NEW YORK (dpa-AFX) – For the standard values on New York’s Wall Street, a hesitant start is emerging on Monday. The Dow Jones Industrial (Dow Jones 30 Industrial) was estimated three quarters of an hour before the start by broker IG at 14 023 points and thus just under 0.1 percent in the red. It looks a little better for the technology-heavy US index NASDAQ 100, which was valued 0.17 percent higher than 14 023 points. This would bring him close to his previous record up to a distance of 50 points.

In the market, it was said that investors waited at the beginning of the week for standard values for the time being, which will come from the US Federal Reserve in the course of the week. From this, the next interest rate decision is on the agenda on Wednesday with possible comments on the currently extremely high inflation. However, there is a little more interest in the technology stocks, which already outperformed the broader market on Friday.

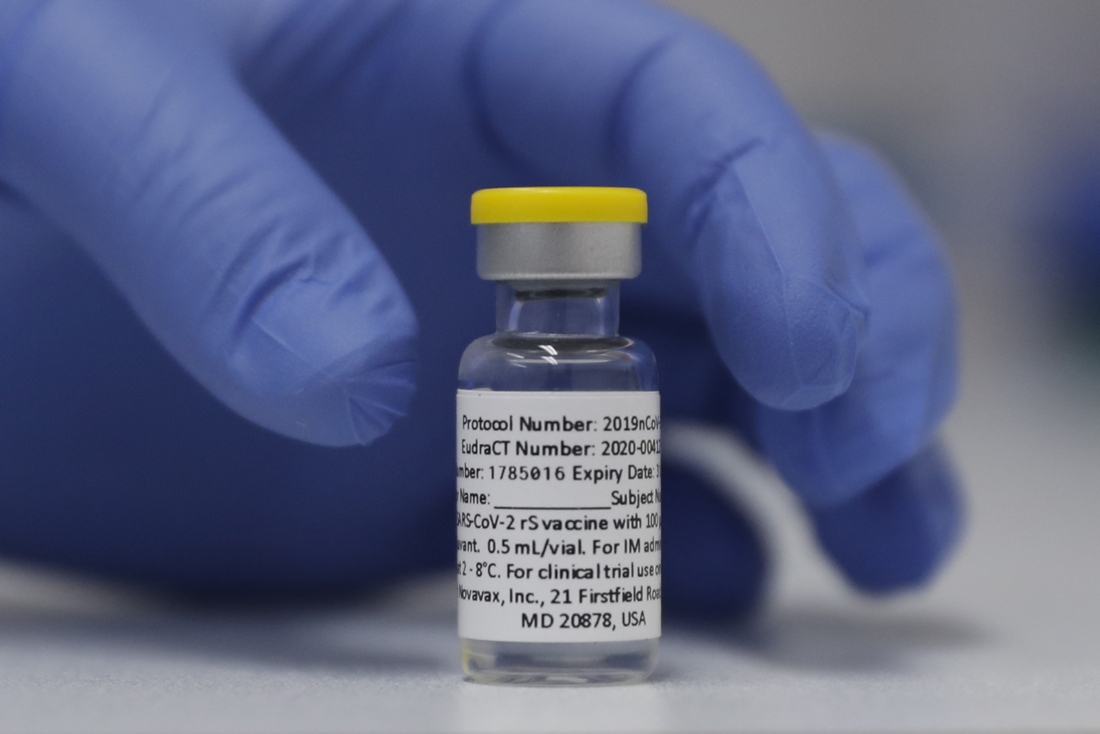

A corona vaccine once again made pre-market headlines, this time the one that has not yet been approved by Novavax. The BiotechCompany announced that its own active ingredient had shown itself to be highly effective in tests, including against mutations of the virus. According to the information, it should protect 90 percent from all symptoms, and 100 percent from severe courses. This sparked the imagination of investors: the shares rose by 6.6 percent in the pre-market period.

Otherwise, oil values are worth a look again on Monday because of the price development on the oil market. The price for a barrel of the US West Texas Intermediate (WTI) had temporarily risen to its highest level since September 2018 on Monday. Papers from ExxonMobil and Chevron then gained 0.4 percent each pre-IPO.

In the case of Oatly shares (Oatly AB), the first analyst assessments came into focus on Monday after the strong IPO. After a rally in the first few days from the $ 17 issue price to $ 28.73 on Friday, many experts are now approaching the oat drink manufacturer with a neutral vote, including renowned houses such as JPMorgan or Morgan Stanley. The shares were now traded 0.3 percent lighter before the IPO./tih/fba

–

TRADE FOREIGN EXCHANGE WITH UP TO LEVER 30 NOW

Trade forex with high leverage and small spreads. With just € 100 you can benefit from the effect of € 3,000 in capital.

–

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford the high risk of losing your money.

–

– .