17:52

Monday 19th September 2022

–

I wrote – Manal Al-Masry:

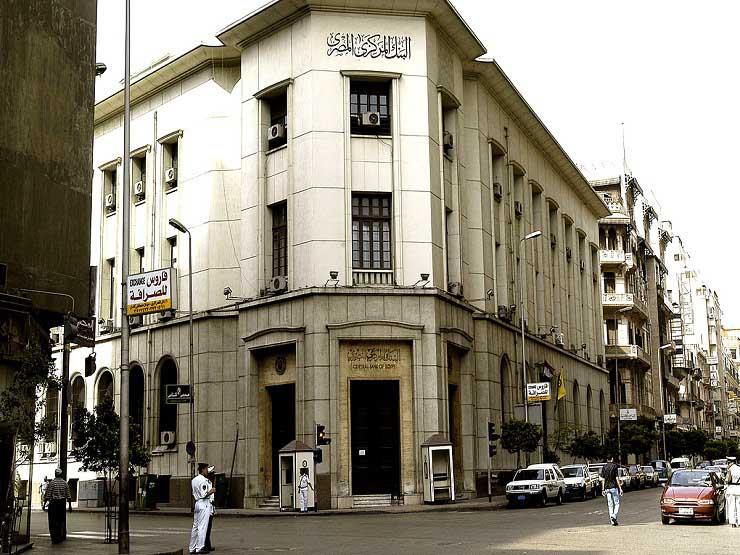

The bankers, with whom Masrawy spoke, expected the Central Bank to resort to offering a high-yield certificate again through the Al-Ahly and Egypt banks, as one of the cards available to curb inflation, especially as it approaches. reach an agreement with the International Monetary Fund and the prospects for the devaluation of the pound.

Jihad Azour, director of the Department for the Middle East and Central Asia at the International Monetary Fund, said yesterday in an interview with Al-Arabiya TV that negotiations to obtain new funding with Egypt are continuing and things are proceeding according to the schedule.

He added that the rise in interest rates is linked to jumps in inflation, so central bank monetary policies resort to raising interest rates to curb inflation and “is a priority for all countries, including countries of the region “.

The Central Bank had allowed Al-Ahly Bank and Egypt to issue a certificate with a high interest rate of 18% per annum for one year on March 21, in an effort to curb inflation and provide a real return on customer savings. before it was suspended at the end of last June, with a total collection of 750 billion pounds.

Mohamed Badra, a banking expert, told Masrawy that it is necessary for the Central Bank to resort to offering a high-yield certificate of at least 18% through government banks, coinciding with his decision at the meeting of the Committee of monetary policy next Thursday with the aim of providing a real return on customer savings above the inflation rate.

The Central Bank will hold a meeting of the Monetary Policy Committee next Thursday, 22 September, to discuss the fate of the interest, in the second meeting of the Committee after Hassan Abdullah took over as interim governor of the Central Bank.

Badra explained that the return on customer savings currently in banks is negative and not in line with high inflation, which makes the value of investing in banks unattractive and some customers may fall into attempts to erect (comfortable) .

The annual core inflation rate hit 16.7% last August, a level it hadn’t seen in years, according to central bank data, and surpassing the central bank’s inflation target of 7%, an increase o a 2% decrease during the fourth quarter of 2022.

The annual inflation rate in cities increased to 14.6% last August, up from 13.6% in July, according to data from the Central Agency for Public Mobilization and Statistics.

Banking expert Sahar Al-Damaty agrees with Badra’s proposal regarding high certificates, while expecting the Central Bank to raise interest rates at Thursday’s meeting by 1% to maintain the attractiveness of the bank. investment in the Egyptian pound through the presence of a real yield.

The real rate of return is the nominal interest rate earned by the saver or investor minus the inflation rate, which is currently negative.

But the deputy director of international transactions at one of the banks said that it is not easy to expect to raise the interest rate, especially with the expected decision of the US Federal Reserve, but it is possible that the central bank will resort to offering the certificate to high yield in case of completion of the loan from the International Monetary Fund to cope with the possible inflation from the decline of the pound by satisfying the documentary credits in the banks.

The banker explained that the loan agreement of the International Monetary Fund will help to open the doors to deal with the documentary credits that have been suspended for months in the banks, which leads to a large demand for the dollar, which pushes the pound to fall further, and In this case, the Central may resort to accepting to offer a high-yield certificate to absorb the expected inflationary pressures.

The average dollar price against the pound rose 23.4% from its current March 20 level to £ 15.76.

–