In 2011, I decided not to pay off my mortgage until I retired. I was still working in the banking industry and had a strong cash flow. I thought I was going to work at least another five years. Then, in 2012, I retired by negotiating a severance package that included six years of living expenses.

What happened was interesting. I ended up paying off a condo mortgage in 2015 and selling my primary residence in 2017, which ultimately paid off his mortgage of $ 815,000.

Today, my family and I live in a house we bought in early 2019 with cash. We are full-time parents and part-time writers. It feels good not to have a mortgage in retirement.

Let me share my reasoning from 2011 on why I didn’t want to pay off my mortgage before I retired. At the time, I was a 33-year-old executive director focused on career growth. However, I was also starting to exhaust myself.

Pay off your mortgage in retirement

The following was my state of mind in 2011.

Having a mortgage is a wonderful thing. In fact, I owe a large part of the longevity of my job to my mortgage. When I was 24 I ran into a lot of money because of some good stock picks. I just got lucky because, thank goodness, I don’t have a great track record in stock picking.

I never really told anyone how much I had, but it was enough to reduce the median price of a house in San Francisco by 25% (~ $ 580,000) and still have several years of mortgage payments.

In my mid-twenties, I started to question the meaning of work. Maybe I was just suffering from the lesser-known “quarter-life crisis”. Because I had gotten to what I considered too much money too quickly, working to earn more money lost its appeal.

It didn’t matter if I added a thousand or ten thousand more to my savings, making money was so uninspiring. I was demotivated due to a few chance trades that required very few skills, just a lot of balls.

The terrorist attack of September 11, 2001 also took place recently. I was actually helping organize a Latin American investment conference at 1 WTC earlier in 2001. The attack shook me deeply and made me want to do something more meaningful in my life.

Despite having good net worth for my age, I don’t need anything to live a comfortable life. Give me clean clothes and a place right on the beach with a hot tub on the bedroom balcony and you’ll be fine!

Renting just feels bad after a certain point

I had already lived in a nice bedroom with parking for $ 1,600 for a few years and was tired of throwing my money away. The next logical step was to move to a two-bedroom, two-bathroom apartment, but these places regularly rent for between $ 2,500 and $ 3,500 a month in San Francisco.

It was unbearable to pay someone else over $ 2,000 in rent, even though I got shelter in return. $ 2,000 per month is $ 3,000 of pre-tax income you have to earn! Forget that. The rent return is always 100% negative.

Granted, there was also an irrational fear of becoming a 40-year-old tenant if I followed my pace. There is nothing wrong with being a 40 year old tenant, just like there is nothing wrong with being a 40 year old virgin.

Either way, I didn’t feel like spending hard-earned money month after month to help someone else pay off their mortgage. If you are in the federal tax bracket of 24% or less, rent by all means. Renting is mostly cheaper at the beginning and offers a lot of flexibility.

I found my starting condo

In 2003, I found a cozy little two-bedroom condo facing the park in Pacific Heights, a prime neighborhood. After putting 25% off costs, the monthly mortgage payment and HOA cost 20% less than it would have cost to rent.

I didn’t hesitate at all to pay $ 120,000. In fact, I was absolutely thrilled to be deploying my savings into something useful. As a result, I had a lot less savings and a six-figure mortgage to keep me honest and motivated again.

With the mortgage, I found a purpose! It’s funny how things work.

I couldn’t be a bum and give my best at work because if I got fired I would risk going broke. Yes, I still had savings, but everything is relative because I had an even heavier amount before the deposit!

I developed a game plan to get to know the people in my organization better. I worked harder on everything that was asked of me. It was time to do or die, and I am doing it!

Related: The Biggest Downside To Paying Off Your Mortgage

Having liquidity is always important

Despite having a beautiful home of my own, liquidity is still king. It’s been a decade since I bought my condo and now the payments seem incredibly low.

Funny how time makes everything cheaper, especially if you have a fixed payment. The condo is now a rental, generating positive free cash flow as rents have climbed about 90% since then, while payments have actually fallen 25% due to refinancing.

Inflation is a wonderful thing!

I have the money to pay off the entire loan, but I’m not considering doing so just because it’s important to stay liquid and have cash.

You can dump all your money on your property, but what if the house burns down? Sure, home insurance will cover at least 80% of the rebuilding costs, but right now when your house is on fire, you’re going to shit bricks and wonder if you’ve lost all that money.

If you find yourself in a higher federal tax bracket (32%, 35%), it is your responsibility to keep your mortgage as long as you work. The government is robbing you of your hard earned money and having that shield helps a lot more than if you are in the 25% or less bracket.

Yes, I understand that is not the best way to pay interest to save on taxes. That said, it’s all about cash flow and tax minimization in a rising tax environment. Focus on cash flow, especially as interest rates fell after the global pandemic.

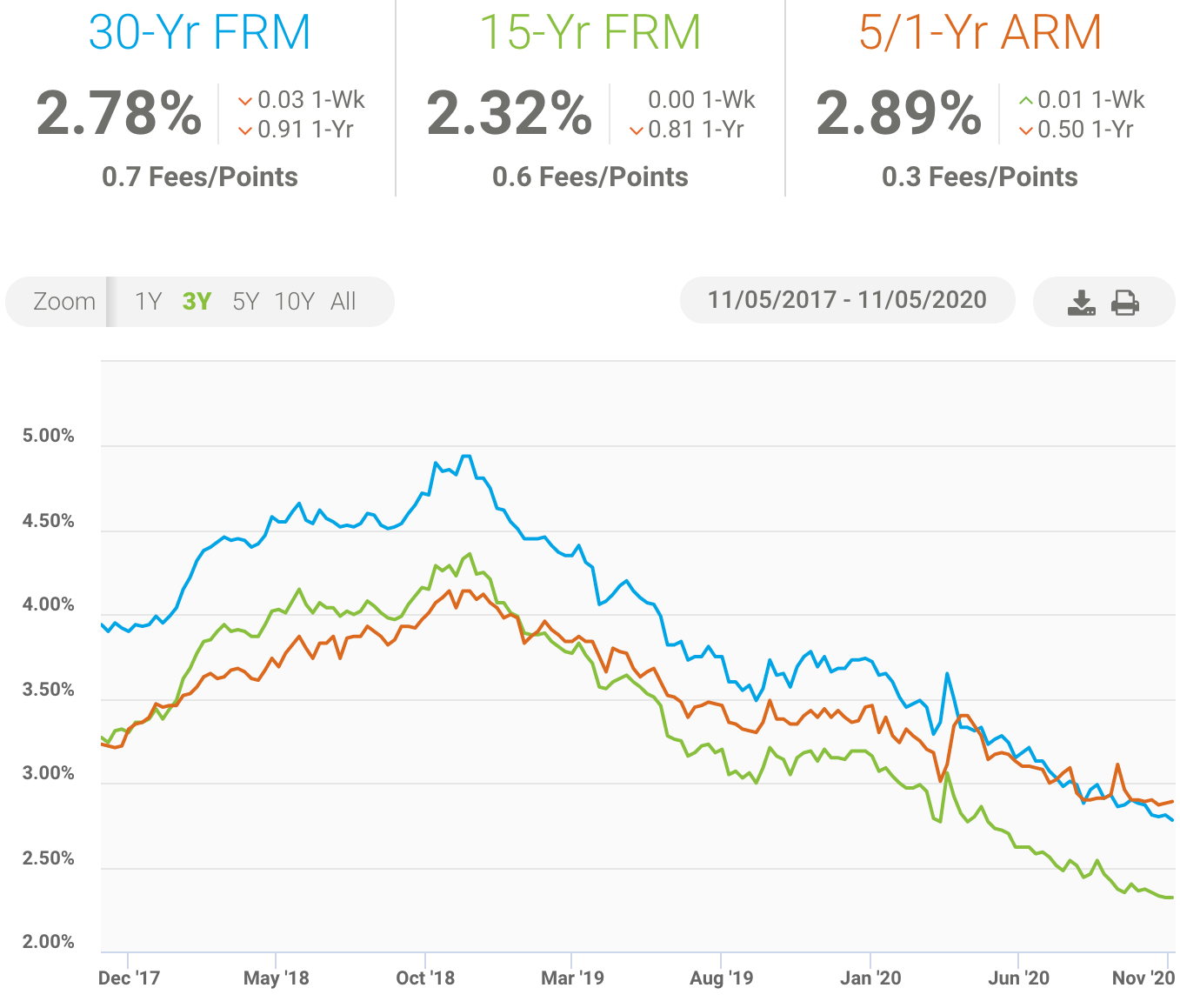

Mortgage rates are so low

Mortgage rates are so low now. You can take out a 30-year fixed rate mortgage at less than 3%. You can also get an ARM 7/1 for less than 2.5%. No wonder the demand for real estate remains so strong.

Therefore, it makes sense to stay liquid and not make additional payments at such a low rate. Remember that you can deduct interest on a mortgage up to $ 750,000. And if Joe Biden sets the rules, the limit could go back to $ 1,100,000.

Cash is always king, and you want to have as much cash as possible to ensure your financial well-being, as well as to take advantage of investment opportunities when they arise. Please read more tips for mortgage refinancing.

Don’t pay your mortgage until you retire

When you see yourself retiring in 5-10 years, start formalizing a mortgage repayment plan so that when you finally retire, you will be mortgage free. The interest deductions all these years are just side benefits. It’s your ability to live in your home rent-free for the rest of your life that is your biggest benefit!

Use accounting to your advantage, not to the benefit of the lender. It’s about matching the cash flow so that you are always very healthy.

If you can match your mortgage repayment with when you no longer have regular income, this is probably the best case scenario. Paying off your mortgage early is a very personal decision. You just need to make sure you know yourself!

Updates on mortgage payments

Update 12/01/2016 – I ended up paying off one of my rental mortgages that was worth about $ 1 million because I bought a new single family home with a $ 1 million mortgage in the spring of 2014. Four mortgages was too much. so I maintained three.

Update 6/1/2016 – I just completed refinancing a 5/1 jumbo arm from 2.625% to 2.375% for another 5/1 ARM lock. I’m pretty excited because I also paid off $ 130,000 of the mortgage to $ 850,000. My monthly payments drop to $ 3300 from $ 4338!

Update 09/17/2016 – I am now surgically investing $ 250,000 in real estate crowdsourcing opportunities to make my life easier. My real estate crowdfunding investments generate 100% passive income.

Update 04/12/2020 – I have been pre-approved for a 7/1 jumbo arm for 2.125% and am actively looking to buy real estate in major cities. I’m confident there will be a rebound in demand once immunity is heard in 2021/2022.

After all these years, I still think you should keep your mortgage while working. Take advantage of low mortgage rates and invest your savings to build more wealth. When you retire or stop working, actively start paying off your mortgage.

I have never regretted paying off a mortgage early, no matter how much I might have earned on the stock market. I don’t think you will either, unless you find yourself in a financial crisis after paying off the mortgage.

Recommendations

Refinance your mortgage. Check out Credible, one of the largest mortgage markets where lenders compete for your business. You will get real quotes from pre-approved and qualified lenders in under three minutes. Credible is the easiest way to compare rates and lenders in one place. Take advantage of lower rates by refinancing today.

Invest in real estate crowdfunding:If you’re looking to buy a property as an investment or reinvest the proceeds from the sale of your home, take a look at Fundrise, one of the largest real estate crowdfunding platforms today.

Fundrise allows anyone to invest in mid-sized commercial real estate transactions across the country that were once available only to institutions or high net worth individuals. Thanks to technology, it is now much easier to enjoy a lower appraisal and a higher net rental yield across America. I have personally invested $ 810,000 in real estate crowdfunding to earn 100% passive income.

–

–