing upgrades aim to address this.”

### Looking Ahead: The Road for ETH

**World Today News:** What are your key takeaways for our readers regarding Ethereum’s potential future?

**Dr. Carter:**

“Ethereum is undoubtedly one of the moast promising cryptocurrencies with robust fundamentals and a dedicated community. While short-term price predictions are uncertain, the factors driving its current growth suggest a radiant future for Ethereum, potentially establishing it as a dominant force in the evolving financial landscape.”

**Stay informed:**

For continued updates and analysis on Ethereum and other cryptocurrencies, follow World Today News.

**Read More:**

* [The Future of DeFi: What to Expect in 2024](link to related article)

* [Ethereum’s Scalability Problem: Can It Be Solved?](link to related article)