There are good reasons why deflation is central banks’ great enemy. An economy in deflation will sooner or later move towards a permanent downward spiral. It starts with the debt.

Deflation or falling prices have a problematic side effect. When goods and services become cheaper, there is no need to raise or lower wages. If prices fall and wages stay the same, purchasing power would increase. This is nice for consumers, but for companies there is no reason to reflect lower prices in wages.

While wages and, ultimately, economic output fall, the debt remains as it is. Outstanding debt doesn’t go down just because prices go down. It becomes harder to repay loans. One has to spend a higher percentage of income to service the loan when wages go down.

That affects consumption. Less income is available. In addition, falling prices can also lead to consumer spending being postponed. The goods are getting cheaper.

Japan has been in such a spiral for a long time. The stock market was not spared from this either. If companies earn less and less yen, there is no reason for prices to rise. The stock market fell for over 20 years. That wasn’t just due to deflation. The market came out of a bubble. Conversely, if inflation had continued, it would have been easier and faster to overcome it.

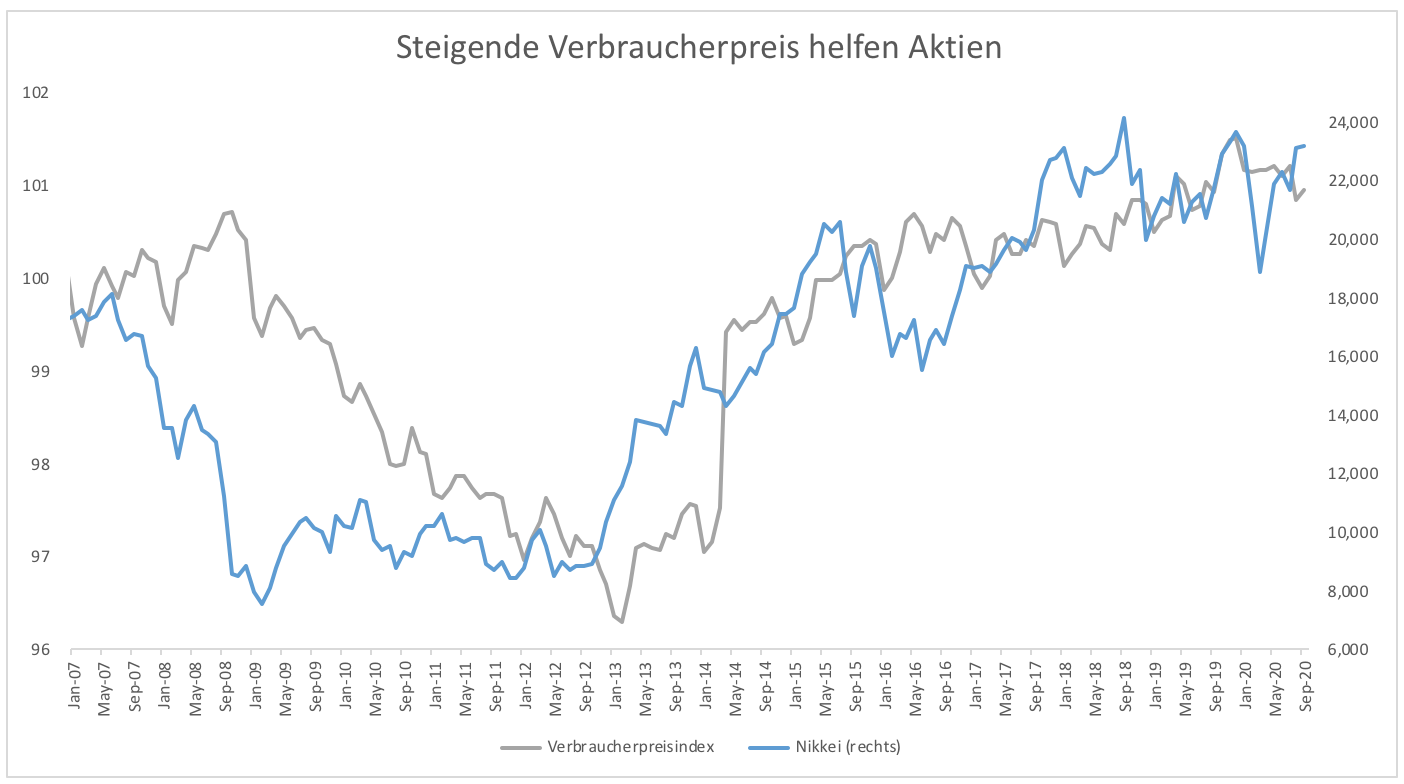

It is therefore not surprising that the Japanese stock market and the consumer price index are correlated. Since the beginning of “Abenomics” with monetary easing, inflation has risen again. The stock market also rose (chart 1).

Inflation was one issue, currency another. The yen depreciated. Businesses made more yen when they exported. In real terms, they no longer earned, but nominally, profits rose. This is why prices also rose (Figure 2).

The currency and the stock market have been decoupled for some time. Now deflation is back in Japan. Those are two factors that are dragging the market down. What helps the market are purchases by the central bank. The Bank of Japan not only buys bonds but also stocks.

These purchases do not change the fact that deflation and the currency speak for falling profits. As long as investors see at least a vague connection between company value and profit, the central bank can buy as much as it wants, the prices cannot rise in the long run.

In these months we see a tug-of-war between the central bank and the laws that speak for falling prices. Who wins is still open. Personally, I don’t think the central bank can permanently repeal the laws.

Clemens Schmale

Tip: As a Godmode PLUS customer, you should also test Guidants PROmax. There are daily trading suggestions, direct exchange with our stock market experts in a special stream, the stock screener and Godmode PLUS inclusive. Analyzes from Godmode PLUS are also used as the basis for trades in the three model portfolios. Subscribe to the new PROmax now!

–