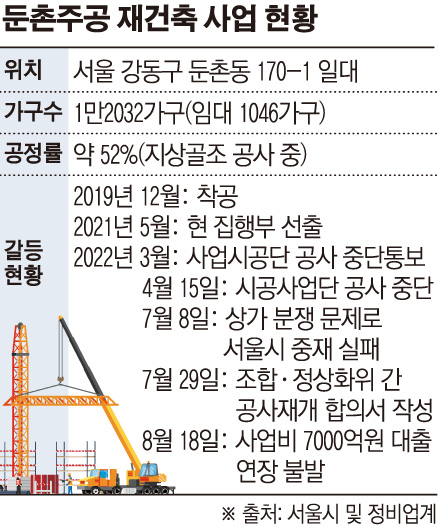

The extension of the 700 billion received bank loan has been urgently canceled

Conflicts in searching malls and price tag disputes carry on

▲ Dunchon Jugong Complex, Gangdong-gu, Seoul. (reporter Cho Hyun-wook gusdnr8863 @)

–

The reconstruction project of Dunchon Jugong, Gangdong-gu, Seoul has again been given undesirable news. Because present loan providers (a federation of lending economical institutions) have refused to increase the business expenditure financial loan scheduled for the 23rd, the union have to convert off the ‘light in the foot’. Initially, the syndicate ideas to raise money via multiple securities corporations and, in the long operate, to make a new lending group by the design undertaking group (Hyundai E&C, HDC Hyundai Advancement, Daewoo E&C and Lotte E&C) . Nevertheless, as important conflicts this kind of as conversations on climbing construction charges continue in response to opposition from the Dunchon Jugong Searching Mall Affiliation, company uncertainty is envisioned to continue for now.

According to the servicing marketplace on the 21st, the lending group of 24 economic companies, like NH Nonghyup Lender, notified the Dunchon Jugong Reconstruction Affiliation on the 18th that it was extremely hard to increase the 700 billion received mortgage thanks on the 23rd. extension of the personal loan for company fees must be decided by the lenders unanimously, but it is identified that a dozen monetary institutions, which include the 2nd financial institution, have opposed the extension.

In response to the Dunchon Jugong Union’s refusal to prolong the financial loan extension, it programs to set out an urgent fire by issuing small-term securitized securities (small-phrase asset-backed electronic bonds, ABSTB) backed by the project’s construction company. To this finish, on the 20th the syndicate held an unexpected emergency conference of delegates and decided to concern limited-term securitized securities.

Securities companies issued include things like BNK Investment & Securities, SK Securities, Bukuk Securities and Kiwoom Securities. Small-phrase digital bonds are a form of commercial paper and the maturity is established at a greatest of 3 months. The affiliation challenges small-term securitization securities as collateral for the creating team. The length of the bond is 66 times, from 23 to 28 October. The fascination charge is 4.47%, which is the mortgage interest rate degree of the existing challenge cost.

–

–

(Graphic = Reporter Son Mi-kyung sssmk @)

–

It is identified that some of the design organizations affiliated with the development group originally opposed the issuance of securities for worry of a credit score ranking downgrade, and then pursued the subrogation of the price tag of the venture (the transfer of the legal rights on the personal debt held by the creditor to the payer). Nonetheless, in the stop, all four building providers supported the issuance of small-time period securitized securities, and the severe scenario wherever the Dunchon Jugong complex went up for auction was avoided.

Soon after boosting brief-phrase resources, the cooperative varieties a new lending team and starts lending business fees. Contemplating the period of time of suspension of activity and inflation, the new bank loan need to access up to 800 billion received. A union formal stated: “Right after consulting the building project team, we will move forward with the refinancing with a finance firm that has permitted the extension of the financial loan on the expenditures of the current job.”

Dunchon Jugong drifted without the need of resolving components of operate stress even following the rebuilding venture normalized past month. Whilst the difficulty of repaying the 700 billion gained job was promptly overturned, the deadline was postponed till October 28 and, in the end, the basic difficulty can only be solved by forming a new loan group.

The spark of conflict between the Dunchon Jugong Buying Avenue Affiliation and the construction task group nonetheless lingers. The partners of the procuring centers are in the placement that “the small business normalization settlement entered into in between the cooperative and the operating group on the 29th of last month can not be identified as it is an agreement with the exception of the purchasing centre.”

In addition, the cooperative and the construction undertaking group ought to remedy a variety of difficulties of rising development expenditures, these types of as re-verification of the building cost of the existing agreement, verification of the charge of the reduction thanks to the suspension of works, and – calculation of the sale price tag, as a result it is predicted that the road will be hard right until the function is resumed.

A servicing industry formal claimed: “This quick-phrase challenge of securitization notes is not a option to the trouble, but a hold off just after the typical meeting for building to resume in October,” he claimed.

–