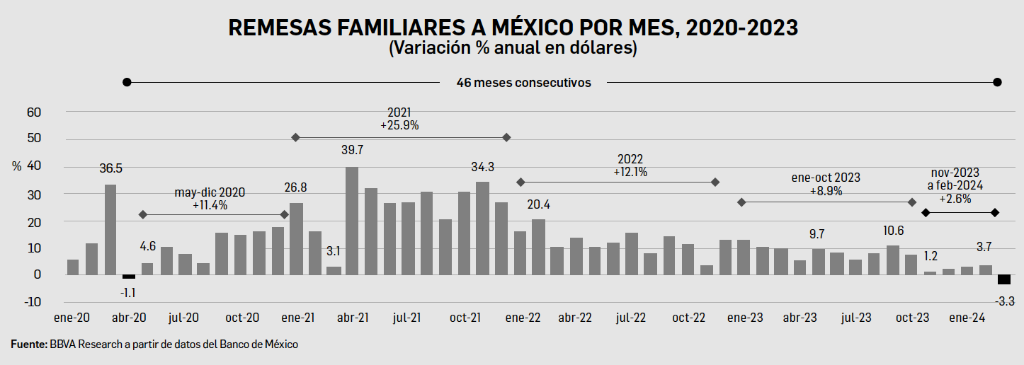

Mexico City. The flow of remittances that Mexico received in March 2024 registered an annual drop of 3.3 percent, which put an end to a streak of 46 months of increases, which began in May 2020, that is, at the beginning of the confinement due to the covid-19 pandemic, official data reveal.

According to figures from the Bank of Mexico (BdeM), the transfers that families received in the third month of this year amounted to 5,021 million dollars, a decrease compared to the 5,189 million reported in the same month of 2023.

Analysts agreed that for months there had already been an evident slowdown in the arrival of remittances to Mexico, one of the main factors being the strength of the peso against the US currency.

Regarding the accumulated figure for the year, that is, the first quarter of 2024, the amount was 14,105 million dollars, an increase of one percent compared to the 13,927 million dollars for the same period last year.

The monthly drop in March, BBVA México noted, put an end to a streak of 46 consecutive months with annual increases, which began in May 2020 and ended in February 2024; In that period, remittances increased in annualized terms from 38.8 billion to 63.6 billion dollars, a growth of 64.1 percent in dollars.

He highlighted that the February data already warned an obvious slowdown

in dollars in remittances, since between January and October 2023 they averaged an increase of 8.9 percent and for the period between November 2023 and February 2024 the increase was 2.6 percent on average.

Data from the Bank of Mexico confirm the trend that had been anticipated

pointed out the analysis area of the largest bank in the country.

Valmex emphasized that by converting dollars to pesos and adjusting shipments for inflation, remittances fell 15.7 percent in March, a percentage that represents a loss in purchasing power. He anticipates that in the coming months these transfers could maintain their dynamism, but they may also lose strength if the United States economy slows down.

Janneth Quiroz Zamora, director of financial analysis at Monex, highlighted that although the drop at an annual rate is the first to be recorded since April 2020, the purchasing power of remittances has decreased uninterruptedly for 17 months, which could reduce dynamism to local consumption.

BBVA explained that in addition to the drop in dollars and the inflationary factor, it should be considered that March was one of the months in which the price of the US dollar fell below 17 pesos, which translates into fewer pesos at the time of collection. .

Thus, the institution explained, in March 2024, with an average exchange rate of 16.84 pesos per dollar, Mexico received nearly 84.6 billion pesos in remittances, which is equivalent to a contraction of 15.2 percent in real terms in the income from this concept for recipient households, compared to the same period in 2023.

He reported that remittances to other countries in Latin America and the Caribbean also had a lower performance in March than that recorded in January and February. Shipments to El Salvador fell 4.9 percent and to Honduras 4.6 percent, which, he noted, may also be due to lower growth in the US economy.

We must be aware of the data that emerges in these months to be able to understand if the recent slowdown in remittances to Mexico and several countries in Latin America and the Caribbean is explained by a seasonal factor (Holy Week in March) or we are looking at signs of a possible slowdown in the United States

he pointed out.

#March #months #increase #remittances

– 2024-05-13 12:16:49