In recent weeks, there has been an increased interest in people’s savings in tier 2 and tier 3 pensions. The great interest is due to the current poor performance of pension funds. Read this blog to find out if there is a risk of losing all your capital and what to do or not to do now.

–

–

Content will continue after the ad

Advertising

–

In short:

- The prices of securities used by pension managers are falling, for several reasons – both the Russian invasion of Ukraine and the repeated wave of Covid-19 in China.

- As long as uncertainty remains and economies continue to adjust to the new conditions, we can expect the volatility to continue.

- Ending the war in Ukraine would send a clear positive signal to capital markets, but if it continues, growth in capital markets will return.

Why has pension capital fallen?

In the financial markets, the prices of both shares and debt securities, which are mainly used by pension managers to increase the 2nd and 3rd level savings of future Latvian pensioners, have decreased.

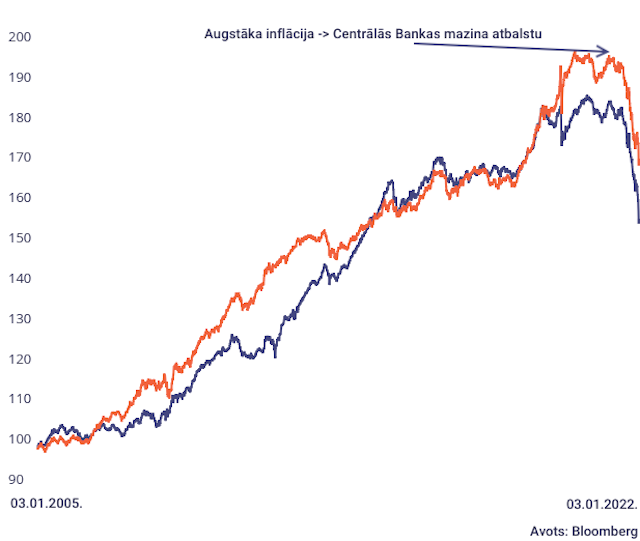

Figure 1. European and US stock market results (01.01.2005 = 100)

Source: Bloomberg

Figure 2. European and US debt securities market results (01.01.2005 = 100)

Source: Bloomberg

The most visible factors that have determined the decline in securities prices:

- Russia’s new invasion of Ukraine;

- The energy crisis and the sharp rise in raw material prices;

- Supply chain disruptions;

- Covid-19 outbreak in China in spring;

- The sharp rise in prices is forcing central banks to act;

Apart from the actions of central banks, other factors interact and are reflected in delayed production or higher prices. Delayed production or forced downtime means lost revenue, while companies’ inability to pass on production prices to consumers has a negative effect on their profit margins. Although no significant deterioration in the profit margins of large companies has been observed on stock exchanges yet, investors have already become concerned about the future profit prospects of companies.

Another important factor in the decline in the prices of both equities and debt securities is the reaction of leading central banks to high inflation rates, including their expected reaction in the future, moving away from a particularly supportive monetary policy. In other words, it is also called the normalization of monetary policy. Initially, the rise in prices was largely reflected in products in the energy sector, but now the rise in prices is clearly visible in a wider range of products and, consequently, the actions of central banks must be followed. Under these circumstances, Russia’s aggression in Ukraine became another strong channel for upward pressure on prices, prompting central banks to reconsider their previous plans to normalize monetary policy.

The European Central Bank (ECB) has so far decided to end its net asset purchases under the Pandemic Extraordinary Asset Purchase Program (APRP), and net purchases of the traditional asset purchase program (AIP) are imminent, signaling an increase in interest rates. The US Federal Reserve and the Bank of England, on the other hand, have already stopped buying net assets and, even more so, have started to raise interest rates, signaling that interest rates will continue to rise in future monetary policy meetings.

It was during the Covid-19 crisis that the support of central banks’ monetary policy was one of the most important factors for the capital market, which allowed it to recover rapidly (including the recovery of pension plan yields). The easing of a particularly accommodative monetary policy, or the normalization of monetary policy, contributes to rising corporate debt service and borrowing costs.

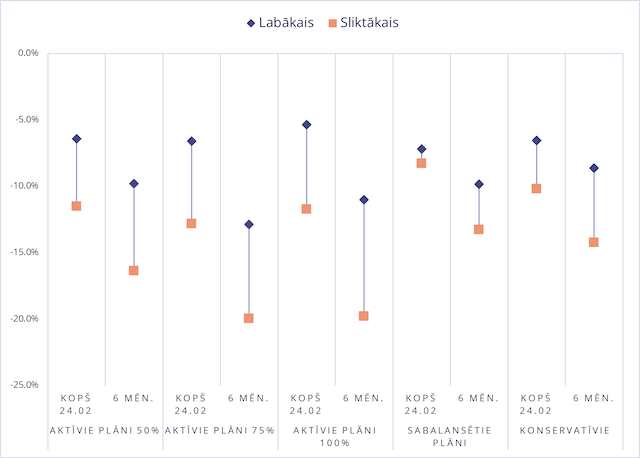

As Russia’s aggression in Ukraine has been one of the most visible negative factors in Latvia, people rightly wonder how much the Russian invasion of Ukraine has cost us in the form of pension savings. Although it is not possible to give a very precise answer, because, as I said before, various factors are currently working on the financial markets at the same time, it is possible to look at the reduction in pension capital since the new Russian invasion of Ukraine on 24 February.

Figure 3. Results of Latvian 2nd tier pension funds (15.06.2022)

Source: Manapensija.lv

Is there a risk of losing all pension capital?

The risk of losing all tier 2 or tier 3 pension capital is tantamount to an apocalypse, or the complete destruction of the global economy. At the same time, financial markets in times of high uncertainty (effects of Covid-19 on Chinese supplies, war, deglobalisation, relocation of supply chains) tend to be highly volatile, which means that as long as economies remain high and economies continue to adjust, volatility can be expected to continue.

What is worth doing and what is better not to do?

Regardless of age, it is important to build up savings for old age, including at pension level 3. (Unlike pension level 2, level 3 is voluntary.) When looking at the total return on accumulated capital, it is also important to take into account state aid in the form of tax incentives. In addition, people over the age of 10 may not be worried about the current volatility in the financial markets. However, as the desired withdrawal time approaches, it is important to choose an investment plan in good time with a strategy that provides lower volatility.

We can be sure that only a few of us will be able to record our 2nd or 3rd level pension savings at the highest level of savings.

Of course, the situation is unfavorable for people who have to retire now – if the strategy recommended by analysts is switched to less volatile conservative plans in time, the results will not be significantly better this time than in balanced or active plans with a higher share of shares. This result can be explained by the high inflation rate and the changes in the monetary policy stance of central banks, which bring about changes in interest rates on debt securities (bonds). As interest rates rise, the prices of debt securities fall. What to do if it’s time to retire? As for the 3rd pillar of pensions, it is very individual. The choice largely depends on how long a person is willing to wait for their withdrawal, if this period is shorter than 3-4 years, it is difficult to imagine a situation in which conservative plans could recoup all that was lost this year.

What to expect next?

The global economy is currently subject to uncertainty, which will continue to weigh on capital markets in the near future. Russia’s aggression has surprised many and given the global economy an extra dose of uncertainty, but eurozone economies will be able to adapt to the new conditions, where energy and capital prices or interest rates will be higher.

Although oil production in Russia accounts for 10% of global production, alternatives to Russian oil exist, as do other minerals. The process of change can be frustrating due to the time it takes to reorient and build new infrastructure. A complete end to the war in Ukraine would clearly send a positive signal to capital markets, but if it continues, growth in capital markets will return.

–