The emerging countries that are part of the G20 increasingly have more weight in the world economy, especially China, followed by India, Brazil, Russia and Mexico, which “also play an important role in the economic performance of their regional neighbors,” he highlighted. the International Monetary Fund (IMF).

Together, those emerging economies that are part of the G20 (Saudi Arabia, Argentina, Brazil, China, India, Indonesia, Mexico, Russia, South Africa and Turkey) doubled their participation in world trade and foreign direct investment and now represent a third of the world’s gross domestic product (GDP).

“The contagion effects of internal shocks in the emerging markets of the G20 have increased in the last two decades and are now comparable to those of advanced economies,” the IMF acknowledged in the documents it is presenting in the preamble to the Meetings of Spring with the World Bank.

In general, the global economy “is increasingly influenced by the large emerging markets of the G20.” A decrease in productivity in them can hit world production three times more than what would have happened in the year 2000, the IMF estimated.

It is because in the last two decades these markets have become increasingly integrated into global markets; “They have become large importers of manufactured products, as well as large exporters of intermediate goods, especially in the manufacturing industry and mining.”

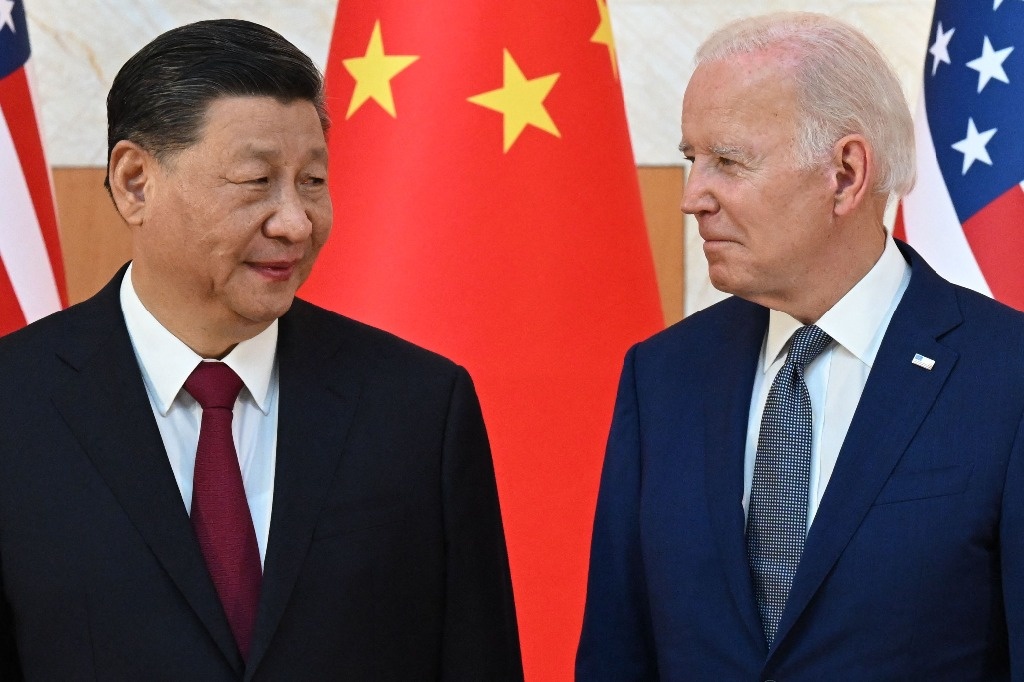

The largest contagion effects come from China and represent a variation in the production of emerging markets such as the United States, according to new research from the agency. A slowdown in the Asian economy “could be especially costly given its role as a manufacturing power and its high integration,” he explained.

In the Americas, shocks from China contribute the most to contagion effects, but shocks from Mexico are also important, particularly in Central and North America. “For advanced economies, the contagion effects originate mainly in energy exporters and in Mexico, due to its strong ties with the United States.”

“However, the growing role of all G20 emerging markets means that others can help sustain the global economy. A possible acceleration of growth in these countries could generate positive global spillovers and boost global growth by half a percentage point.”

The IMF highlights that there is a competition effect between low-wage countries, such as China and Mexico, which until now dominate sectors that depend largely on foreign suppliers such as textiles and chemicals. Therefore “it is not surprising that shocks in the G20 emerging markets can also trigger considerable reallocations of economic activity between countries and sectors.”

#Emerging #G20 #countries #gaining #weight #including #China

– 2024-04-10 20:31:01