‘Don’t ask your accountant today if he has a workable job. You would light the fuse’, says Jan Tuerlinckx, partner attorney at Tuerlinckx Tax Lawyers.

At the end of September, the day and night are of equal length for the second time in the year. That’s called the equinox. Then darkness sets in earlier and earlier. That darkness provides insight into the economic fabric. Then it can be determined which companies are still working late in the evening and in the early night. That doesn’t require statistics. The light is still on for bookkeepers, accountants and tax consultants, who are concerned with filing tax returns. Even during the weekend, the lamp is still on during this period, although it is less visible.

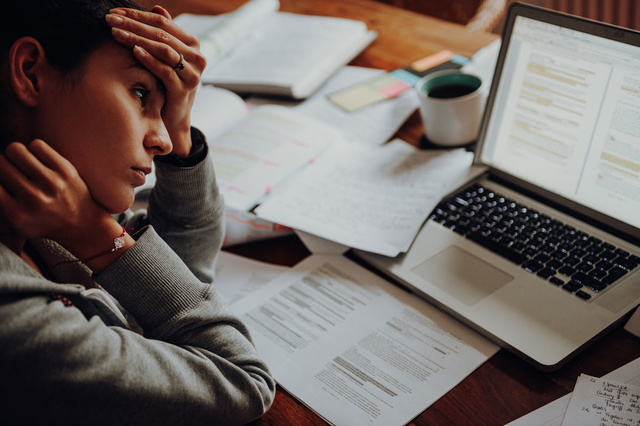

But is that still necessary in 2021, in full digital evolution? Is this possible in times when stress management is central, burnout is one of the important occupational diseases and workable work has become an essential human right? Workable work stands for quality work, dixit the government. Work that captivates and allows you to grow. It is work that is in balance with your private life. It doesn’t make you too stressed and it doesn’t make you sick. A workable job is a nice job that you can keep up for a long time.

Don’t ask your bookkeeper, accountant or tax consultant today if he has a workable job. You would light the fire. In the fall they have to work double shifts and more to get the work done. An outsider might ask whether this has to do with inefficiency rather than coercion. The professionals must have submitted their declarations by the beginning of November. The assessment year is then more than ten months old.

Don’t ask your accountant or tax consultant today if he has a workable job.

But the idea that there are more than ten months to complete the declaration does not correspond to reality. Tax-on-web, the application used to file the electronic personal income tax return, will be released no earlier than May. Updates of that application are also sent until a few months later. With each of those updates, adjustments are made, so that no final declaration can actually be submitted. The tax return includes figures from sheets prepared by various government departments. It is no exception that the government uploads the last chips at the end of June.

However, no one will deny that the tax society plays a crucial role in keeping the country’s revenues going. The fact that it is confronted with a veritable laundry list of obstacles leads to understandable complaints: the malfunctioning of Tax-on-web, the appalling communication about it by the government, the increase in administrative obligations (such as DAC6 and the UBO register), the coincidence of the quarterly VAT returns, the personal income tax returns and the annual accounts.

It is fair to mention, however, that Minister Vincent Van Peteghem (CD&V) allowed a collective postponement at the last minute for the personal income tax returns. The same thing happened last year and the year before that. That cost a lot of blood, sweat, tears, petitions, parliamentary questions, actions by professional associations, and five and six.

Never before have so few students enrolled in accountancy and tax law. That is a shame, because every stakeholder benefits from qualitative figures. If you enjoy adding a number professional to your social circle, feel free to support him or her during a stressful period like this. They can use the support. If you have even more fun and are in charge in this country, think about this problem structurally and involved. In this way we prevent the number professionals from becoming tax collectors. We know from the Bible that they were not loved. Everyone benefits from correct figures and professional support. Without them, the latter turns off the light.

At the end of September, the day and night are of equal length for the second time in the year. That’s called the equinox. Then darkness sets in earlier and earlier. That darkness provides insight into the economic fabric. Then it can be determined which companies are still working late in the evening and in the early night. That doesn’t require statistics. The lamp is still lit for bookkeepers, accountants and tax consultants, who are concerned with submitting tax returns. Even during the weekend, the lamp is still on during this period, if it is less visible. But is that still necessary in 2021, in full digital evolution? Is this possible in times when stress management is central, burnout is one of the important occupational diseases and workable work has become an essential human right? Workable work stands for quality work, dixit the government. Work that captivates and allows you to grow. It is work that is in balance with your private life. It doesn’t make you too stressed and it doesn’t make you sick. A workable job is a nice job that you can sustain for a long time. Don’t ask your bookkeeper, accountant or tax consultant today whether he has a workable job. You would light the fire. In the fall they have to work double shifts and more to get the work done. An outsider might ask whether this has to do with inefficiency rather than coercion. The professionals must have submitted their declarations by the beginning of November. Then the assessment year is already more than ten months old. But the idea that there are more than ten months to complete the tax return does not correspond to reality. Tax-on-web, the application for submitting electronic personal income tax returns, will be released no earlier than May. Updates of that application are also sent until a few months later. With each of those updates, adjustments are made, so that no final declaration can actually be submitted. The tax return includes figures from sheets prepared by various government departments. It is no exception that the government uploads the last chips at the end of June. However, no one will deny that the tax society plays a crucial role in keeping the country’s revenues going. The fact that it is confronted with a veritable laundry list of obstacles leads to understandable complaints: the malfunctioning of Tax-on-web, the appalling communication about it by the government, the increase in administrative obligations (such as DAC6 and the UBO register), the coincidence of the quarterly VAT returns, the personal income tax returns and the annual accounts. It is fair to mention, however, that Minister Vincent Van Peteghem (CD&V) allowed a collective postponement at the last minute for the personal income tax returns. The same thing happened last year and the year before that. That cost a lot of blood, sweat, tears, petitions, parliamentary questions, actions by professional associations, and five and six. Never before have so few students enrolled in accountancy and tax law. That is a shame, because every stakeholder benefits from qualitative figures. If you enjoy adding a number professional to your social circle, feel free to support him or her during a stressful period like this. They can use the support. If you have even more fun and are in charge of this country, think about this problem structurally and involved. In this way we prevent the number professionals from becoming tax collectors. We know from the Bible that they were not loved. Everyone benefits from correct figures and professional support. Without them, the latter turns off the light.

– .

![Smartphone users make such mistakes! Some of them can cost you dearly [lista – 14.11.21 r.] Smartphone users make such mistakes! Some of them can cost you dearly [lista – 14.11.21 r.]](https://d-art.ppstatic.pl/kadry/k/r/1/dc/c2/618d96aba4317_o_original.jpg)